Based in Houston, Texas, Halliburton Company (HAL) serves the global energy industry across the entire oil and gas well lifecycle. With a market cap of about $28.2 billion, the company delivers integrated solutions spanning well construction, reservoir modeling, drilling fluids, evaluation, completion, production optimization, and more.

Over the past 52 weeks, HAL stock climbed nearly 32.8%, outperforming the broader S&P 500 Index ($SPX), which rose 15.4% during the same period. The momentum has accelerated into 2026, with Halliburton’s shares up 19.9% year-to-date (YTD), while the benchmark index managed a modest 1.1% gain.

Halliburton has also outpaced its sector peers. Compared with the State Street Energy Select Sector SPDR ETF (XLE), which gained 17.2% over the past year and 15.6% YTD, HAL’s performance reflects stronger execution and investor confidence.

On Jan. 21, Halliburton’s shares rallied 4.1% as the company unveiled its Q4 2025 results. Revenue advanced marginally year over year to $5.7 billion, comfortably beating Street estimates of $5.4 billion, while adjusted EPS slipped 1.4% to $0.69 but still surpassed expectations of $0.54.

Looking forward, management has cast 2026 as a year of recalibration. They expect Q4 momentum to carry forward as new technologies sharpen operational quality. At the same time, the company continues to prioritize shareholder value through dividends and share buybacks, underscoring confidence in its strategy.

For fiscal year 2026, ending in December, analysts project diluted EPS of $2.26, representing a 6.6% year-over-year decline. Even so, Halliburton has beaten EPS expectations in two of the past four quarters and met estimates in the remaining two, underscoring steady delivery.

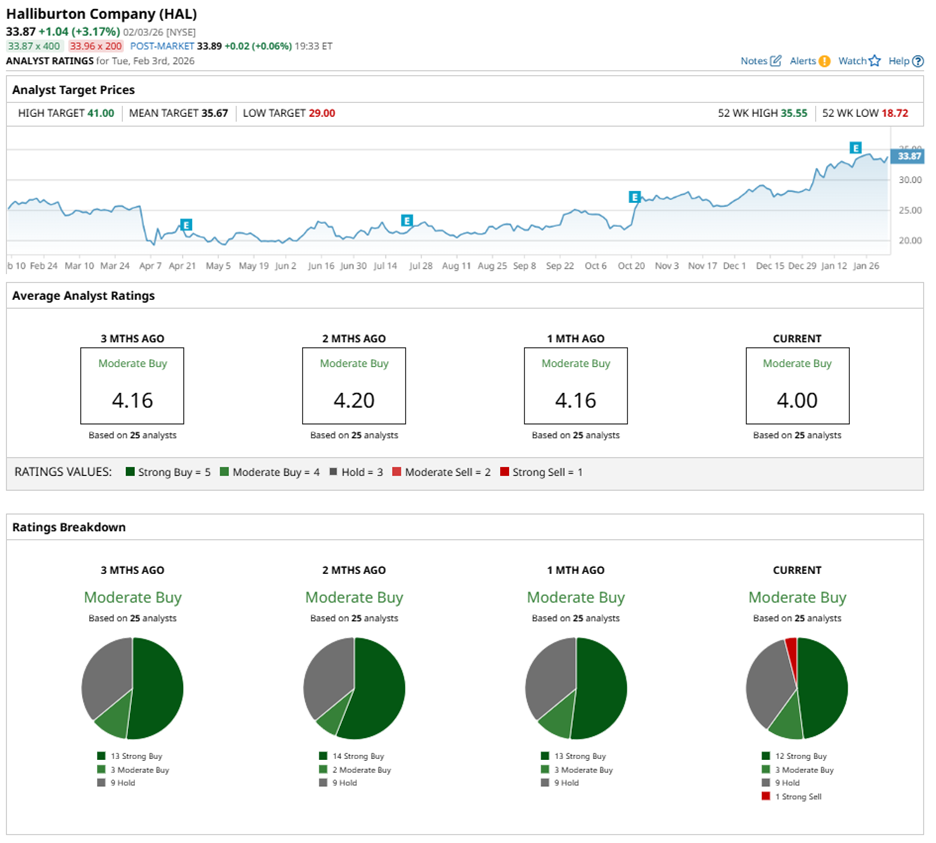

Wall Street leans constructively on the stock, assigning it an overall “Moderate Buy” rating. Of the 25 analysts covering HAL stock, 12 rate it a “Strong Buy,” three favor a “Moderate Buy,” nine recommend “Hold,” and just one flags a “Strong Sell.”

The current sentiment has barely shifted from three months ago, when 13 analysts also labeled the stock a “Strong Buy.”

Analyst actions reinforce that view. On Jan. 21, Stifel’s analyst Stephen Gengaro lifted his price target to $35 from $32, maintaining a “Buy” stance on HAL stock. He highlighted Halliburton’s leadership in U.S. well development, while noting that international activity and pricing could add meaningful tailwinds.

That being said, HAL’s average price target of $35.67 implies potential upside of 5.3%, while the Street-high target of $41 suggests a gain of 21.1% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)