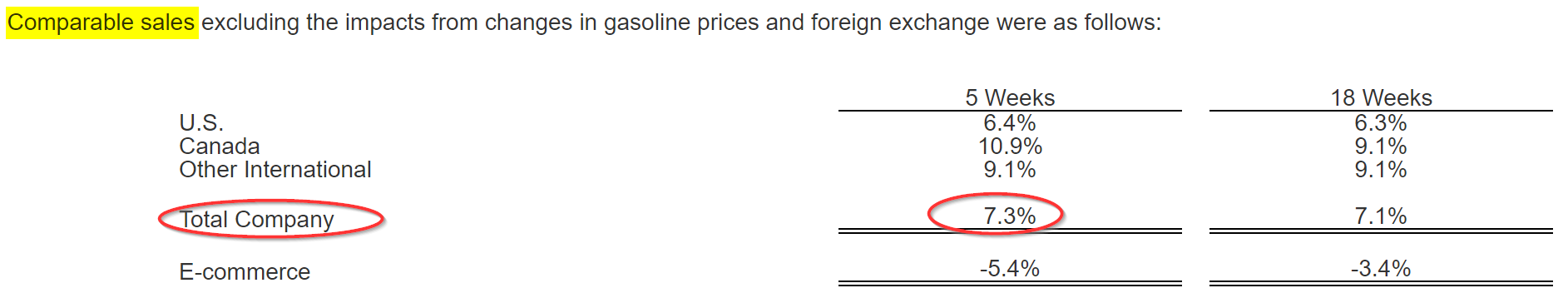

Costco Wholesale Corp (COST) reported on Jan. 5 that its December sales grew 7.0% year-over-year and 7.3% comp sales for the 5 weeks ending Dec. (excluding gas and FX). This highlights the attraction of COST stock to growth investors.

In fact, post-market close on Jan. 5, the stock is now up 2.4% to $461.00 per share. That puts it up slightly for the year-to-date period. In addition, analysts are likely to upgrade their views on the stock's outlook.

For example, the average earnings per share (EPS) forecast of 13 analysts for the fiscal year ending Aug. 31, 2023, is $14.26 per share, up 8.5% from $13.14 EPS in Aug. 2021. And for the following year, they project $16.07 EPS or 22.2% over 2022 and 12.7% over projections for the year ending Aug. 2023.

This is appealing to growth investors who are seeing other traditional growth companies lower their expectations and cut employees. On the other hand, the stock does have a high earnings multiple. The price-to-earnings (P/E) multiple for the year ending Aug. 2023 is over 32 times. That reflects a high valuation for its growth.

Shorting OTM Puts for Income

One way to conservatively play this is to short out-of-the-money (OTM) puts - i.e., at strike prices well below today's price, in case the stock falls. That is a way to create income for a conservative investor in a high P/E stock. And if the stock falls the investor can automatically buy in at a lower price and multiple.

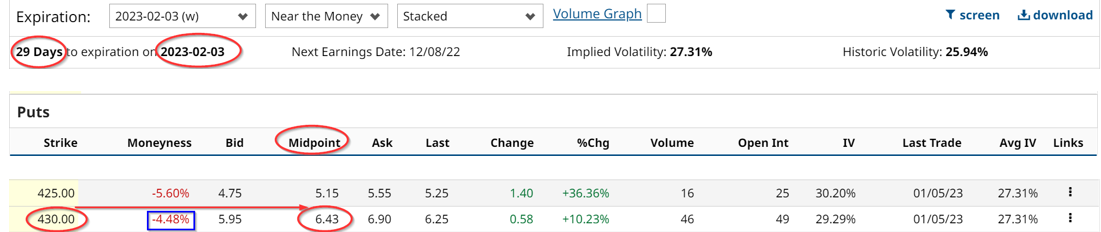

For example, for the period ending Feb. 3, 2023, Costco puts at $430 per share or 6.7% below the price on Jan. 5 after hours, now trade for $6.43 per put option. That means that the investor gains an immediate put yield of 1.50% (i.e., $6.43 premium/$ 430 strike price).

This means that the investor who puts up $43,000 in cash or margin with the brokerage firm, can then put in an order to “sell to open” one put contract at the $430 strike price. The investor will immediately receive $643 in income.

This also means that on an annualized basis the potential income opportunity works out to almost 18%, assuming that this trade can be duplicated each month for the same high level of premium income.

And, just as I pointed out in my recent article on Archer-Daniels Midland Co. (ADM) stock, this premium income also lowers the breakeven price. For example, the breakeven price before the investor begins to lose money is $423.57 (i.e., $430 strike price - $6.43 premium received). This means that COST stock has to fall further by over 8% before the investor will begin to lose money on an unrealized capital gain basis.

But just shown in the ADM stock article, the investor can immediately sell OTM covered calls for the shares that they now own. This is also known as a “wheel” strategy, as the investor has then come full circle from selling puts, purchasing shares upon exercise, and then selling calls.

This shows that selling OTM cash-secured puts in COST stock is a way to play the growth of Costco Wholesale Corp on a conservative basis.

More Stock Market News from Barchart

- Stocks Retreat on U.S. Labor Market Strength and a Hawkish Fed

- Slowdown in Auto Sales Could Weigh on Chipmakers

- U.S. Labor Market Strength and Hawkish Fed Comments Hammer Stocks

- Unusual Options Volume for Coty (COTY) Screams a Long-Term Opportunity

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)