Spotify Technology (SPOT) stock shot up last month after its earnings release as I described in my last article on the company. This has led to high levels in its call and put option premiums. As a result, value investors are shorting out-of-the-money (OTM) covered calls and cash-secured puts for good income plays. One way to do this is with a Jade Lizard strategy.

At $75.89 per share on Dec. 20, the stock is now down over 64% in the last year and off over 25% in the last six months. But in the last month since it announced its Q3 earnings it is actually up over 1.68% and higher. This high level of volatility has led to high levels in its call and put premiums.

Covered Call Plays

This means that investors can buy shares in the stock and “sell to open” (i.e., short) higher OTM strike prices to generate income. For example, the Jan. 20, 2023, $83.00 strike price, which is about 9.3% over today's price, trades for $2.18 per call option. That works out to a covered call yield of 2.87% in just one month.

That means that the investor could buy 100 shares today at $75.89 for $7,589 and then “sell-to-open” 1 call option contract at $83.00 for expiration on Jan. 20, 2023, and immediately received $218 per contract in their account. As a result, the $218 represents $2.87% of their $7,589 investment.

That represents a potential annualized return of over 34% if the investor can repeat this short income covered call play each month.

Moreover, even if the stock rises to just below $83.00 by the Jan. 20 close of business, the investor gets to keep the unrealized gain. That means the potential return over the next month could be as much as 12.2%.

Hedging With a Jade Lizard Strategy

To be even more conservative the investor could decide to buy the $84.00 strike price call for $1.73 per contract. This is just in case the stock rises significantly above the $83.00 call short strike price. This means that the net income received would be 45 cents per contract.

However, there is still a $2.00 spread risk between the $83.00 and $85.00 strike prices. To cover the net spread cost of $1.55 (i.e., $2.00 minus 45 cents received on a net basis), the investor could short OTM puts.

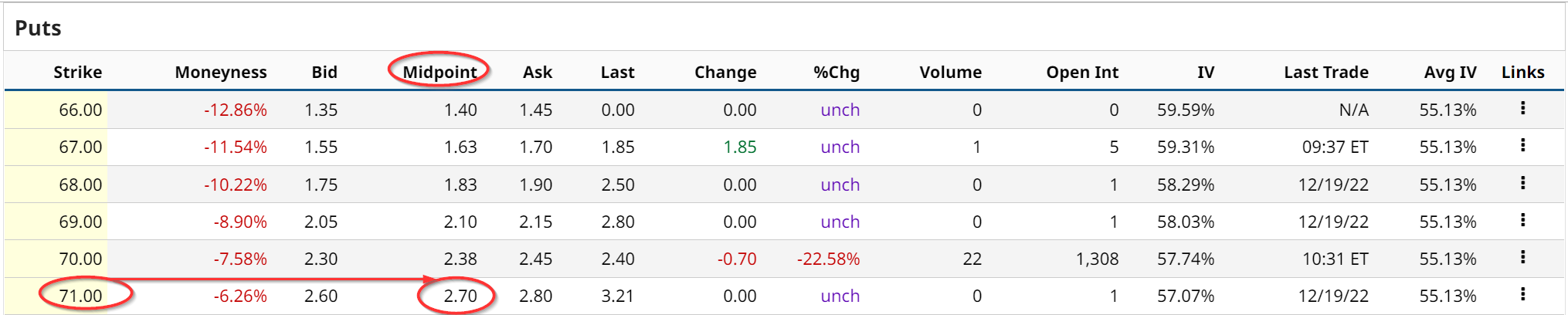

For example, the $71.00 strike price puts trade for $2.70, as seen in the Barchart option chain below.

This more than covers the net spread risk of $1.55, and still leaves the investor with a profit. The $2.70 put premium received covers the net $1.55 spread risk by $1.15 (i.e., $2.70 - $2.00 spread risk + $0.45 net received from the two call trades). However, the investor will have to put up $7,000 in cash or margin to cover this spread risk.

This whole set of trades is known as a Jade Lizard strategy. It works out quite well since now there is definitely no upside risk over the $83.00 strike price. In addition, he net investment return is at least $1.15 per contract and can be higher if SPOT rises to $83.00 per share.

The only risk is if SPOT stock falls below $71.00 or over 6.4% of today's price. But even if that happens, the investor gets to buy SPOT stock at a good price.

For example, the investor can then turn around and sell covered calls. In addition, unless the stock falls below $69.85 (i.e., $71 - $1.15 net premium received) by Jan. 20, the investor still comes out ahead with this strategy.

The investor has to stay on top of the Jade Lizard options strategy. For example, it might make sense to close out the long call trade closer to expiration and recoup some income. This could happen if SPOT stock stays flat or trades in the range between the $71 and $83.00 strike prices. By managing the strategy the investor will increase the net return to over $1.15 per contract.

More Stock Market News from Barchart

- Unusual Options Activity May Suggest Big 5 Sporting Goods (BGFV) Lacks ‘Firepower’

- BOJ Surprises Markets by Widening its 10-Year Yield Target Range

- One of Warren Buffett's Smaller Holdings Is Making Some Big Moves

- Stocks Climb on Strength in Tech Stocks

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)