With one month to go in 2022, a year that was anything but ordinary, the leading grain and oilseed prices remain at the highest level in years. Rising interest rates have increased the cost of leasing land for growing crops and purchasing farmland has become prohibitive as prices have soared. The highest inflation in four decades has pushed all input costs higher, and grain and oilseed prices have kept pace. Rising energy prices have caused the demand and price of biofuel to increase. Corn is the main ingredient in US ethanol, and soybeans are required for biodiesel production.

Moreover, the war in Ukraine, Europe’s breadbasket, has turned farmland into minefields and the Black Sea Ports, a critical logistical export hub, into a battle zone. Simultaneously, sanctions on Russia and Russian retaliation have caused fertilizer prices to soar and availabilities to decline. The bottom line is that corn, soybean, and wheat futures markets remain at elevated prices during winter.

Corn corrects but remains at a high level

In April 2022, nearby CBOT corn futures at $8.27 per bushel was the highest price since the coarse grain traded to its all-time high of $8.4375 in August 2012.

The chart highlights the correction from the April 2022 high, but corn prices remain at a multi-year high at $6.65 per bushel on December 1.

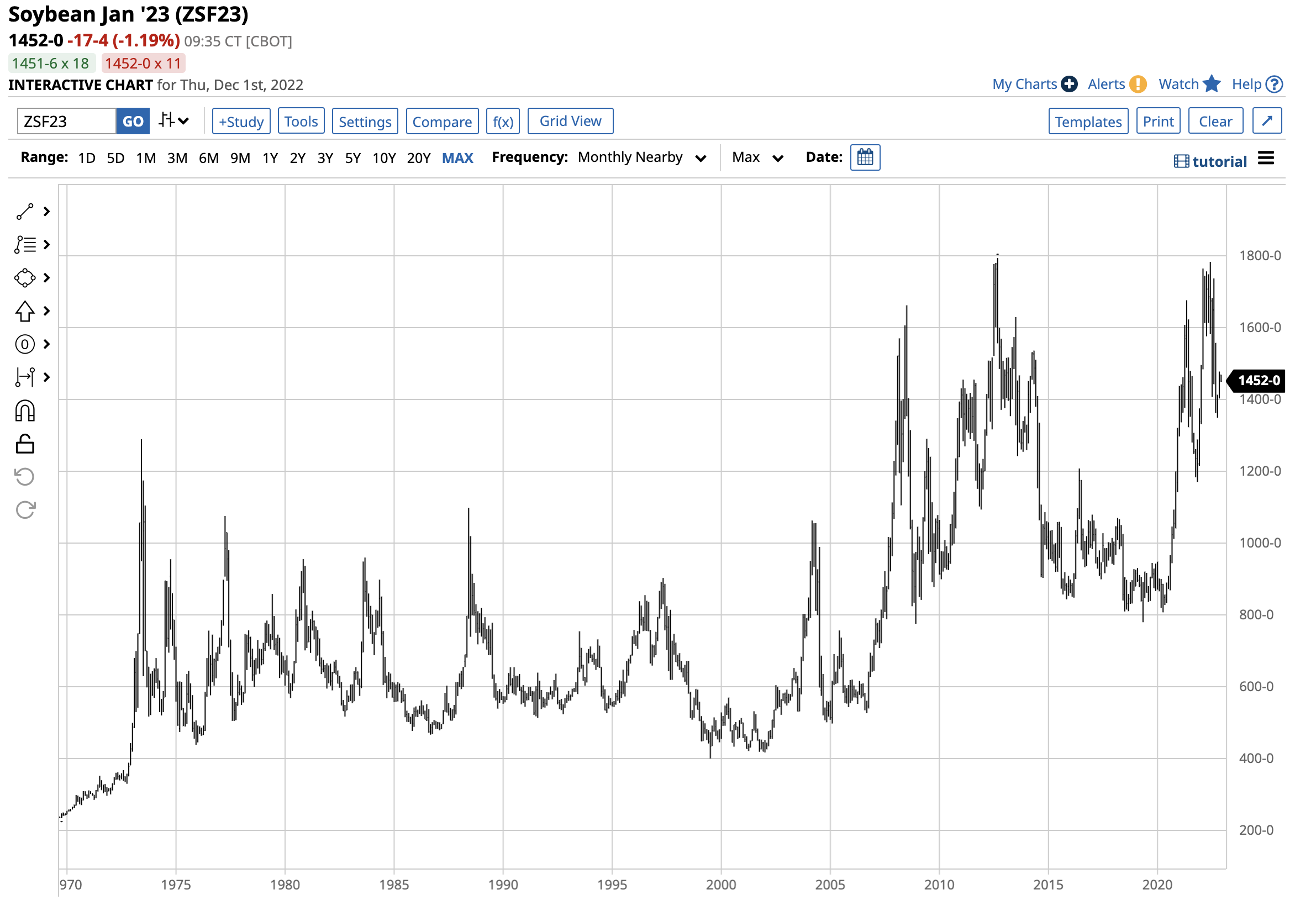

Beans are in the teens

Soybeans never traded in the teens until 2008. In 1973, the price of the nearby CBOT futures contract reached $12.90 per bushel, starting the chant for beans in the teens.

The chart shows that soybean futures reached an all-time peak of $17.9475 per bushel in September 2012, a drought-ridden year. In 2022, the war in Ukraine and raging inflation pushed the price to $17.84, just shy of the 2012 high, before correcting to the $14.52 level on December 1. Like corn, the beans remain at a multiyear high as we move toward the end of 2022.

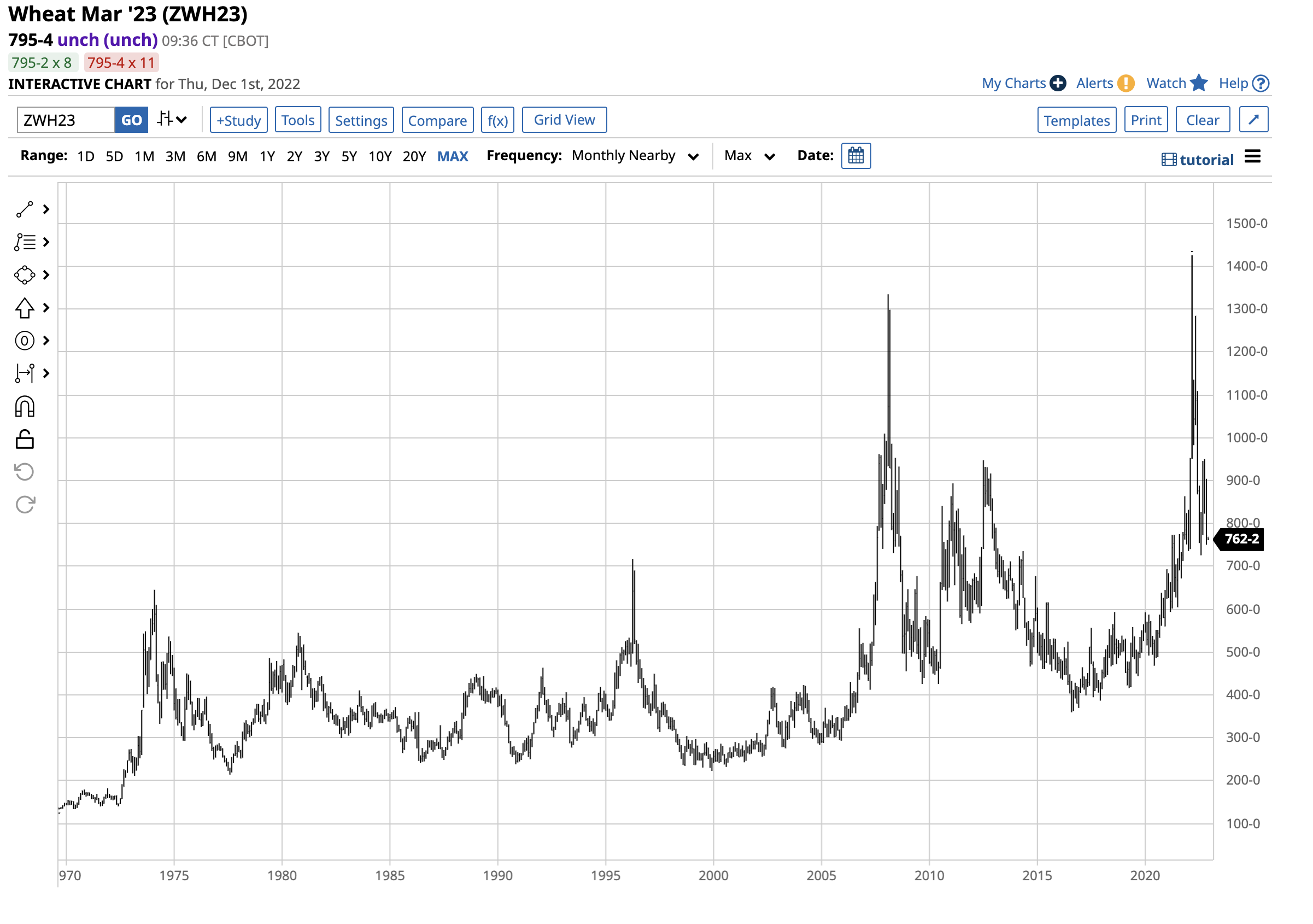

Wheat is high- A spread that monitors wholesale consumer sentiment is sky high

CBOT soft red winter wheat futures eclipsed the 2008 $13.3450 high in 2022.

The chart shows the rally that took nearby CBOT wheat futures to $14.2525 per bushel in March 2022. Russia and Ukraine are leading world wheat-producing and exporting countries. The war caused significant supply concerns, but wheat futures have corrected to below the $8 per bushel level on December 1.

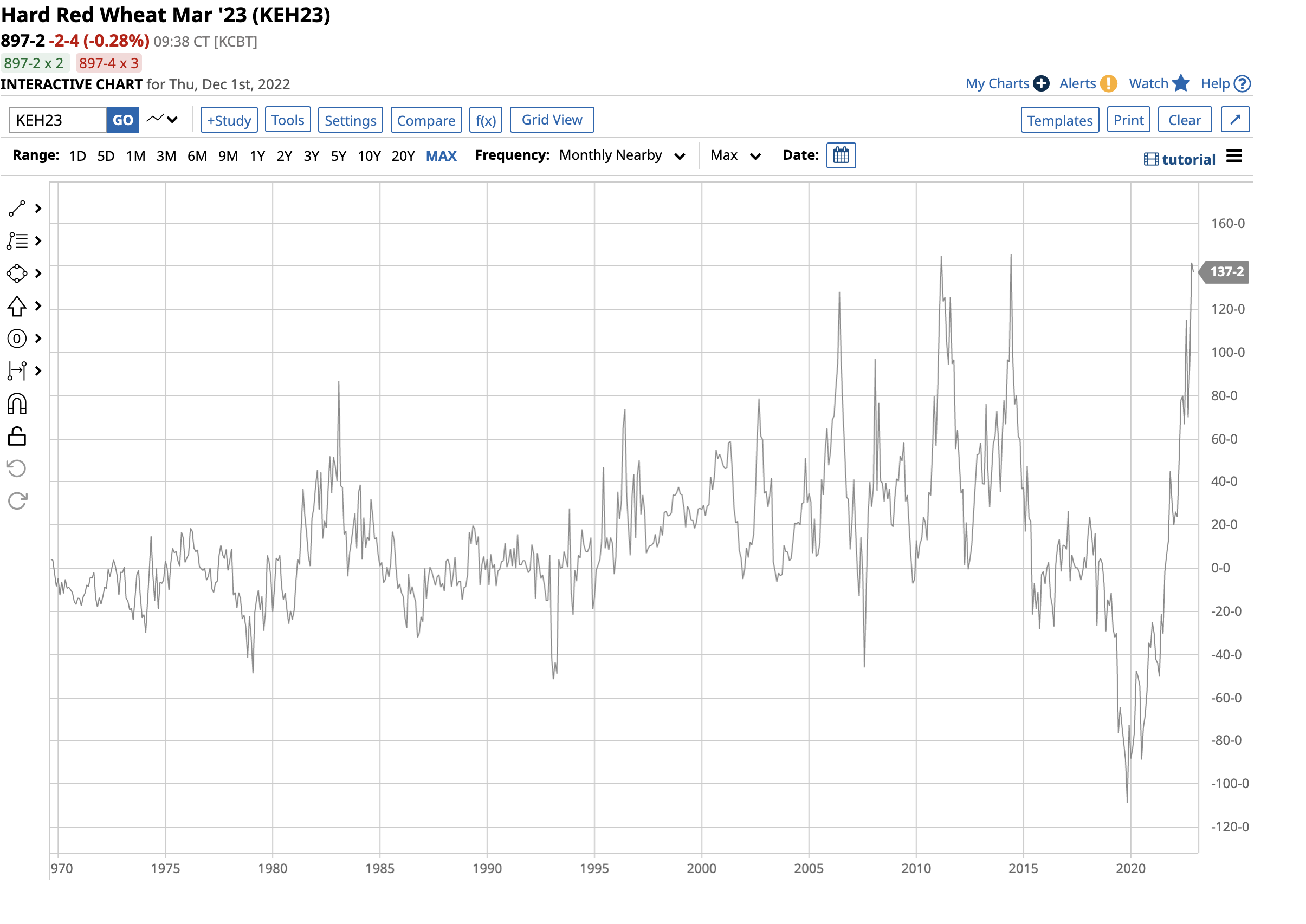

The spread between the hard and soft red winter wheat futures is one sign of supply concerns.

The chart of the spread ({KEH23}-{ZWH23}) shows a over $1.35 per bushel premium for the KCBT hard red winter wheat over the CBOT soft red winter wheat; it is sitting near a record high. US wholesale wheat consumers and bread manufacturers tend to price their wheat requirements on contracts tied to the KCBT hard red winter wheat contract. The premium is a sign that the consumers are hedging their price and supply risk as the war in Ukraine continues to cause concerns. The spread rose from an over $1 premium for the CBOT soft red winter wheat in late 2019 when prices were falling, and consumers purchased wheat hand-to-mouth. In late 2022, it is nearly $2.50 per bushel higher because of the multi-year highs in the wheat futures market and concerns that another year of war in Ukraine will cause global wheat supplies to fall to levels that create a deficit where the demand overwhelms the supplies.

The CBOT contract is the worldwide benchmark, but the KCBT contract’s position as a pricing tool for US consumers has caused an explosive move in the difference between the two wheat qualities.

The Teucrium grain and oilseed ETFs are alternatives to the futures

The path of least resistance of grain prices now depends on the size of the crop below the equator and the ongoing war in Ukraine. With inflation at multiyear highs, high input costs will likely put upward pressure on grain and oilseed prices over the coming weeks and months.

The most direct route for a risk position in corn, soybeans, and wheat is via the futures and futures options on the CME’s CBOT division. The Teucrium family of grain and oilseed ETF products provides an alternative to the futures arena.

- At $26.40 per share on December 1, the Teucrium Corn ETF (CORN) had over $206.555 million in assets under management. CORN trades an average of 161,144 shares daily and charges a 1.14% management fee.

- At $27.45 per share on December 1, the Teucrium Soybean ETF (SOYB) had $65.191 million in assets under management. SOYB trades an average of 46,030 shares daily and charges a 1.16% management fee.

- At $8.04 per share on December 1, the Teucrium Wheat ETF (WEAT) had nearly $319.2 million in assets under management. WEAT trades an average of over 1.18 million shares daily and charges a 1.14% expense ratio.

The Teucrium ETFs track the prices of CBOT corn, soybeans, and soft red winter wheat, the global benchmark for the primary ingredient in bread. The ETFs tend to underperform the nearby futures contracts on the upside and outperform on the downside as they hold three actively traded futures contracts to reduce the roll risks. The most price variance tends to occur in the nearby contracts, which attract the most speculative activity, causing the ETFs to do worse on a rally on a percentage basis and better during price declines.

The path of least resistance of prices depends on the war in Europe

As we move towards the end of 2022, the focus is now on the growing season in South America and below the equator. Brazil is the top soybean-producing country behind the US, and Argentina is third. Brazil and Argentina are the third and fourth top corn-producing countries, with Ukraine in fifth place. Meanwhile, Russia is the third-leading wheat producer and leading exporter, with Ukraine in eighth place. The weather across the southern hemisphere will guide prices over the coming weeks, but the ongoing war in Europe remains the most critical factor for the path of least resistance of prices in 2023.

If the war continues, fertilizer shortages could worsen, impacting farmers worldwide. Moreover, Europe’s breadbasket and crucial export hub in the Black Sea will continue to be battlefields, reducing the level of grains available to feed the world. An end to the conflict could cause prices to fall, but the damage in 2022 remains dangerous for the world’s food supplies.

I remain a buyer of corn, soybean, and wheat futures and ETFs on any significant price corrections until the war ends.

More Grain News from Barchart

- Dec Wheats Firm to Red Traded Deferreds

- Tight Overnight Pushes Corn’s Downside

- Sharp Pullback In Soy Oil

- Wednesday Wheats Gain Back Double Digits

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)