- To me, the biggest story of Friday was the passing of bipartisan legislation to avert a US rail strike. A strike would've been catastrophic economically, and hopefully this is a step in the right direction.

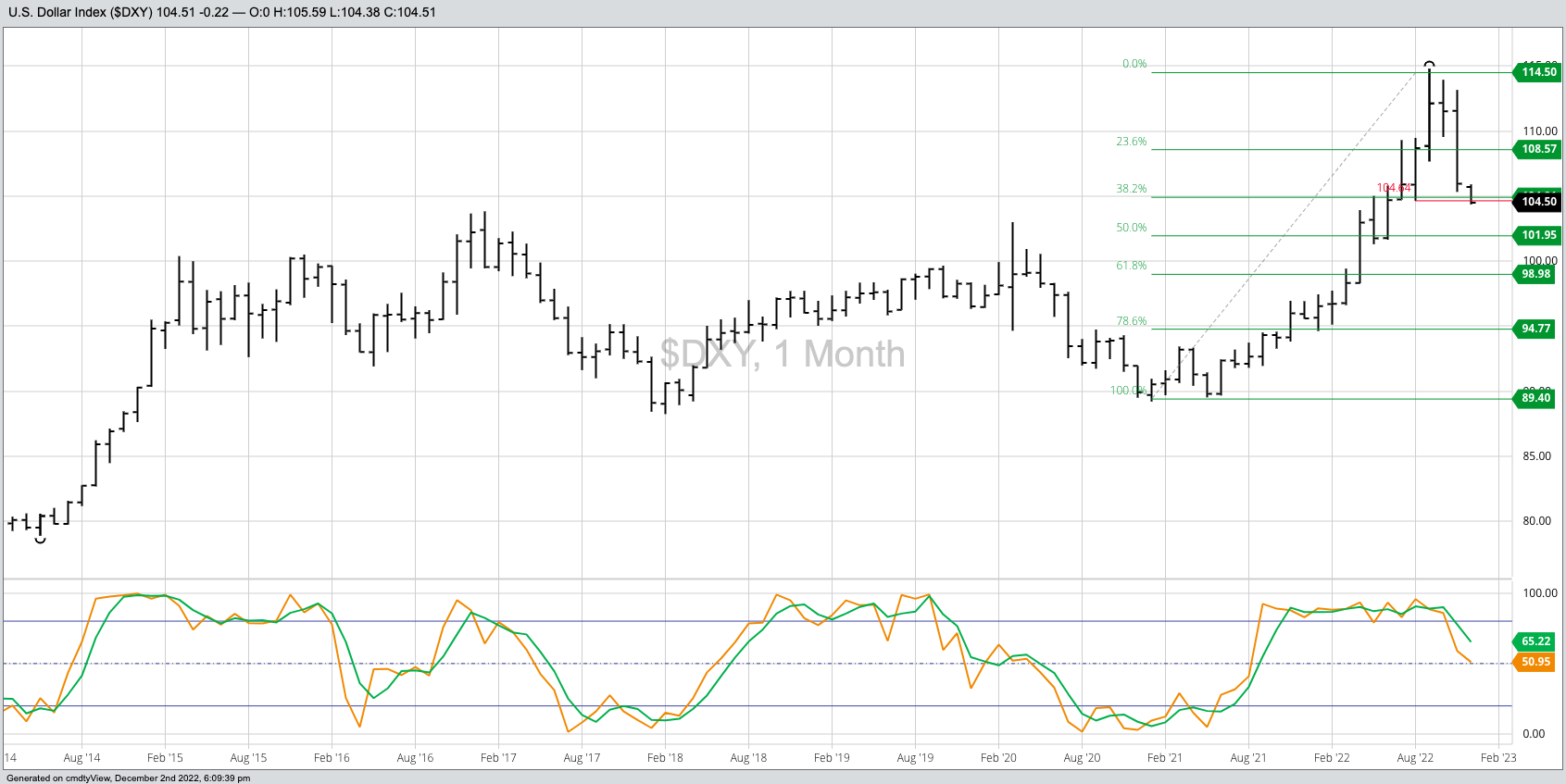

- The other big story was the continues slide of the US dollar index. The greenback's new long-term downtrend will have ripple effects on nearly all market sectors and the ongoing debate over inflation.

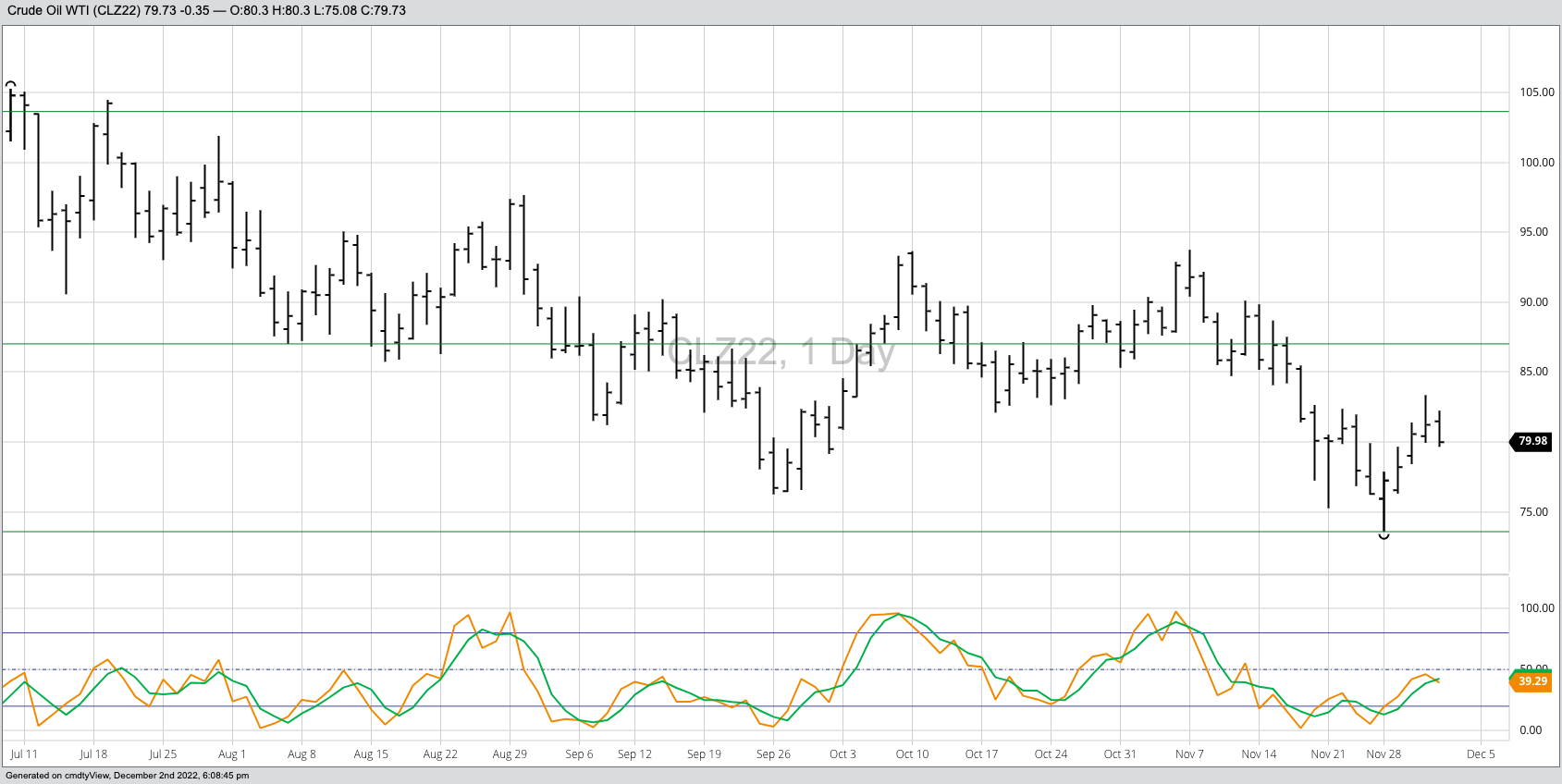

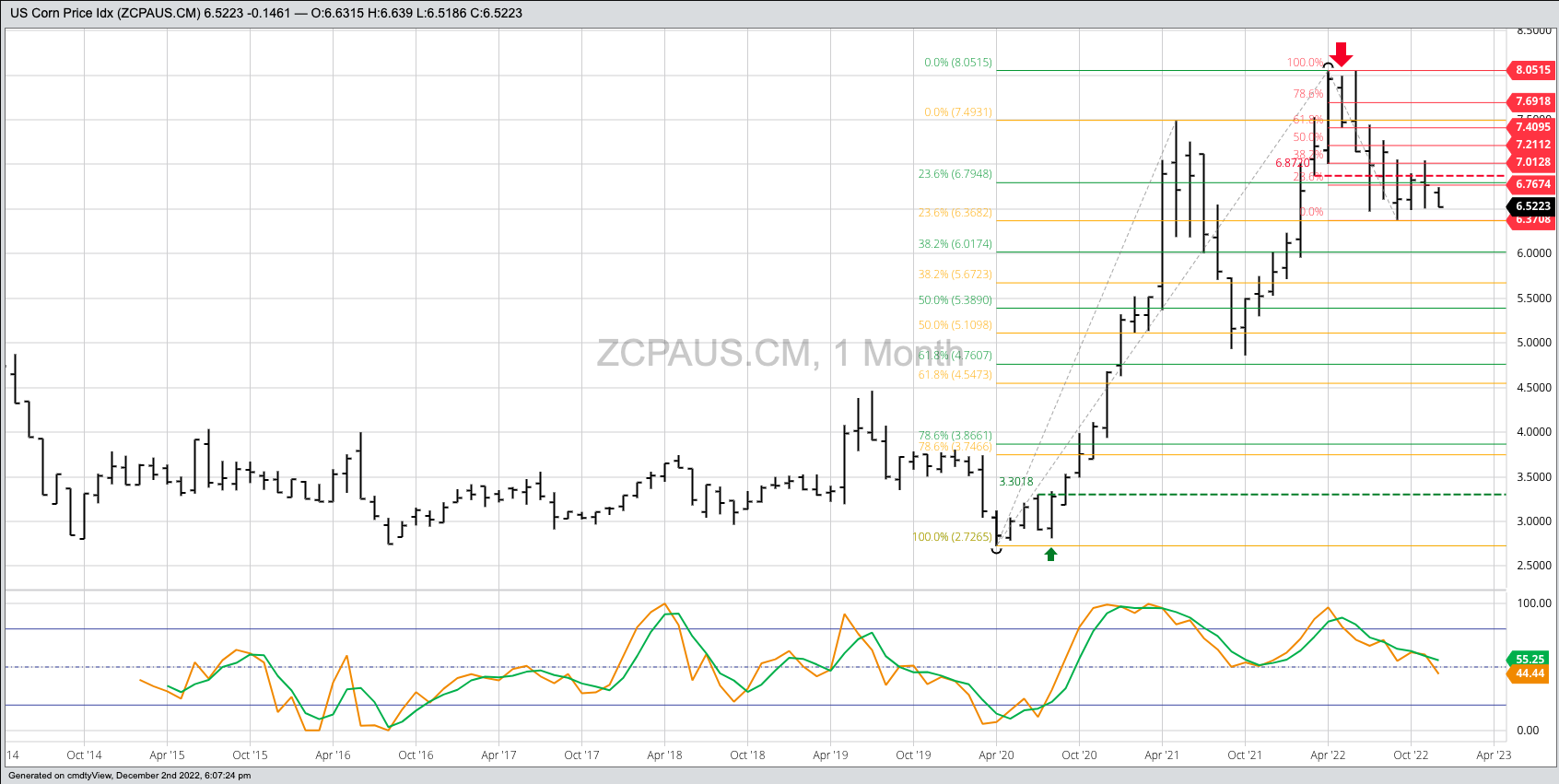

- Two of the three Kings of Commodities, crude oil and corn, also saw major developments as we head into the first weekend of winter.

Let me start by saying I will get to the requested topics of corn spreads and the connection between soybean oil and heating oil next week, but as the curtain comes down on this week there was a lot to talk about. So much so I couldn’t decide on one, meaning I’ll touch on some of the big news of the day as if we were conversing over an after-hours cocktail.

The US Senate passed (by a vote of 80 to 15) and President Biden signed legislation to avert a rail strike. In all honesty, I can’t recall a vote in recent history that was this bipartisan. While I understand the issues rail unions are pushing for, most notably sick days, the cold reality is the US can’t have a rail strike. And while I don’t agree with all the Biden Administration has said and done, I do agree with this action. In the big picture, the President did what was best for the US despite what the political fallout might be down the road. That’s how it is supposed to work.

The US dollar index ($DXY) moved below its previous 4-month low of 104.64 overnight through early Friday morning. Sure, the dollar then strengthened again after the release of the November jobs data (more on this later) but once done the technical implications weren’t to be undone. The US dollar index confirmed a new long-term downtrend on its monthly chart, a change signaled by the most recent bearish crossover by monthly stochastics above the overbought level of 80% at the end of September. By the end of the day the index the index was down 0.23 at 104.50. The next target is down at 101.95.

Yes, the November jobs data was released and yes, the 263,000 was much larger than the expected 200,000. Most of the industry media made a big deal out of this, with MarketWatch proclaiming it to be “the most important inflation data of 2022”. As I said at the time, that’s a crock. The November jobs report is nothing more than government numbers that will be revised next month and beyond. We can already read long-term trend changes in the various market sectors (US dollar index, US stock indexes, US Treasuries, commodities) to understand where the US is with inflation. Additionally, the Fed continues to front-run additional rate hikes to remove the element of surprise and market chaos. There is more going on in markets than silly government numbers.

Friday also saw the EU agree on a price cap for Russian seaborne oil, putting it at $60. The hue and cry leading up to this was it would send global energy markets skyrocketing again and light a new fire under inflation. What I found interesting is this argument was made loudest by Russia and its allies, some sitting comfortably in the US. Maybe this will ignite the next round of inflation, anything is possible these days, but the initial reaction was for crude oil (CLF23) to close 1.5% lower (WTI) while distillates (HOF23) (heating oil, jet fuel, diesel fuel) dropped another 2.9%. As for me, I fall on the side of as many penalties as possible from the West for the Madman Across the Water’s invasion of his neighbor.

Last but certainly not least, King Corn’s crown is looking a bit tarnished this first weekend of winter. After moving into delivery, the December issue has collapsed, falling to a low of $6.29 Friday, its lowest mark since August 22. Meanwhile, the Dec-March spread fell to a carry of 11.25 cents after closing last Friday at a carry of 3.25 cents. Not to be outdone, March closed 25 cents lower for the week and the March-May spread saw its inverse erased with a close of 1.0 cent carry. Finally, the national average cash price closed November at $6.7850 correlating to an available stocks-to-use of 8.5% as compared to the end of October numbers of $6.9675 and 8.3%. This means supply and demand loosened a bit last month as merchandisers locked in enough grain to get them through December in case of a rail strike. As for demand, ethanol is expected to see a seasonal slowdown while exports were near non-existent during Q1. All of this shines the spotlight back on the Barchart National Corn Price Index (ZCPAUS.CM) that completed a long-term reversal pattern on its monthly chart this past May.

More Stock Market News from Barchart

- Stocks Recover Most of Their Losses as Bond Yields Erase an Early Surge

- Chinese Tech Stock Sentiment Improves with Fewer Covid Restrictions

- Stocks Fall as Labor Market Strength Keeps an Aggressive Fed in Play

- If You Like Plant-Based Food Stocks, It’s a Case of Buy This, Not That

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)