Norwegian Cruise Line (NCLH) remains mired in the aftermath of the pandemic, failing to regain its pre-2020 momentum amid lingering operational challenges and market headwinds. As the worst-performing cruise stock over the past six years, NCLH has lagged far behind peers, with shares plummeting amid debt burdens and subdued demand recovery.

Activist investor Elliott Management seeks to raise NCLH from the depths. It recently amassed a stake exceeding 10% and is pushing for sweeping reforms, including board overhauls and cost-cutting measures to steer the company back to profitability. But can Elliott's intervention spark a turnaround, or will entrenched issues keep NCLH adrift in turbulent waters?

About Norwegian Cruise Line Stock

Norwegian Cruise Line operates as a global cruise company, offering itineraries to over 500 destinations worldwide through its three brands: Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises. The company focuses on premium experiences with features like freestyle cruising, upscale dining, and onboard entertainment. Its fleet totals around 32 ships, smaller than Carnival Corporation's (CCL) approximately 92 vessels across multiple brands but comparable to Royal Caribbean's (RCL) 27 ships, positioning NCLH as the third-largest player in the industry. Headquartered in Miami, Florida, NCLH emphasizes innovative ship designs and experiential travel.

In 2026, NCLH stock has risen about 8% year-to-date (YTD), reflecting modest gains amid broader market volatility, but it remains down roughly 55% from pre-pandemic highs around $54 per share. This underperformance contrasts sharply with the S&P 500 ($SPX), which has more than doubled over the last six years, though it is essentially flat so far YTD, highlighting NCLH's vulnerability to sector-specific pressures like fuel costs and consumer spending shifts.

Valuation metrics paint a picture of potential opportunity. The trailing P/E ratio stands at 11.68, below the U.S. hospitality industry average of 21.4, indicating investors pay less per dollar of earnings compared to peers. The forward P/E of 9.82 suggests anticipated earnings growth, while the P/S ratio of 1.26 is lower than historical averages around 1.7, meaning the stock trades discounted to its revenue generation. P/B at 4.83 exceeds the company's five-year average of about 6.4 but aligns with recovery expectations.

These figures—lower P/E and P/S relative to industry and historical norms—imply undervaluation, as they reflect pessimism not fully justified by fundamentals like fleet expansion and demand rebound. Overall, NCLH appears undervalued, offering upside for patient investors if operational improvements materialize.

Can Elliott Management Revive the Shipwreck?

NCLH's dismal performance stems from a confluence of factors, including heavy debt accumulated during the pandemic shutdowns, which strained cash flows and delayed recovery investments. Operational missteps, such as elevated unit costs and inefficient spending on non-core events like high-profile concerts and luxury experiences, have eroded margins.

The company's 9.6% profit margin trails RCL's 23.8% and CCL's 10.37%, underscoring cost control issues, yet it has a superior return on equity at 55.51% versus RCL's 45.06%. Broader industry challenges, like Caribbean capacity surges and fuel volatility, have hit NCLH harder due to its premium positioning and slower deleveraging.

While CCL has fared slightly better, down only 24% from pre-pandemic levels thanks to aggressive cost-cutting and fleet optimization, RCL has thrived, surging 176% through superior yield management and innovative attractions like private islands. NCLH's lag—down 55%—highlights its strategic shortfalls, including failed private island initiatives and board decisions that prioritized tenure over expertise.

Elliott Management aims to address these by demanding a rigorous board succession process, independent directors with cruise experience, and a new business plan to close gaps with rivals. The activist criticizes extravagant outlays, such as flying guests to Iceland for a Katy Perry concert, arguing they fail to drive shareholder value.

Elliott envisions reforms boosting shares to $56, more than doubling from current levels, through margin expansion, overhead reductions, and focused growth. Recent leadership changes, including a new president, align with this push, but success hinges on execution amid economic uncertainties. If Elliott prevails, NCLH could reclaim its pre-pandemic trajectory; otherwise, persistent underperformance risks further activist pressure or consolidation.

What Do Analysts Expect for NCLH Stock?

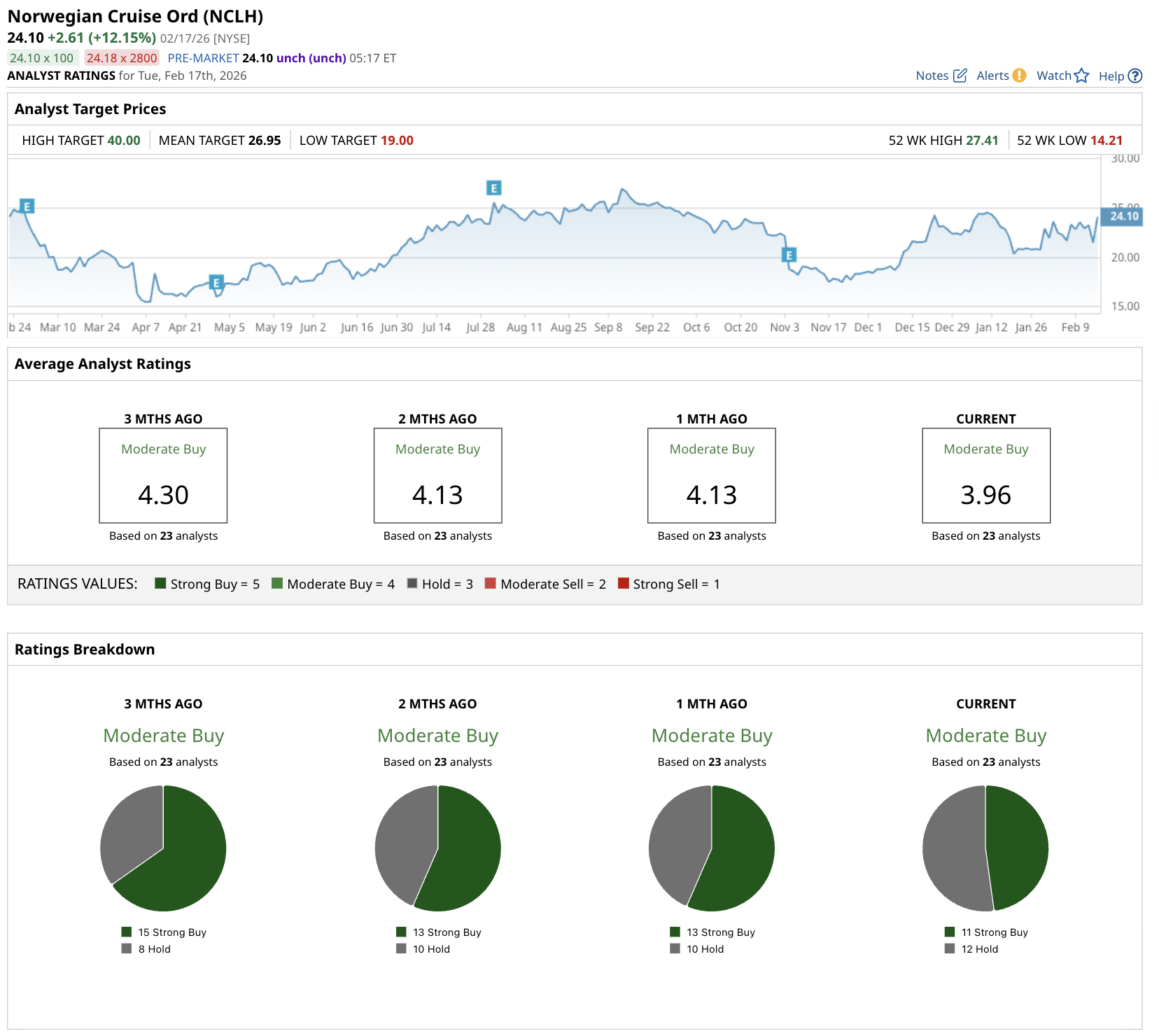

Analysts maintain a "Moderate Buy" consensus on NCLH, with coverage from 23 firms. The ratings breakdown includes 11 "Strong Buys" and 12 "Holds," reflecting cautious optimism amid recent challenges. Notable shifts include downgrades from J.P. Morgan and Barclays last week, citing leadership transitions, softer 2026 guidance, and delayed deleveraging, which lowered the consensus score from 4.30 to 3.96 over three months.

Its mean target of $26.95 represents potential upside of 11.4% based on Tuesday's closing price of $24.10. Targets range from $19 to $40, with firms like Stifel and Mizuho expressing confidence in yield improvements post-2026 Caribbean normalization, while others flag near-term risks.

Elliott Management's involvement has injected volatility, but analysts see long-term value in fleet growth and demand trends, tempering expectations for immediate gains.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)