A large tranche of puts in Archer-Daniels Midland (ADM) stock was shorted recently. This will provide the institutional investor with a good income play for the out-of-the-money short put trade. This is because the investor likely believes that ADM stock is near a low and won't decline to the much lower put strike price.

As a result, they are able to make a good income yield on the short-put trade over the next 3 months.

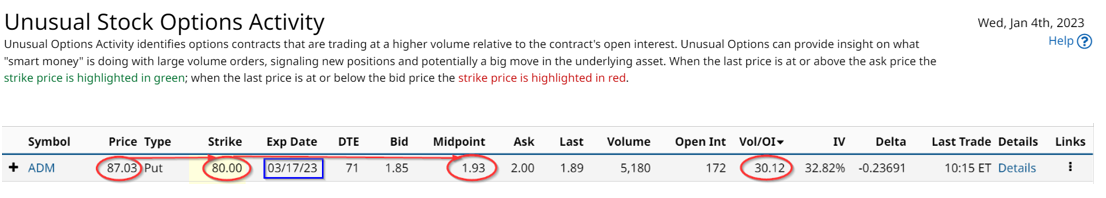

This trade can be seen on the Barchart Unusual Stock Options Activity report for Jan. 4 here. It shows that some investors sold 5,180 puts for $1.93 at the midpoint price for $80 strike price puts expiring March 17, 2023. So that means they received almost $1 million (i.e., $1.93 x 5,180 x 100 = $999,970), although they had to provide cash and/or margin of $41.44 million (i.e., $80 x 100 x 5,180 contracts).

Since ADM stock now trades for $87.99, the short put investors obviously don't project that ADM will fall $7.99 per share or 9.08% by March 17. As a result, they will make an income yield of 2.413% over the next 71 days (i.e., $1.93/$80). So, on a strictly annualized basis, this works out to 12.4% per year, since there are 5.14 tranches of 71 days in a year (i.e., 5.14 x 2.413% = 12.4%).

This is a very good income play for institutional investors. But what if the stock does fall to $80? What will the investor do?

ADM Stock Looks Cheap

As it stands, ADM stock looks inexpensive at today's price. That is what the investors might be counting on. They figure that at $87.99 it trades for just 11.88x earnings for 2022 and just 13.88x for 2023. That is despite the fact that analysts forecast a decline in EPS in 2023 from $7.55 to $6.60.

Granted, that is not ideal, but if the stock falls from lower earnings, it could reach $80 or lower. For example, at $80 the stock will be just 12.1x earnings, close to where it trades now on a P/E basis.

So, where does this leave the short-put investor if that happens? For one, they will be forced to buy the stock at $80 per share. But they still get to keep the $1.93 per contract in income, so, in effect, their breakeven price is $80-$1.93, or $78.07. In other words, ADM stock will have to fall by 11.27% before they even begin to have an unrealized loss.

And the latter point is important. There will be no realized loss. They will own 5,180 x 100 or 51,800,000 shares in ADM stock. They can immediately sell covered calls that are out-of-the-money (OTM) to help make more income.

Moreover, their price is very cheap. For example, a $78.07 net buy-in price/$ 6.60 EPS is just 11.8x. That is a very reasonable multiple to pay for the stock. Morningstar reports that the average P/E multiple over the past 5 years has been 14x. That implies the stock could rise significantly from the net buy-in price.

This shows that shorting OTM puts in ADM stock could be a good trade for income for value investors.

More Stock Market News from Barchart

- Stocks Mixed on Strong U.S. Labor News

- Markets Today: Stocks Climb on Positive China Developments and Lower Bond Yields

- Analyzing a February VIX Butterfly Spread

- Pre-Market Brief: Stocks Mostly Higher Ahead of FOMC Meeting Minutes

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)