/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

SanDisk Corporation's (SNDK) stock has rallied significantly, rising over 180% year-to-date (YTD). Moreover, SNDK shares have climbed more than 1,500% over the past six months, driven by rising demand for its NAND memory products.

As artificial intelligence (AI) adoption expands across data centers and edge computing applications, systems are becoming more complex, and storage needs are rising rapidly. This has intensified demand for high-performance memory and storage solutions, placing SanDisk in a strong position to benefit from the ongoing investments in AI infrastructure.

At the same time, SanDisk is also benefiting from favorable conditions in the supply side of the memory market. Global supply constraints have tightened availability, creating a supportive pricing environment for manufacturers. With limited supply in the market, SanDisk has been able to secure higher pricing for its products, which has translated into a meaningful boost to earnings.

Even after such a significant rally, here are two reasons why SNDK stock could climb further as we head into 2026.

Reason #1: Explosive Earnings Momentum Could Drive SNDK Stock Higher

SanDisk's stock has additional room to run, supported by a sharp improvement in the company’s earnings and strengthening industry fundamentals. Powerful demand and supply dynamics in the NAND flash market are creating favorable conditions for both pricing and profitability, which should continue to lift the company's financial performance.

SanDisk recently posted a strong second-quarter result. Its revenue reached $3.03 billion, rising 31% from the prior quarter and 61% from the same period last year. Profitability also improved significantly. Adjusted gross margin climbed to 51.1%, a major jump from 29.9% in the previous quarter, driven largely by stronger pricing and ongoing reductions in unit costs.

Operating performance followed the same trajectory. Adjusted operating margins expanded to 37.5%, up from just 10.6% in the prior quarter. Earnings growth was even better, with adjusted EPS rising to $6.20 compared with $1.22 in Q1. With revenue continuing to grow and cost efficiencies taking hold, SanDisk's earnings could accelerate further as the year progresses.

Looking ahead, SanDisk could deliver a solid Q3 performance. Management’s revenue outlook for Q3 is $4.4 billion to $4.8 billion, representing quarter-over-quarter growth of 45% to 58%. This suggests a sequential acceleration in growth rate, management noting that the market is likely to remain more undersupplied than it was in Q2. That imbalance should keep pricing elevated, providing additional support for margins.

Profit expectations for the third quarter support the bullish outlook for SNDK stock. SanDisk forecasts an adjusted gross margin in the range of 65% to 67%, a significant growth from Q2 levels and far above the margin recorded a year ago. Adjusted EPS is projected between $12 and $14, with the midpoint implying that earnings could more than double sequentially.

A key driver behind this strength is rising NAND demand from the data center segment, driven by rapid adoption among AI infrastructure builders and major technology companies deploying AI at scale. Higher demand and pricing across multiple segments could continue to support earnings expansion and further upside in SanDisk's share price.

Reason #2: SanDisk's Growth Outlook Justifies Further Multiple Expansion

Even though SNDK stock has rallied significantly, its valuation looks reasonable and compares favorably with peers. The company currently trades at a forward price-to-earnings (P/E) ratio of 32.9, a level that seems justified given its strong earnings growth outlook.

Analysts expect SanDisk's profitability to accelerate sharply over the next few years. Its EPS is projected to surge by 821.4% in fiscal 2026, reflecting a major turnaround in performance. Growth is then expected to remain strong, with EPS forecasted to climb another 173.7% in fiscal 2027.

What makes the company's valuation even more attractive is that it trades at a discount compared with other major players in the storage industry. Western Digital (WDC), for example, is valued at a higher forward P/E multiple of 38.8, while Seagate (STX) trades at an even steeper 40.4 times forward earnings.

The Bottom Line for SNDK Stock

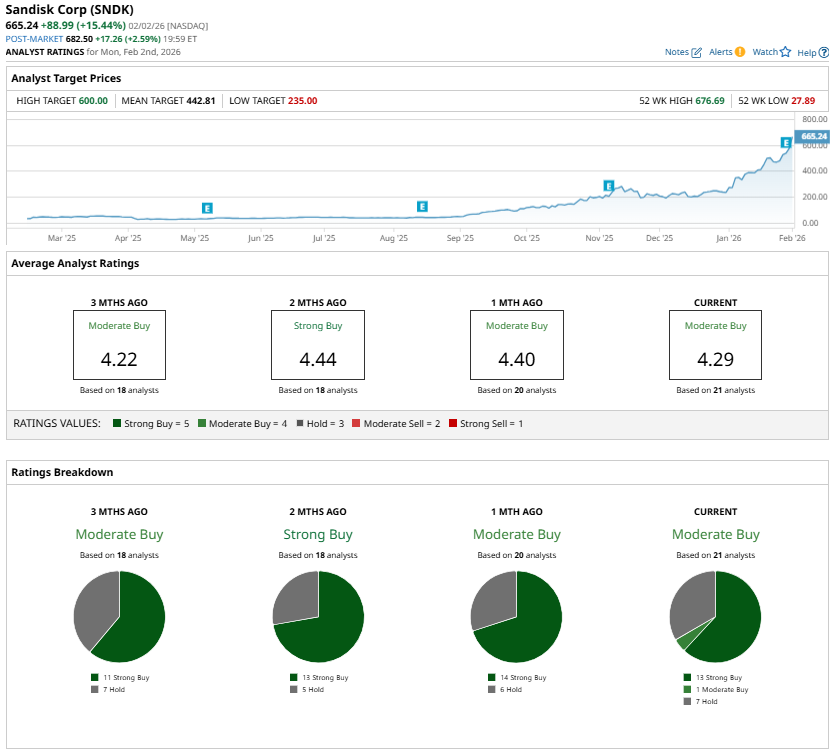

SanDisk's sharp rally is why not all analysts are backing SNDK stock. While SanDisk has a “Moderate Buy” consensus rating, it still has room to run. With earnings accelerating on the back of strong NAND demand and higher pricing, the company is positioned for continued growth. Moreover, its valuation remains reasonable, implying that the stock has further upside.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)