/Spotify%20Logo%20Dark%20Background.jpg)

Spotify Technologies (SPOT) reported disappointing earnings last month for Q3. But SPOT stock shot up almost 10% yesterday. Analysts expect huge revenue gains next year, making its call options look cheap.

The music streaming company's operating earnings turned negative for the second quarter in a row, disappointing investors. However, there are enough silver linings in the cloud, so to speak, that investors can expect to push SPOT stock higher.

Underlying Growth Looks Solid

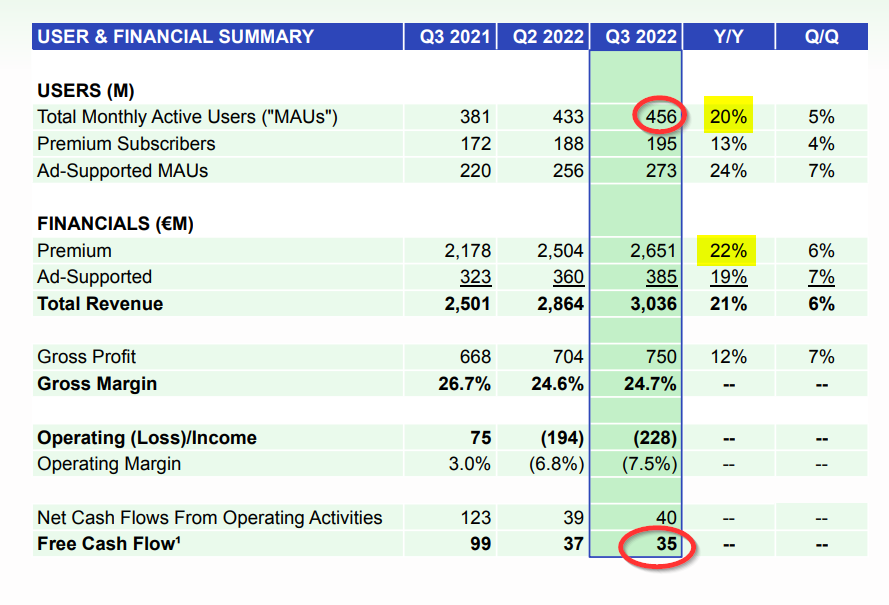

For one, the company reported that its total active monthly users (MAU) grew sequentially from last quarter's 433 million to 456 million in Q3. That is a core metric, signifying that its underlying traffic generation is still growing. This represents 5.3% growth in the past quarter alone. And year over year (YoY), its MAUs grew by 20%.

Second, its revenue was up 20% YoY and its premium paying users continued to grow. Premium users rose from 188 million in Q2 to 195 million in Q3, a gain of 3.7%, or almost 15% annually going forward on a run-rate basis. This is important since Spotify relies on subscriptions or premiums for EUR 2.6 billion of the total EUR 3.0 billion in quarterly revenue. That represents 86.7% of its total sales.

So, as long as traffic, subscription users, and sales are still growing, Spotify has a chance.

In addition, as readers of my articles know well, I like investing in companies that produce free cash flow (FCF). And Spotify is still producing positive FCF, albeit at lower levels. Last quarter they eeked out EUR 35 million in FCF, down slightly from EUR 37 million in Q2 and EUR 99 million a year ago.

Moreover, analysts are forecasting that next year Spotify will show over 15% revenue growth next year as well. This makes Spotify valuable in the long term. It also makes its call options valuable.

SPOT Stock Call Options Look Attractive

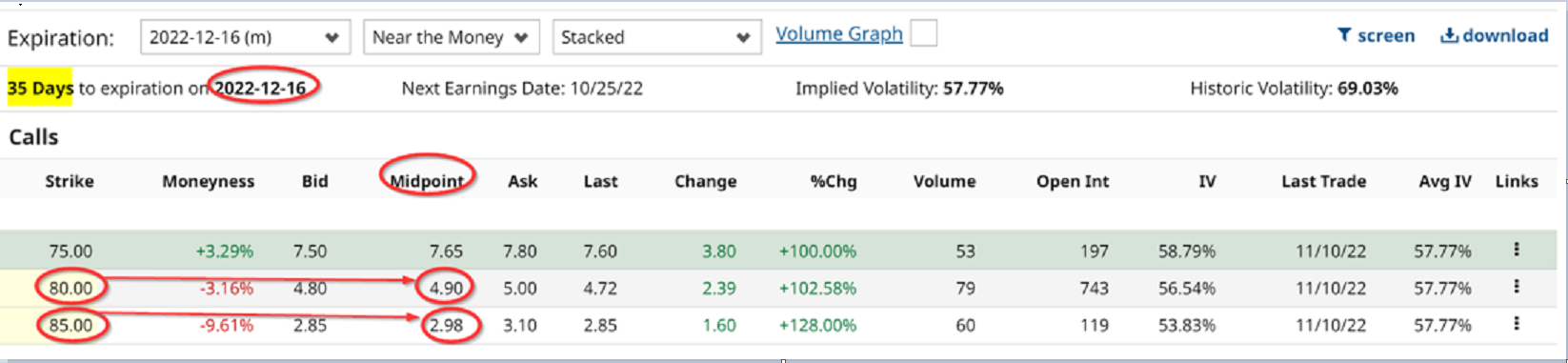

SPOT call options expiring Dec. 16 show that the out-of-the-money (OTM) strike price at $85.00 per share cost only $2.98 per contract. That means that the break-even price for a long OTM call investor is $87.98, which is just 12% over the Thursday, Nov. 10, closing price of $78.44. And if that is too risky for some investors, the $80 strike price calls trade for $4.90, leaving the break-even at $84.90 or just 8.2% over Thursday's price of $78.44. This can be seen in the Barchart option chain below:

Moreover, since Spotify's option premiums are high now, it is possible to cover a good deal of the cost of these calls by selling OTM puts. For example, the $70 put strike price for Dec. 16 expiration has a premium of $2.33 per share.

Therefore, if an investor is willing to put up $7,000 per put contract at the $70 strike price, he can pay for 78% of the cost of the long call premium at $85 (i.e., $2.33/$2.98 = 78%), and 47.6% of the $80 calls costing $4.90 (i.e., $2.33/$4.90 = 47.55%).

The bottom line here is that this is a very cheap way to take a large long position in Spotify going long in near-term calls, financed by selling OTM put contracts.

Investors might also like to know that the new Netflix Swedish movie on Spotify, The Playlist, is well worth watching, as it describes how the company got off the ground.

More Stock Market News from Barchart

- Stocks Skyrocket as Yields Plunge on a Soft U.S. CPI Report

- Hopes are Building for Tech Earnings to Stabilize

- Stocks Soar as Bond Yields Plunge on Soft U.S. Consumer Prices

- Markets Today: Stocks Rocket Higher as U.S. Inflation Concerns Ease

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)