As Wall Street just relearned, silver doesn’t correct quietly. After an explosive rally into late January, silver futures (SIG26) on Friday collapsed 31% in a historic volatility reset—one of the sharpest multi-day drops in decades. For investors who stayed on the sidelines, that kind of move creates a natural question:

Is this finally an entry point on silver — or is there more downside ahead?

In this Market on Close clip, Senior Market Strategist John Rowland, CMT, walks through how he’s thinking about silver after the crash — not emotionally, but structurally.

Why Volatility Changes the Decision-Making Process

Silver’s recent selloff wasn’t subtle. Prices collapsed from last week’s highs as margin requirements increased and forced selling hit speculative positions. That matters because extreme volatility changes how trades should be sized and managed.

John’s point is simple: this is not a “buy blindly” environment.

Instead, silver must be approached through defined risk levels, where you know quickly if you’re wrong.

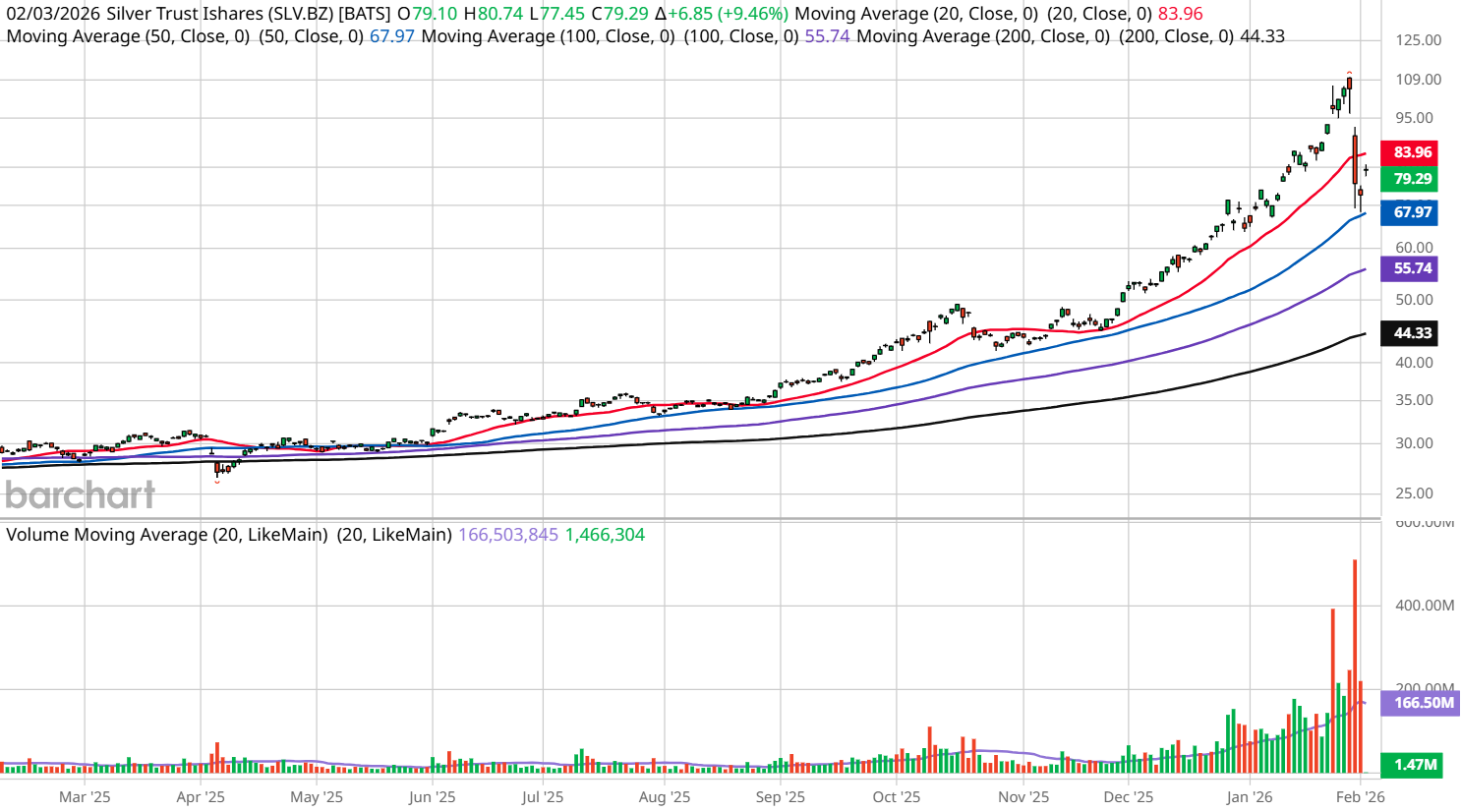

The First Level: The 50-Day Moving Average

John identifies the current demand zone sitting directly on top of the 50-day moving average as the first place where a starter position could make sense.

Why this level matters:

- It represents recent consolidation

- It allows for tight risk control

- If silver breaks below this structure, the trade thesis is invalidated quickly

This is less about predicting a bottom, and more about risk containment.

The Second Level: The $50 Zone and the 200-Day

John also makes it clear that silver corrections often don’t stop at the first support.

Historically, sharp “end-of-the-road” type moves tend to retrace toward the 200-day moving average, which in this case lines up just below $50.

That level is notable because:

- It aligns with long-term trend support

- It matches widely discussed downside targets from macro strategists

- It would represent a full reset of the speculative excess from the recent rally

This doesn’t mean silver must go there, but it’s a level investors should respect.

Why This Is a “Nibbling” Conversation, Not a Conviction Call

John’s language around this conversation is intentional. He doesn’t talk about loading up. Instead, he talks about starting small, knowing exactly where risk breaks down, and staying flexible.

That approach acknowledges two realities:

- Silver remains structurally volatile

- Large moves often come in stages, not all at once

The takeaway isn’t bullish or bearish; it’s disciplined.

The Bigger Lesson

When markets move this fast, the edge doesn’t come from bold predictions. It comes from process.

Silver’s reset has created opportunity, but only for investors who:

- Respect volatility

- Define risk before entering

- Accept that patience is a position

Watch this quick clip to hear John explain the key levels:

- Stream the full episode of Market on Close

- Turn on notifications to catch the next episode live

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)