Netflix, Inc. (NFLX) stock looks attractive from a value investor's standpoint. Moreover, the streaming firm predicts rising membership accounts in Q3, potentially leading to higher free cash flow and a stock turnaround.

When Netflix reported its Q2 earnings on July 19, its paid memberships fell for the second quarter in a row. Although NFLX stock initially fell after the results, the stock has been floating higher.

One reason is that Netflix also predicts that its paid memberships could rise in Q3 to slightly over the level where it fell at the end of Q1. Moreover, this could lead to a potential gain in free cash flow (FCF).

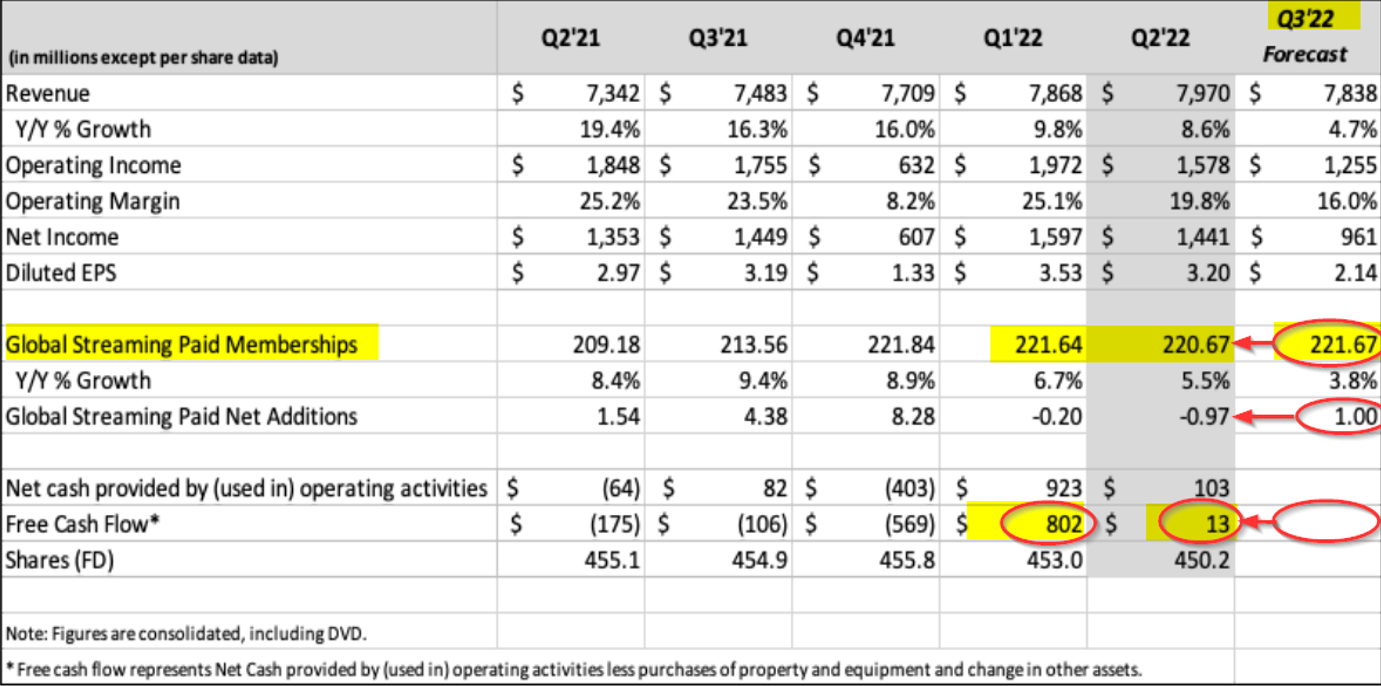

You can see this in the table below, which Netflix prepared in its shareholder letter.

This shows that for Q3 Netflix predicts that paid memberships will rise by 1 million accounts over the Q2 levels to 221.67 million. This represents a one-half percent increase in memberships and is slightly higher than the 221.64 paid memberships at the end of Q1.

Estimating Free Cash Flow

As a result, investors could reasonably expect that the company will show a significant gain in free cash flow (FCF) during Q3. For example, during Q1 the company produced a 10.19% FCF margin on its $7.868 billion in revenue.

As Netflix now forecasts a similar level of revenue of $7.838 billion for Q3, it's possible FCF could reach $799 million. However, given that Q2 showed a paltry $13 million, it's also likely that the FCF margin could be slightly below the 10.19% average of Q1.

For example, if we use a 10% FCF margin estimate and apply that to analysts' forecasts of $34.2 billion in sales next year, FCF could reach $3.42 billion.

Where This Leaves Investors in NFLX Stock

We can use this FCF estimate to value NFLX stock. For example, if we use a 3% FCF yield, the target price works out to $114 billion (i.e., $3.42b/0.03 = $114b). This represents a potential 4.6% rise in the stock price since Netflix's market cap today is $109 billion.

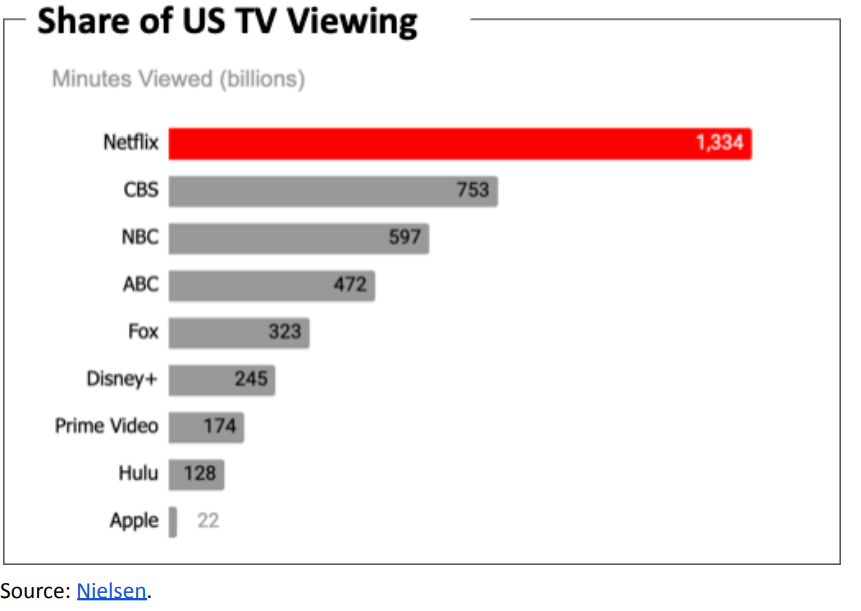

However, investors are likely to project much higher FCF for next year if the company's paid memberships continue to gradually move higher. One reason is Netflix is offering new types of paid memberships and new services such as licensed mobile games. In addition, the company is now offering lower-priced memberships with advertising, bringing a new revenue stream to the company.

As a result, given that NFLX now trades for just 23 times earnings this year and 22 times next year's earnings, the stock looks very cheap. Compare this to its historical average. Morningstar reports that over the last 5 years, its average forward P/E multiple has been 71.26x.

So, even if the market gives the stock one-half of that multiple, and assuming earnings reach $10.92 next year, the stock price target rise to $390.39 per share. This can be seen by multiplying $10.92 by 35.75 (i.e., ½ x 71.2x), or $390.39 per share.

That represents a potential 61.5% gain over today's price of $241.68 (as of Aug. 18). That is a very good return for patient, value investors in NLFX stock.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)