/Intuit%20Inc%20logo-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

California-based Intuit Inc. (INTU) is a global financial technology company that develops tools designed to help individuals and businesses manage their finances more effectively. Serving roughly 100 million customers worldwide, its portfolio includes TurboTax, Credit Karma, QuickBooks, Mailchimp and the Intuit Enterprise Suite. Through these platforms, Intuit provides solutions spanning tax preparation, personal finance, accounting, marketing and business management.

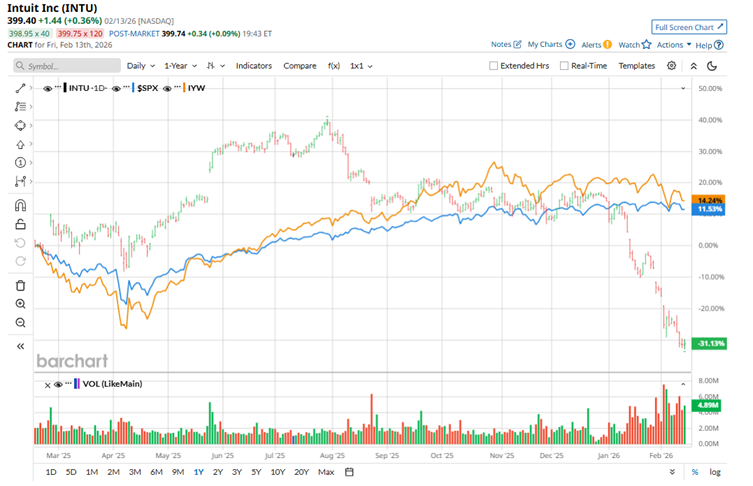

The company continues to invest in new technologies and product innovation aimed at expanding access to financial resources and simplifying complex financial tasks. However, lofty ambitions haven’t translated into stock market success. Despite boasting a sizable $111.2 billion market capitalization, Intuit shares have tumbled 31.6% over the past year, a sharp contrast to the S&P 500 Index ($SPX), which climbed 11.8% during the same stretch.

The selling pressure hasn’t eased in 2026. Year to date, the stock has plunged nearly 39.7%, while the broader index has posted only a modest decline. Looking at sector peers paints a similar picture. Intuit has also lagged the iShares U.S. Technology ETF (IYW), which is up 15.5% in 2025 and has slipped just 4.6% so far in 2026, underscoring the stock’s pronounced underperformance within the tech space.

Intuit’s sharp slide over the past year has been driven largely by AI anxiety. Investors fear that generative AI could disrupt traditional financial software models, even though that threat hasn’t materially surfaced in the company’s actual results. Operationally, Intuit continues to deliver steady performance, but sentiment has told a different story.

More broadly, the stock has been caught in a sweeping market reset. Software companies across the board are being revalued as investors reassess growth durability in an AI-driven world. In Intuit’s case, concerns about future disruption have overshadowed present-day fundamentals, pressuring the shares despite resilient execution.

Looking forward to the fiscal year ending in July 2026, analysts expect INTU’s EPS to rise 12.1% year-over-year to $17.23. Encouragingly, Intuit has consistently outperformed expectations. The company has beaten consensus EPS estimates in each of the last four quarters, underscoring its track record of steady performance.

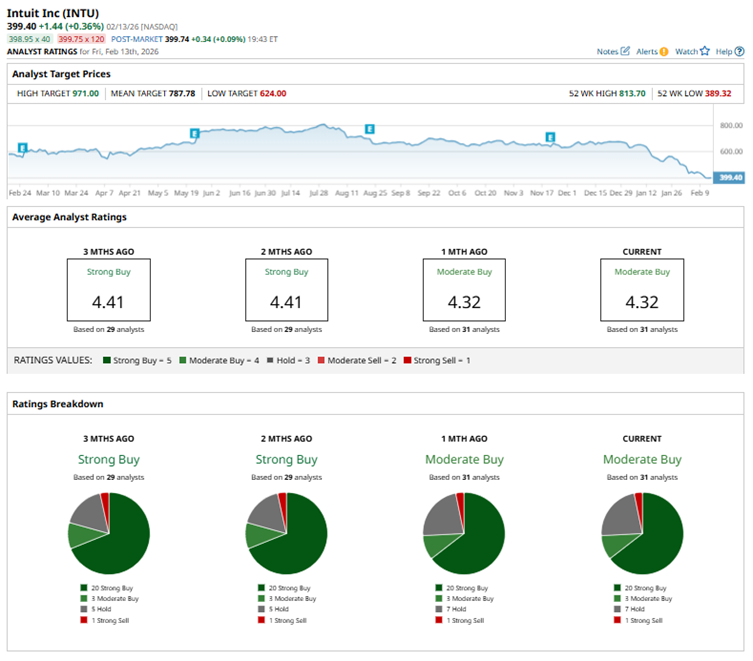

Wall Street is still leaning bullish on Intuit, but the enthusiasm isn’t unanimous. The stock holds a consensus “Moderate Buy” rating from 31 analysts, with 20 “Strong Buys” and three additional “Moderate Buy” anchoring the optimistic camp. Meanwhile, seven analysts sit on the sidelines with “Hold” ratings, and one has turned outright cautious with a “Strong Sell.” Notably, this overall rating mix has remained largely unchanged over the past three months.

Earlier this month, BMO Capital trimmed its price target on Intuit to $624 from $810 but kept its “Outperform” rating intact, signaling continued confidence despite recent volatility. The firm’s stance is backed by its annual survey of U.S. tax filers, which highlighted largely positive trends for TurboTax. In particular, TurboTax Full Service is gaining traction through its expanding local strategy, opening the door to meaningful upsell and cross-sell opportunities.

The mean price target of $787.78 represents a premium of 97.2% to INTU’s current levels, while the Street-high price target of $971 implies a potential upside of 143.1% from the current price levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)