/Netflix%20open%20on%20Tablet.jpg)

Netflix Inc. (NFLX) reported excellent Q4 2022 results on Thursday, Jan. 19, 2023, after the market closed and released its Q4 shareholder letter. The bottom line was that its memberships grew, the company is producing strong free cash flow (FCF) and now it plans on buying back shares in 2023.

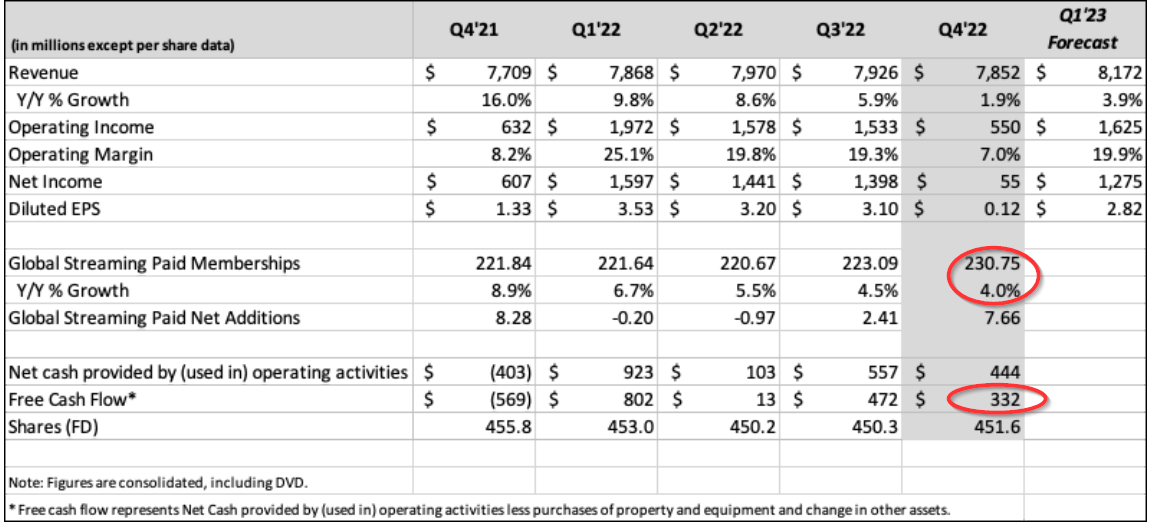

Global streaming Q4 paid memberships rose 4.0% year over year (YoY) to 230.75 million. This exceeded the company's own forecast for 227.59 million memberships by Q4 2022 in last quarter's letter. It was also up 3.43% or 7.66 million from the prior quarter's 223.0 million paid memberships.

That shows that the company has returned to growth, despite the blip it had in Q2 2022, as I explained in my Aug. 19 Barchart article.

Strong FCF and Buybacks to Resume

Moreover, the company is producing strong FCF. Over the last year, it made $1.6 billion in FCF, representing 5.1% of its total revenue of $31.6 billion in 2022. This is a long way from its FCF losses even as recently as Q4 2021 when it had outflows of $569 million, compared to the positive $332 million in Q4 2022.

But even more important is management's forecast that Netflix expects to make $3 billion in FCF during 2023. On top of constant currency revenue growth forecasts, that puts the FCF margin close to 8.9% based on analysts' forecasts of $33.88 billion in revenue during 2023.

Lastly, the company made an announcement that it expects to resume share buybacks sometime during 2023. The company spent over $724 million in share repurchases during the second half of 2022. Assuming it spends at least $2.5 billion on buybacks during 2023.

This represents a buyback yield of 1.7% based on the market capitalization of NFLX stock at $145 billion (i.e., $2.5b/$145b). This is another sign that the company is returning to a healthy financial condition. The company spent a good deal of time in the shareholder letter discussing its new lower-priced ad-supported membership prospects. This new revenue stream should more than cover the lower membership revenues.

Outlook for NFLX Stock

As is usual, the stock has already risen in “buy the rumor, sell the news” activity. In the last month, it is up 9.5% as of the close on Thursday, Jan. 19, at $315.78 per share.

Moreover, analysts project $10.62 in earnings per share (EPS) for 2023. This puts NFLX stock on a forward price-to-earnings (P/E) multiple of 29.7x. This is well below its historical 5-year average of 65x according to Morningstar, and even below the 46.5x average multiple in 2021 before Covid-19 hit the stock price.

Moreover, the resumption of stock buyback activity will work to push the stock higher over the next year as well as raise earnings per share. As a result, investors have much to look forward to over the next year. In the long run, the strong FCF growth, new revenue lines, and share buybacks are all positive narratives supporting the stock's valuation.

Moreover, as I discussed in my previous article on Jan. 1, there are still opportunities to take advantage of the stock option's high implied volatility (IV). I expect to discuss this in an upcoming article after the market has digested today's results.

More Stock Market News from Barchart

- Stocks Close Moderately Lower on Economic Growth Concerns

- Debt Ceiling will be a Wet Blanket Over the Stock Market Until June’s X-Date

- Economic Concerns and Debt Ceiling Risk Weigh on Stocks

- An Uptick in Options Volume for Zoetis (ZTS) Points to a Potential Opportunity

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)