/Netflix%20On%20TV%20with%20Remote.jpg)

Netflix (NFLX) stock is at its highest implied volatility (IV) levels, pushing up its options prices. Now investors can short out-of-the-money (OTM) covered calls, short puts, or even a jade lizard strategy to make extra income. These strategies are designed to take advantage of the high IV levels with NFLX stock options.

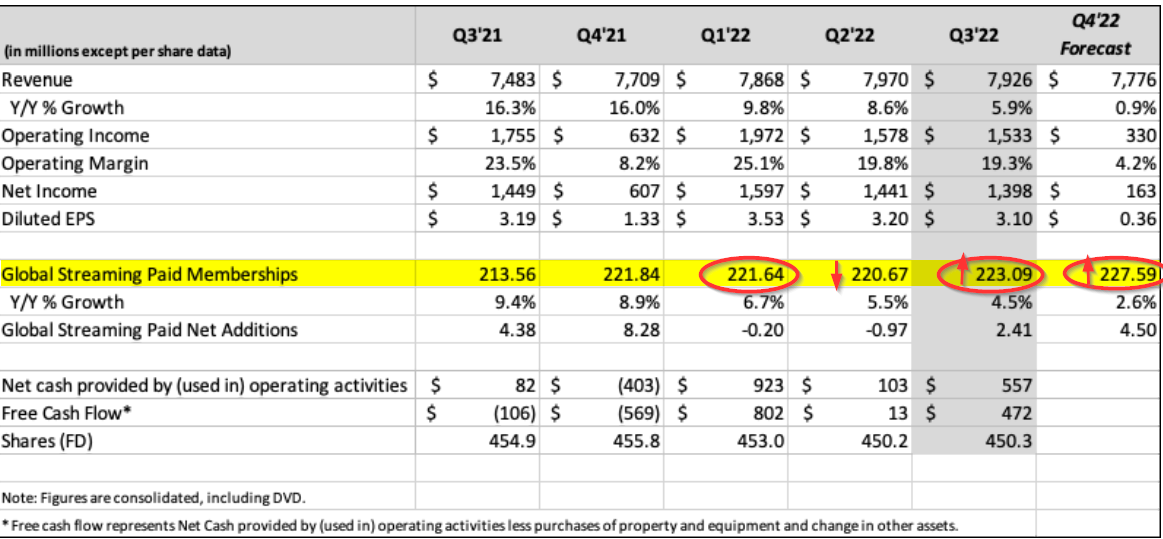

Netflix stock has had a bumpy year. It ended 2021 at $602.44 per share. But by April 19, it was down 43% to $348.61. Then the company reported a decline in its subscriber base by just 1 million subscribers from 221.64 million in Q1. As a result, NFLX stock cratered 20% in one day to $226.19. It later bottomed out at $162.71, down 73% for the year.

But since then, it has rebounded to $294.88, as of Dec. 31, 2022. This is partly due to a turnaround and an increase in its Q3 global subscriber base, as I explained in my Aug. 19 Barchart article. The company ended up with 223.09 global subscribers and the company now forecasts it will have an even higher number in Q4 of 227.59 million, as seen in the table below.

As a result, analysts now project higher earnings per share (EPS) of $10.60 for 2023 vs. the $10.37 forecast for 2022. So, now wonder that NFLX stock now has huge implied volatility. In fact, based on Barchart's Stock IV Rank report, it has one of the highest IVs of all stocks. This leads to high call and put option premiums that investors can take advantage of to create extra income.

Creating Income with NFLX Stock

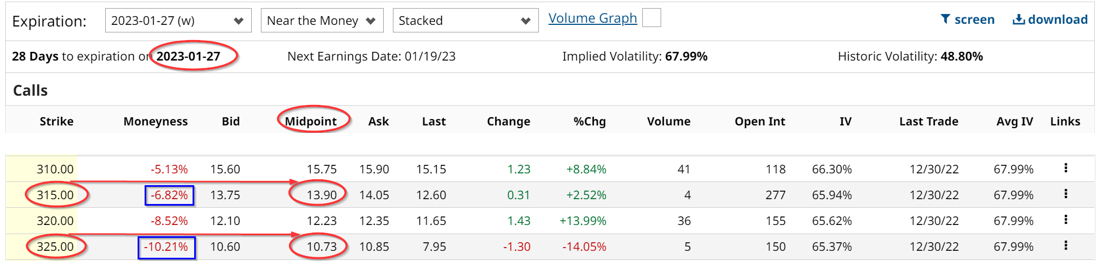

For example, the Jan. 27, 2023 expiration calls have a midprice of $13.90 per call option at the $315 per share strike price, almost 7.0% over today's price. That provides a whopping 4.90% immediate income yield to the investor (i.e., $13.90/$294.80). Remember that the investor will have to buy 100 shares at $294.80 in this covered call strategy.

However, in case the investor wants to protect against the stock rising well above the $315 strike price, they could buy the $325 strike price call for a lower amount of $10.73 per share.

That still leaves an implied return of $3.17 to the covered call investor, or 1.07% for the next 26 days to expiration, as of Jan. 3. Now, if the investor wanted to avoid buying the 100 shares of NFLX stock they could employ a Jade Lizard strategy, as I described in an earlier article on Spotify (SPOT) stock. Here is how you would do that.

In effect, the investor would use this same call spread - i.e., short calls at $315 and buy calls at the $325 strike price, without buying the underlying 100 shares. That leaves both a net credit of $3.17 per call spread, but also leaves a hole of $10 between the $315 and $325 strike price. This effectively creates a risk of losing $6.83 (i.e., $10 - $3.17) per contract.

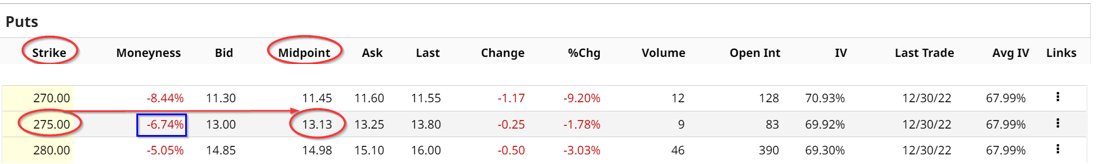

In order to turn this into a net credit, the investor can short out-of-the-money puts at the $275.00 strike price, which implies that NFLX would have to fall by 6.74% before the investor would need to buy the stock at $275.00. In return, the investor receives $13.13 per put contract and will have to put up $27,500 in cash or margin.

However, now the investor has a total income of $16.30 per contract (i.e., $13.13 from the put short and $3.17 from the call spread). That more than covers the $10 risk in the call spread, (i.e., the difference between the $325 call buy and the $315 call short). So if the stock rises to $325 or higher, the investor has no upside risk and still makes at least $6.30 per contract (i.e., $16.30 - $10). That works out to a 2.29% return on investment of the cash/margin cost at $275.00 (the call spread may not entail any margin cost, depending on the brokerage firm).

This is how an investor can profit from a Jade Lizard strategy in Netflix stock.

More Stock Market News from Barchart

- Stocks End the Year on a Weak Note as Global Bond Yields Rise

- Stocks Face Uncertainty in 2023

- Stocks Drop as Bond Yields Climb

- Suncor Energy Attracts Value Buyers with Their Dividend Hike and Buybacks

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)