Corn's new crop bear market got me thinking, do our furry four-legged bears eat corn? And ironically, they do.

With exports falling off, Brazil still loading ships with their bumper crop of corn, and the US planting more corn acres this year, it's continuing to look like a great year for an abundance of corn supply. But, the news says…

The 2023 new crop corn futures contract, December, peaked in April 2022 and has steadily trended lower. Market sentiment can get overly bullish or bearish and cause prices to move quickly in one direction before prices return to a more fair value (mean reversion.) In July 2022, such an event resulted in approximately a $1.00 per bushel increase. These events are typical in a bull or bear market and relatively healthy for current price action trends.

Last week the corn market had a one-week rally, and the media went wild with it. The media reported stories of weather issues and how May could be one of the driest on record and little to no rainfall expected over the next week. Considering the new crop was planted in almost perfect conditions and earlier than usual, the weather in May will have much less impact than the media reports. And while this is not ideal for growing conditions, it won't decimate the new crop.

From the technical side of the market, two weeks ago, the low aligned with the 12-month anniversary of the sell-off from the peak. The market has had a significant move without price corrections since October 2022, resulting in pent-up emotions about taking some profits off the table.

The economic side of the market saw the US Debt Ceiling hanging over market participants' heads, causing uncertainty across the globe and multiple assets.

These micro issues contributed to a burst of short covering in the corn market. Last week's cumulative open interest only increased by 26K in a market with 1.3 million open contracts.

The Exchange-Traded Fund (CORN) is another asset to participate in the corn market.

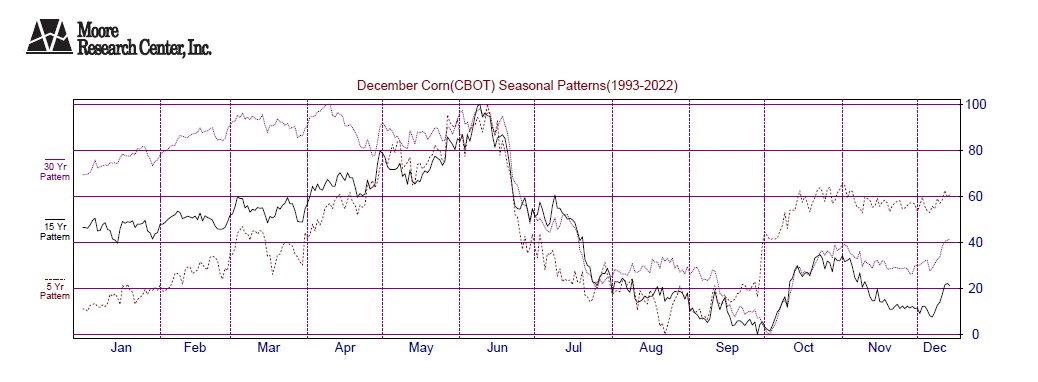

Seasonal Pattern

Source: Moore Research Center, Inc. (MRCI)

In a recent article I wrote for Barchart, "2023 Bumper Corn Crop?" I explained how the traditional post-harvest rally peaking in May or June did not materialize this year—resulting in a failed highly accurate seasonal pattern, often leading to extreme counter-seasonal moves, in corn's case, low prices.

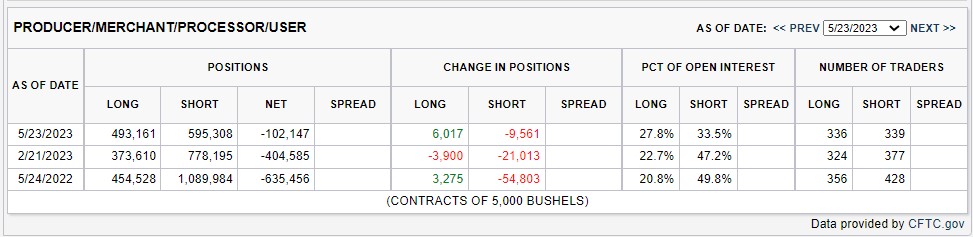

The Commitment of Traders (COT) Report

Source: CMEGroup Exchange

How many are unhedged when a market with a consistent seasonal pattern like corn fails to provide a traditional post-harvest rally for commercial producers to sell into to hedge new crops?

The above table from the CMEGroup offers data regarding the position size of the commercials one year ago and last week's report. Last year, the post-harvest rally occurred on time, allowing commercials to hedge downside price risk, evidenced by their total short positions of 1,089,984 contracts. 2023s failed post-harvest rally only details that 595,303 contracts are short.

As June is a seasonal peak in corn prices before the Fall harvest, commercial traders must find ways to finish their annual hedging. Commercial entities are knowledgeable and savvy market participants. They likely will be looking for selling opportunities on market rallies.

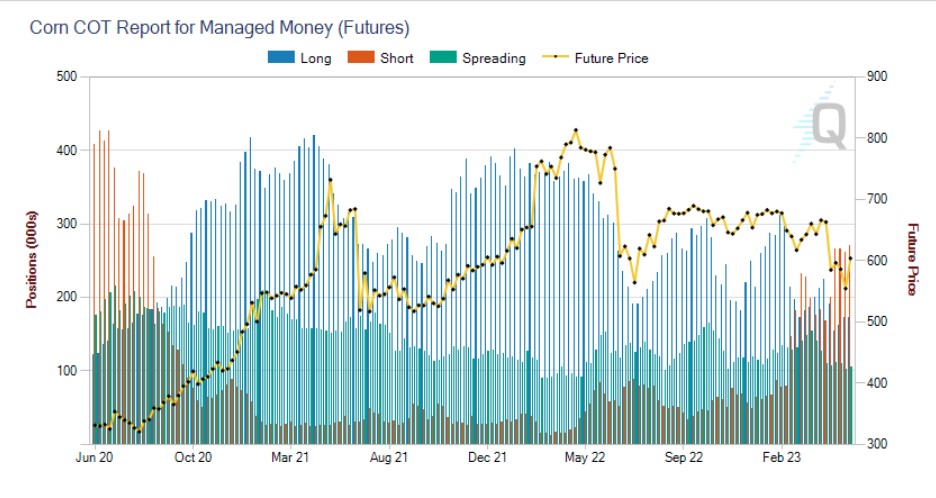

Source: CMEGroup Exchange

Managed money strengthens its bearish corn position by adding more short positions. Last week's COT report revealed that managed money has more shorts (far right red vertical bars) than ever in the past 52 weeks.

Managed money is typically trend following, and we can see the correlations to their long positions (vertical blue bars) and price (yellow line). When prices peaked in April 2022, their short positions (red vertical) became more prominent than in the past. Another note of interest is that when prices peaked in March 2021 and May 2022, the total longs were approximately 400K contracts. Today, they only have 271K short contracts, making more capital available to contribute to the bear market.

In closing….

The post-harvest rally that failed before its seasonal peak in June may have put the commercials in a position to sell more aggressively into rallies. Managed money is already net short in the corn market. If the two most prominent entities of the futures markets begin selling, we could see lower corn prices.

While the weather may affect crop production, beware of staying the course with your positions. The price trend will determine the right side of the market to be on as a speculator.

More Stock Market News from Barchart

- High Put Premiums on Advanced Micro Devices Stock Make Shorting Them Attractive for Income

- Stocks Finish Higher as Negotiators Inch Toward a Debt-Ceiling Agreement

- Intel Risks Being Left Behind in AI Frenzy

- Stocks Climb on Signs of Progress in Debt-Limit Talks

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)