/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

Quantum computing is evolving from a futuristic concept to a practical technology with real momentum, projected to be a $12.6 billion market by 2032. These two companies are positioning themselves as the most aggressive and ambitious players in the emerging quantum computing industry. Investors looking for high-risk, high-reward prospects should keep these two stocks in mind.

IonQ (IONQ)

Valued at $14.2 billion, IonQ (IONQ) is a pure-play quantum platform business focused on building universal, gate-based quantum computers and related technologies. It makes quantum computers or next-generation computers that solve problems faster and far more complex than normal computers. It also develops quantum networks (ultra-secure communication systems), quantum sensors (very precise clocks and navigation tools), and quantum security systems (to safeguard data from future hacking) for use in industries like drug research, cybersecurity, and national defense.

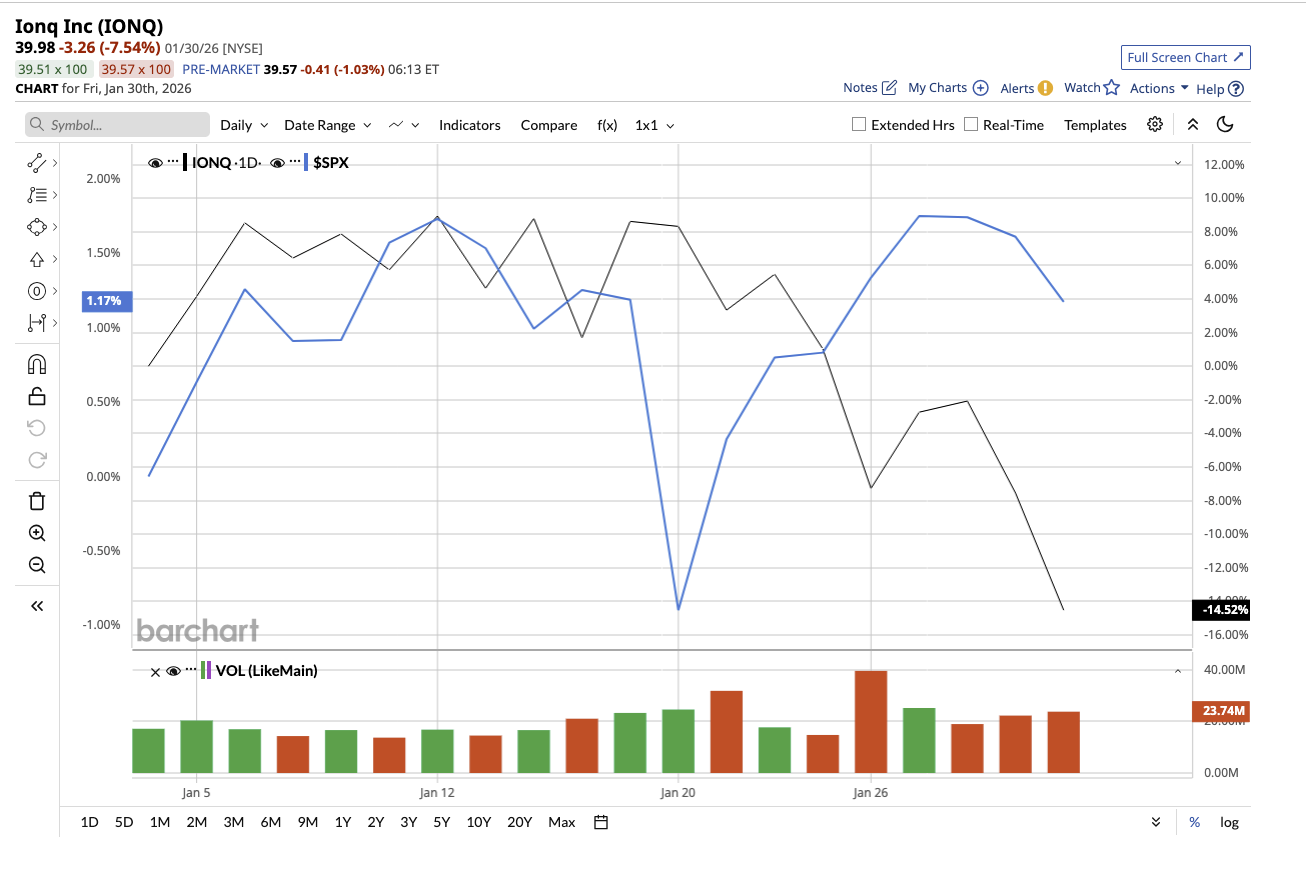

While IONQ stock gained just 4.1% last year and is down 14.5% so far this year, it has returned 274% over the past two years.

In the third quarter, IonQ reported its largest revenue beat ever, exceeding the high end of its own guidance by 37%. Revenue reached $39.9 million, a 222% year-over-year growth, highlighting rapid commercial traction in a sector that is still in the early stages, which management acknowledged as well. Management called this growth an early step in what the company sees as a much larger opportunity. IonQ believes it has only "scratched the surface" of worldwide demand for quantum computing, networking, sensing, and security solutions.

Its fifth-generation system, Tempo, achieved an algorithmic qubit score of 64, boosting computational space by almost 260 million times over its previous commercial system, Forte. IonQ expects Tempo to be available in 2026, with future systems growing to 256 qubits and eventually up to two million physical qubits by 2030. During the quarter, IonQ finalized the acquisition of Oxford Ionics, integrating its Electronic Qubit Control architecture into future systems. This acquisition enables IonQ to leverage current semiconductor supply chains, hence boosting scalability, cost-effectiveness, and deployment. In addition, the company purchased Vector Atomic, a quantum sensing leader.

Furthermore, in collaboration with Nvidia (NVDA), Amazon (AMZN), and AstraZeneca (AZN), the company showed a 20x quantum speedup in computational drug research, completing a task that would typically take nearly a month on classical systems in just 36 hours. IonQ also announced advancements in quantum networking and cybersecurity. Despite heavy investment, IonQ ended the quarter with $1.5 billion in cash and investments, which increased to $3.5 billion after a $2 billion capital raise in October. With zero debt on its balance sheet, the company is one of the strongest capitalized players in quantum computing.

However, these investments have also weighed on profitability. Adjusted EBITDA for the quarter was -$48.9 million, driven primarily by research and development spending. However, management sees these losses as strategic investments required to retain long-term leadership.

IonQ positions itself as the only complete quantum platform company, offering computing, networking, sensing, and cybersecurity in one package. The upside is enormous if quantum computing becomes commercially essential. However, the risks are equally high. The company is unprofitable, requires ongoing capital investment, and works in an industry where timelines and real-world adoption remain uncertain.

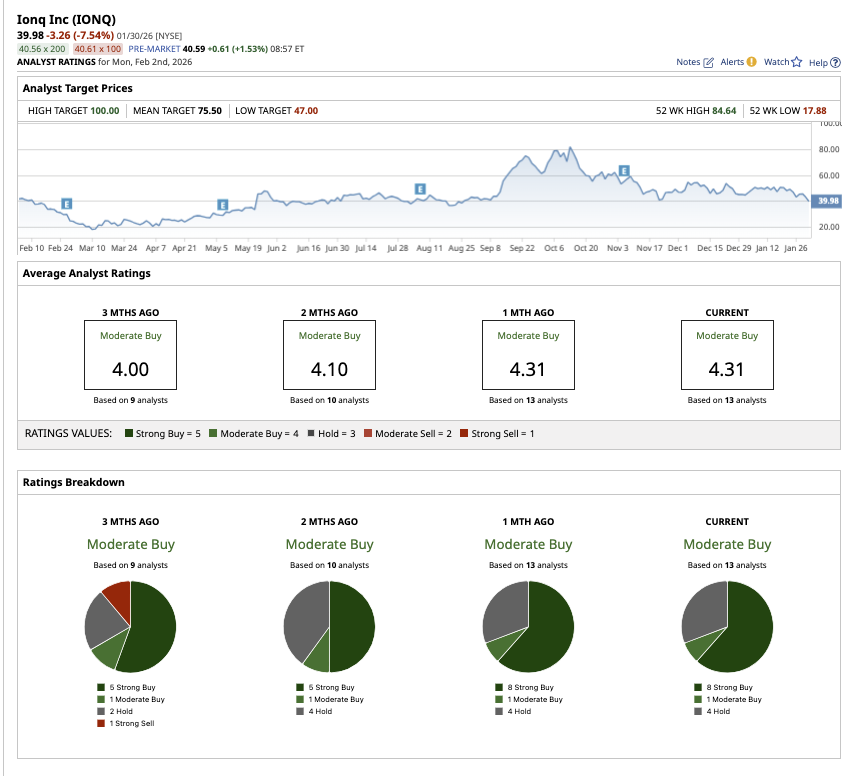

Overall, Wall Street has a consensus rating on IONQ of a “Moderate Buy.” Among the 13 analysts covering IONQ stock, eight rate it a “Strong Buy,” one calls it a “Moderate Buy," and four suggest it is a “Hold.” Its average price target of $75.50 suggests the stock can rally 88.8% from current levels. The high price estimate of $100 implies upside potential of 150.1% over the next 12 months.

Rigetti Computing (RGTI)

Valued at $6 billion, Rigetti Computing (RGTI) has also been drawing investor interest. Rigetti designs and operates superconducting quantum computers, offering both cloud-based access and on-premises systems for enterprises, governments, and research institutions.

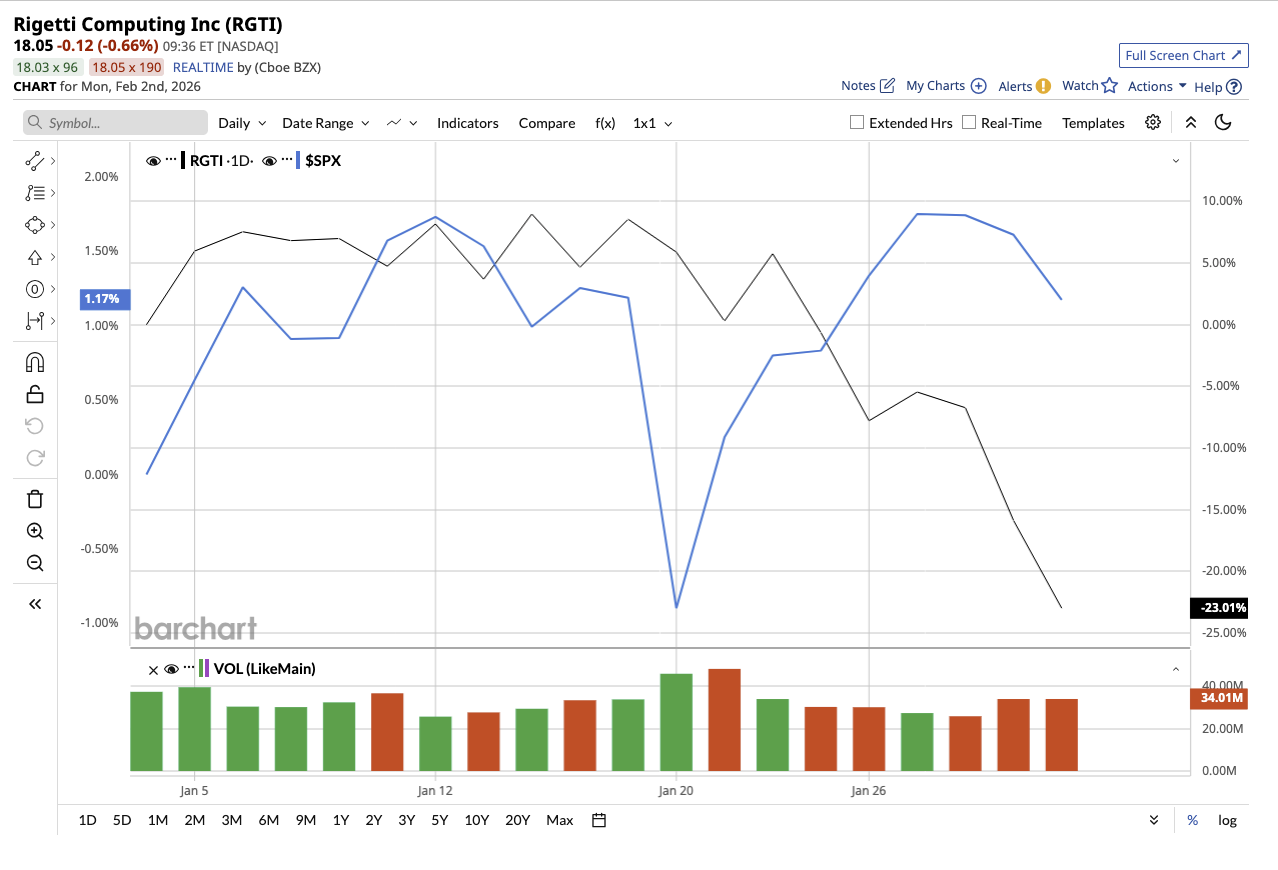

Over the past two years, the stock has returned an eye-catching 1,466.4%. Rigetti stock has been highly volatile over the past 52 weeks, swinging from a low of $6.86 to a high of $58.15.

In the third quarter, the company reported revenue of $1.9 million. Rigetti’s business is still in the early stages, which is why the company reported a net loss of $201 million on a GAAP basis, reflecting heavy investment in research, development, and infrastructure. Nonetheless, it remains committed to rapid hardware development. By the end of 2025, the company plans to offer a 100+ qubit chiplet-based system with a median two-qubit gate fidelity of 99.5%.

Looking ahead, management intends to build a 150+ qubit system with 99.7% fidelity by 2026, followed by a considerably larger 1,000+ qubit system with 99.8% fidelity by 2027. These developments are consistent with Rigetti's goal of enabling increasingly complicated quantum algorithms and advancing toward realistic quantum advantage. While still small in scale, Rigetti secured $5.7 million in purchase orders for two nine-qubit Novera quantum systems. The company also supports Nvidia’s NVQLink, an open platform designed to integrate AI supercomputing with quantum hardware, enabling faster hybrid computation workflows.

On the government side, Rigetti was awarded a $5.8 million contract from the U.S. Air Force Research Laboratory, working alongside QphoX to push forward superconducting quantum networking. Rigetti is a classic early-stage, high-risk quantum investment. The company generates minimal revenue, burns significant capital but also holds proprietary superconducting technology and a clear roadmap toward much larger and more powerful quantum systems.

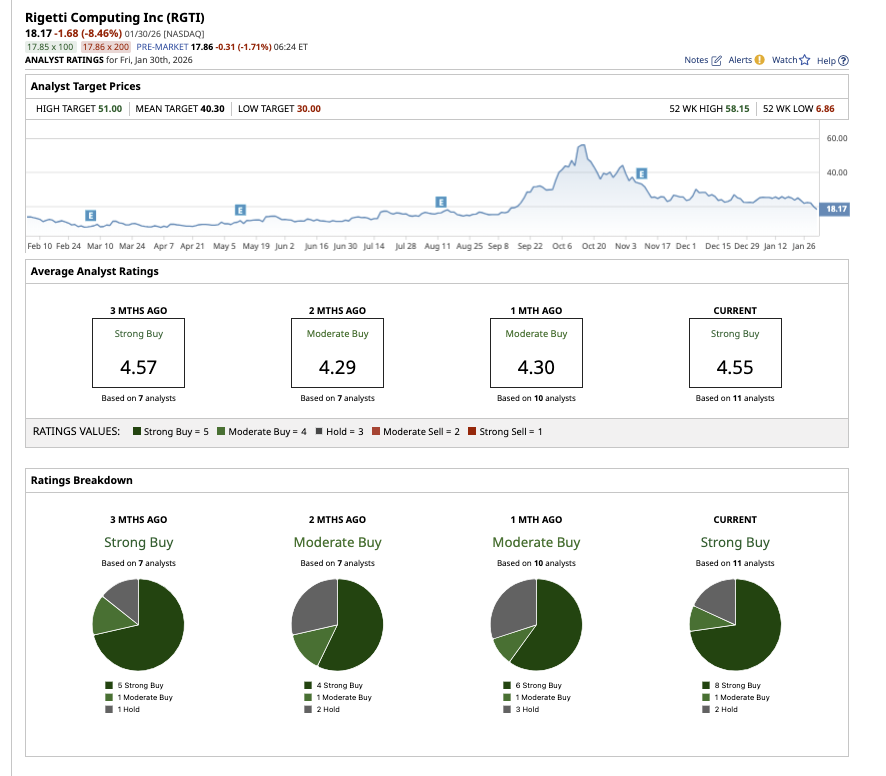

Overall, Rigetti stock has a “Strong Buy” consensus rating. Among the 11 analysts covering RGTI stock, eight rate it a “Strong Buy,” while one gives it a “Moderate Buy” rating, and two say it is a “Hold.” Its average price target of $40.30 suggests upside potential of 121.8% from current levels. Plus, its high-end estimate of $51 suggests it has the potential to rally up to 180.7% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)