In crude oil, crack spreads reflect the margin for processing petroleum into gasoline and distillate products. Since consumers rely on oil products for their energy requirements, the processing margins directly dictate the prices paid at the gasoline pump. Crack spreads indirectly account for the prices of goods brought to market, airline travel, and many other expenses. Crude oil processing spreads or refining margins are a real-time indicator of the demand for oil products, translating to a barometer for underlying crude oil prices as oil is the primary ingredient in the refining process.

Processors crush soybeans into soybean oil and soybean meal. The oil is an ingredient in many foods, is used for cooking, and is an essential input in biodiesel. The meal is required for animal protein feeds. As the crude oil crack spreads act as a barometer for the energy commodity’s fundamental equation, the soybean crush spread does the same for the oilseed.

The Teucrium Soybean ETF (SOYB) moves higher and lower with soybean futures prices.

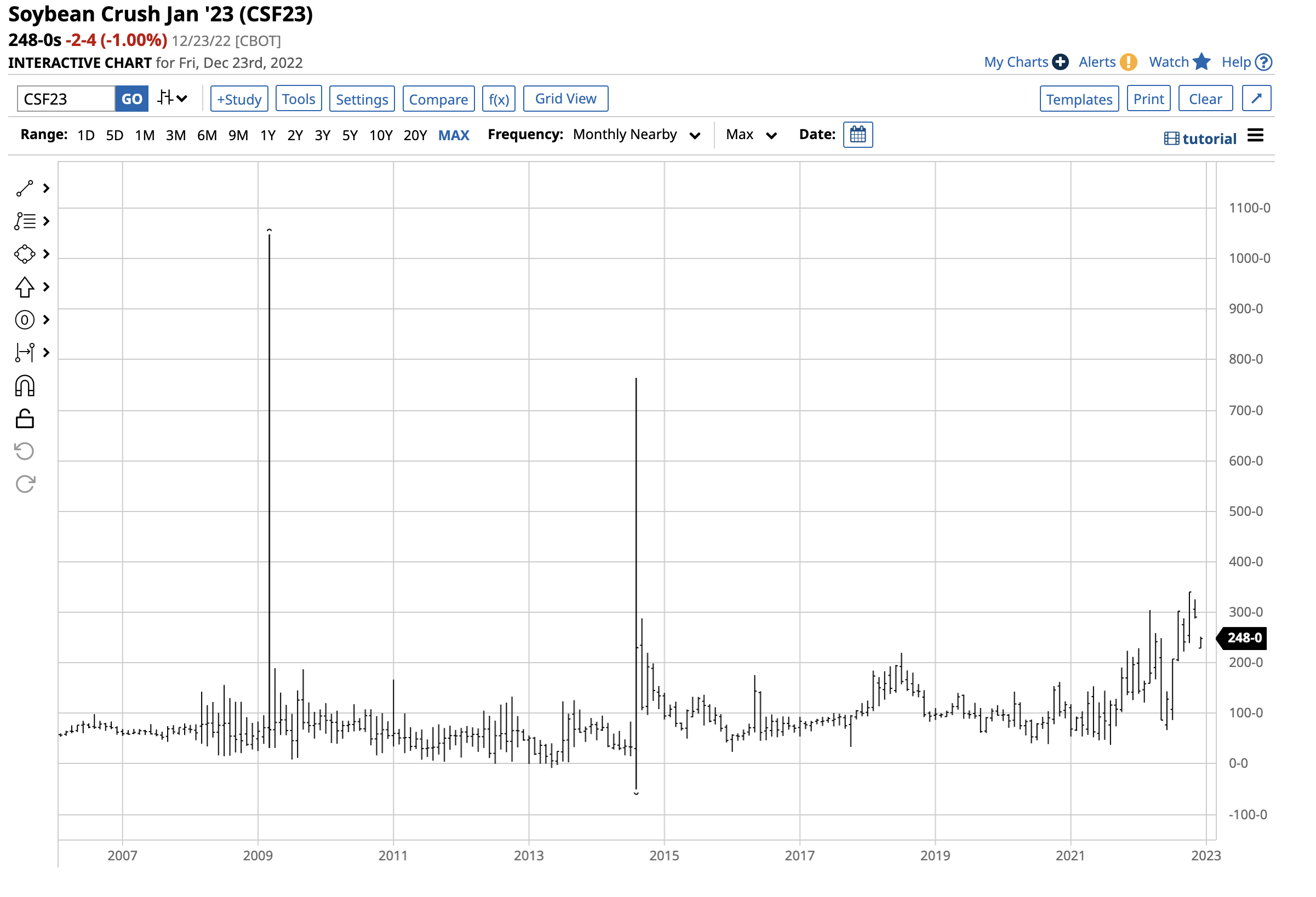

The rally in the soybean crush spread supports oilseed prices

The price action in the soybean crush spread has supported beans in the teens in late 2022. Before 2008, the all-time peak in the nearby CBOT soybean futures contract was $12.90 per bushel. On December 26, the price was just below the $15 level.

Aside from 2009 and 2014 price spikes, the soybean crush reached a $3.4025 high in October 2022.

The chart shows at $2.48 on December 23; the crush remains at a multi-year high.

Nearby soybean oil futures at almost the 66 level remain elevated after reaching a record peak in April 2022.

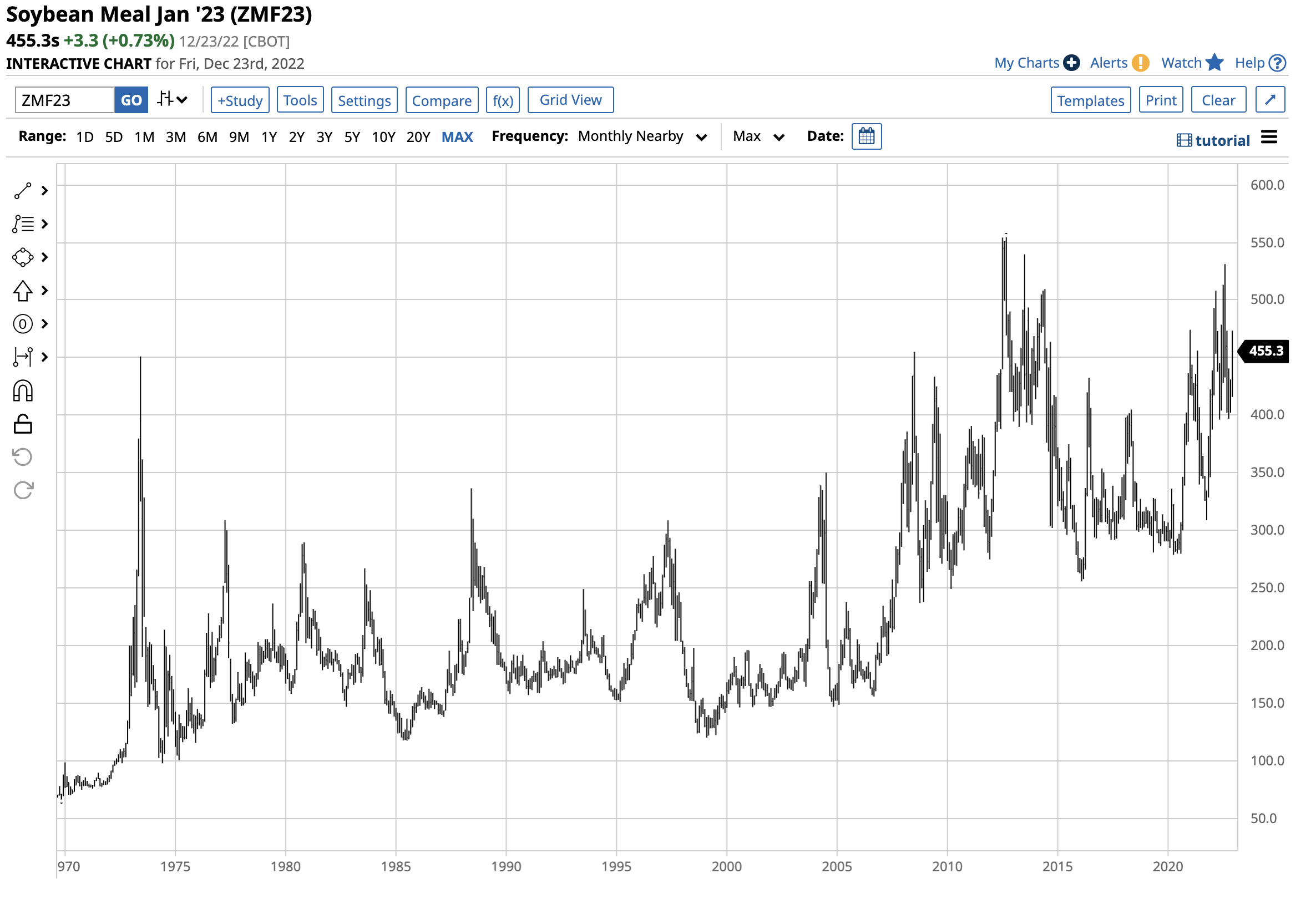

Nearby soybean meal futures remain in a long-term bullish trend, with the price above the $455 per ton level on December 23.

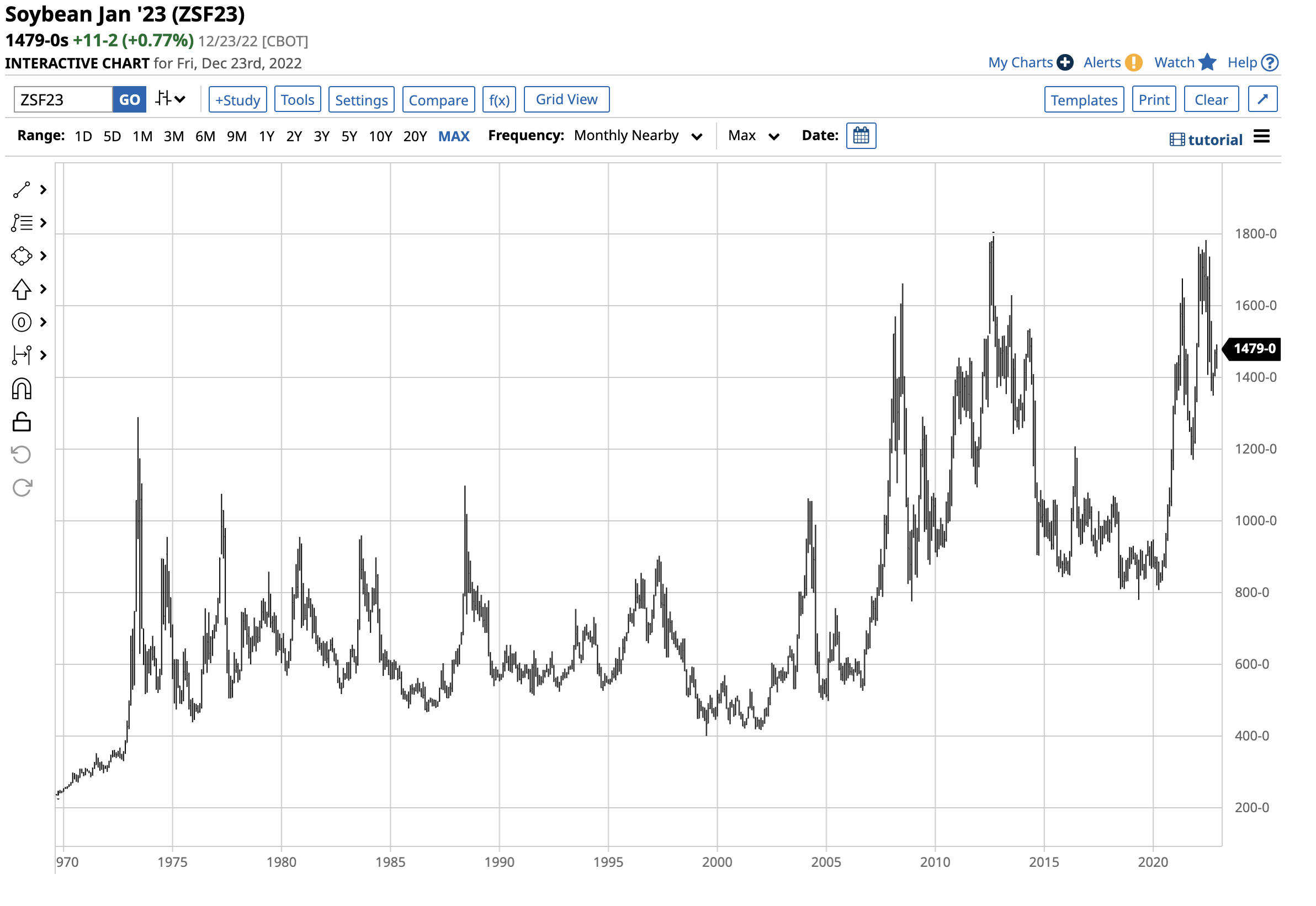

While soybean products are outperforming raw oilseeds, soybeans are also in a long-term bullish trend.

The chart highlights the bullish path of least resistance of the nearby CBOT soybean futures. The crush spread level validates soybeans’ current price near $14.80 per bushel.

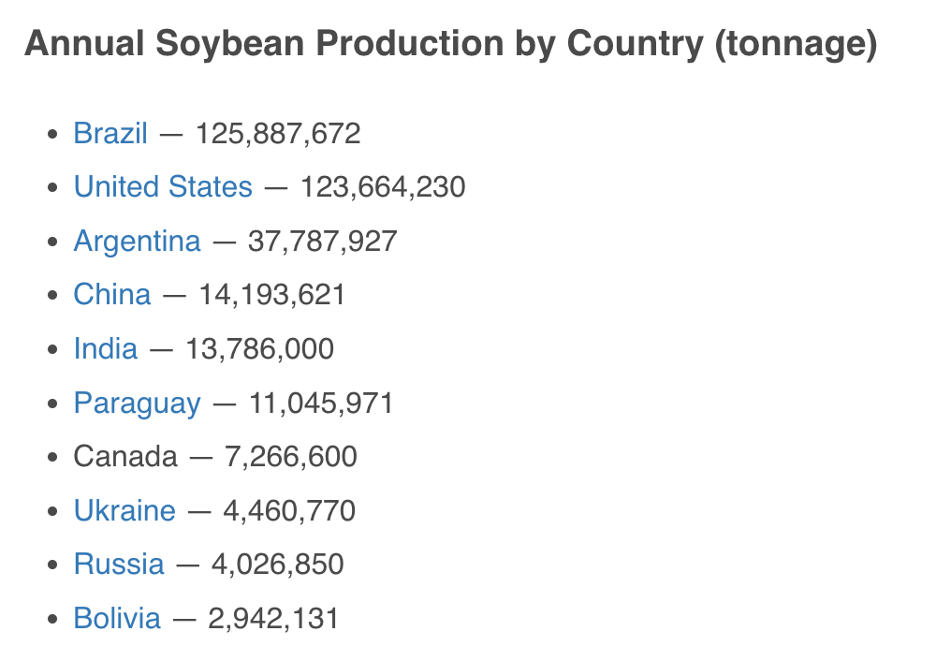

Brazil, the U.S., and Argentina produce the most soybeans

The top three soybean-producing countries account for the lion’s share of the world’s bean supplies.

Source: worldpopulationreview.com

The chart shows that Brazil led the world in soybean production in 2022, with the U.S. a close second. While third-place Argentina produced more than double fourth-place, China, Brazil, and the U.S. are the countries that determine the oilseed’s price.

ADM and BG crush beans- ADM and BG have outperformed the S&P 500 in 2022

Aside from being a barometer for soybean demand, the crush spread is also a real-time indicator of the earnings for companies that process the oilseeds into oil and meal. Archer Daniels Midland (ADM) and Bunge Limited (BG) are publicly traded members of the ABCD agricultural giants, including privately held Cargill and Louis Dreyfus.

The rise in the soybean crush spread has increased profit margins for the ABCD group. ADM and BG have outperformed the overall stock market in a year when the S&P 500 is more than 20% below the December 31, 2021, closing level.

The chart highlights ADM’s move from $67.59 at the end of 2021 to $94.62 per share on December 23, a 40% rally in the shares.

BG shares moved from $93.36 on December 31, 2021, to $98.96 on December 23, 2022, a 6% gain. While both ADM and BG are multinational agricultural giants, BG has significant exposure and business in Brazil. The bottom line is the rise in the soybean crush spread has bolstered profits for the leading agricultural companies.

Beans should remain in the teens in 2023

The USDA’s latest December WASDE report told the soybean market:

Total U.S. oilseed production for 2022/23 is forecast at 127.9 million tons, up slightly due to an increase for cottonseed. Soybean supply and use projections for 2022/23 are unchanged from last month. Based on a review of EPA's recent proposed rule for renewable fuel obligation targets, soybean oil used for biofuel for 2022/23 is reduced 200 million pounds to 11.6 billion. Soybean oil exports are also reduced on historically low export sales through November. With reduced use of soybean oil for biofuel and exports, food use and ending stocks are raised. The U.S. season-average soybean price forecast is WASDE-631-3 unchanged at $14.00 per bushel. The soybean oil price is reduced 1 cent per pound to 68 cents. The soybean meal price forecast is increased $10.00 to $410.00 per short ton. Global oilseed production for 2022/23 is projected at 644.4 million tons, down 1.2 million from last month. Lower sunflower, rapeseed, palm kernel, and cottonseed production forecasts are partly offset by higher soybean output. Global sunflowerseed production is reduced for Russia and Ukraine based on harvest results. Canola production for Canada is lowered 0.5 million tons to 19.0 million based on government reports. Palm kernel and palm oil production is lowered for Indonesia for 2021/22, reflecting crop losses during periods of export restrictions and poor harvest weather. Indonesian palm oil production for 2022/23 is also lowered 1.0 million tons to 45.5 million. The global soybean outlook includes higher production, exports, and ending stocks. Production is raised on higher output for India and Ukraine. Exports are raised slightly as higher shipments for Argentina are partly offset by lower exports for Canada and Paraguay. With global crush relatively unchanged, ending stocks are raised 0.5 million tons to 102.7 million.

Source: USDA December WASDE Report

While the USDA increased U.S. and global soybean production and inventories from the November report, the agency kept the price forecast for 2023 at $14 per bushel. With soybean oil forecasted at 68 cents and meal at $410 per ton, the price estimates for the coming year remain historically high.

The SOYB ETF moves higher and lower with soybean futures prices

Soybean futures reached a high of $17.84 per bushel in June 2022, only 10.75 cents below the 2012 record peak. While soybean, corn, and wheat futures exploded higher because of the war in Europe’s breadbasket, they reached peaks during the planting and growing season in the Northern Hemisphere. While all eyes are on the Brazilian soybean crop in late December, the focus shifts to the U.S. in early 2023 as the snow melts and farmers plant the 2023 crops. Inflation has pushed input prices higher, and the odds of another explosive rally during the planting and growing season are high. We could see new record highs in soybean futures in 2023.

The most direct route for a risk position in soybeans is via the futures and futures options on the CME’s CBOT division. The Teucrium Soybean ETF product (SOYB) provides an alternative to the futures arena. At $27.84 per share on December 23, SOYB had over $64.8 million in assets under management. SOYB trades an average of 45,525 shares daily and charges a 1.16% management fee. SOYB holds s portfolio of three actively traded soybean futures contracts to reduce the roll risk when one contract month rolls to the next. Since the nearby contract tends to experience the most volatility, SOYB often underperformed the nearby contract on the upside but outperforms during downside price corrections.

Keep an eye on the soybean crush spread, as it is a critical tool for monitoring the demand for soybean products that translate to demand for raw oilseeds.

More Grain News from Barchart

- Higher Wheat Prices for Holiday Weekend

- Corn Gains into Holiday Weekend

- Soy Futures Gain into Extended Weekend

- NY Cocoa Prices Surge as ICE Cocoa Inventories Shrink

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)