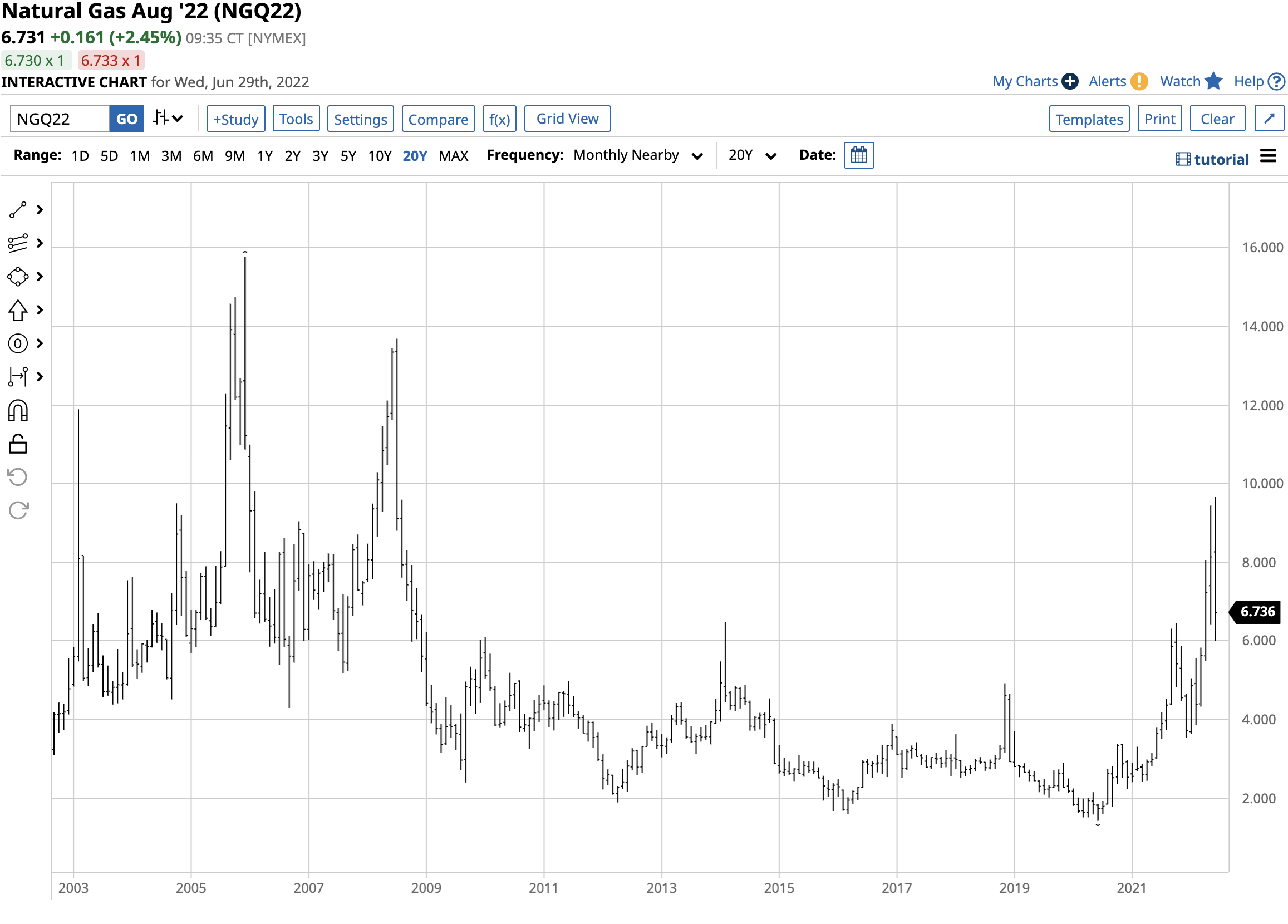

Since 1990, when natural gas trading on the CME’s NYMEX division began, the price has traded as low as $1.04 and as high as $15.78 per MMBtu. The record high came in 2005, and natural gas futures made lower highs and lower lows over the next decade and a half, reaching a low of $1.44 per MMBtu in June 2020.

US natural gas futures broke out of the bearish trend in late 2021 when the price rose above the November 2018 $4.929 high. In 2022, the energy commodity exploded on the upside, reaching almost $10.

A new multi-year high in June and a downdraft

In early June 2022, NYMEX natural gas futures rose to the highest price since 2008.

The chart highlights the rise to $9.664 per MMBtu and the plunge to a low of $6.01 on the continuous contract. Natural gas futures fell $3.654 or 37.8% from June 8 through June 27. The nineteen-day move was nothing short of carnage for anyone holding a long risk position.

Natural gas remains over four times higher than two years ago

The end of June is the second anniversary of the quarter of a century low in June 2020.

The chart dating back to 2002 shows that natural gas futures reached a bottom at the $1.44 per MMBtu level in June 2020. At the $6.75 level on June 29, the energy commodity was over four and one-half times higher in June 2022, despite the recent drop. At the early June high, natural gas futures were over 6.7 times higher than the twenty-five-year 2020 low.

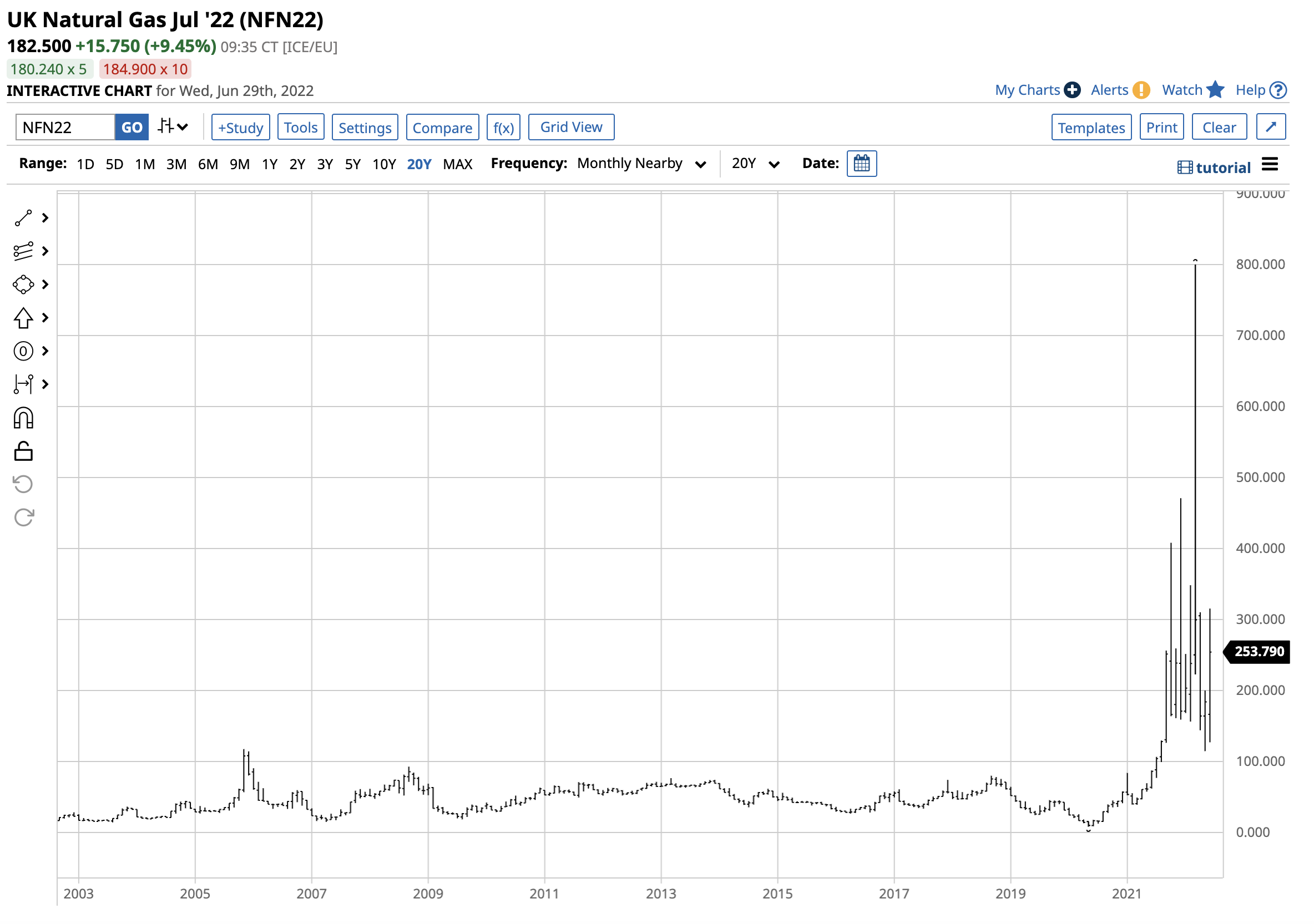

European natural gas prices reflect valid supply concerns

Over the past years, US natural gas has become an increasingly global market. LNG exports expanded the US market far beyond the pipeline network, with ocean vessels carrying the energy commodity to worldwide consumers. Asian countries signed long-term supply contracts with US producers. Meanwhile, Russia’s invasion of Ukraine caused European natural gas prices to skyrocket, increasing the demand for US LNG exports.

The long-term chart shows that before 2021, the all-time high in UK natural gas futures was at the 117 level in November 2005. UK natural gas traded to a low of 8.09 in 2020, right before US futures hit rock bottom at $1.44. Russia’s invasion of Ukraine pushed the price nearly 100 times higher in March 2022 when it reached the 800 level. At 182.50 on June 29, the price was appreciably above the 2005 previous all-time peak.

Russian oil and gas have become a retaliatory tool of war as Europe and the US continue to support Ukraine. As the 2022/2023 winter season approaches over the coming months, expect European supplies to decline as Russia tightens the supply noose to punish NATO members.

The hurricane season poses threats

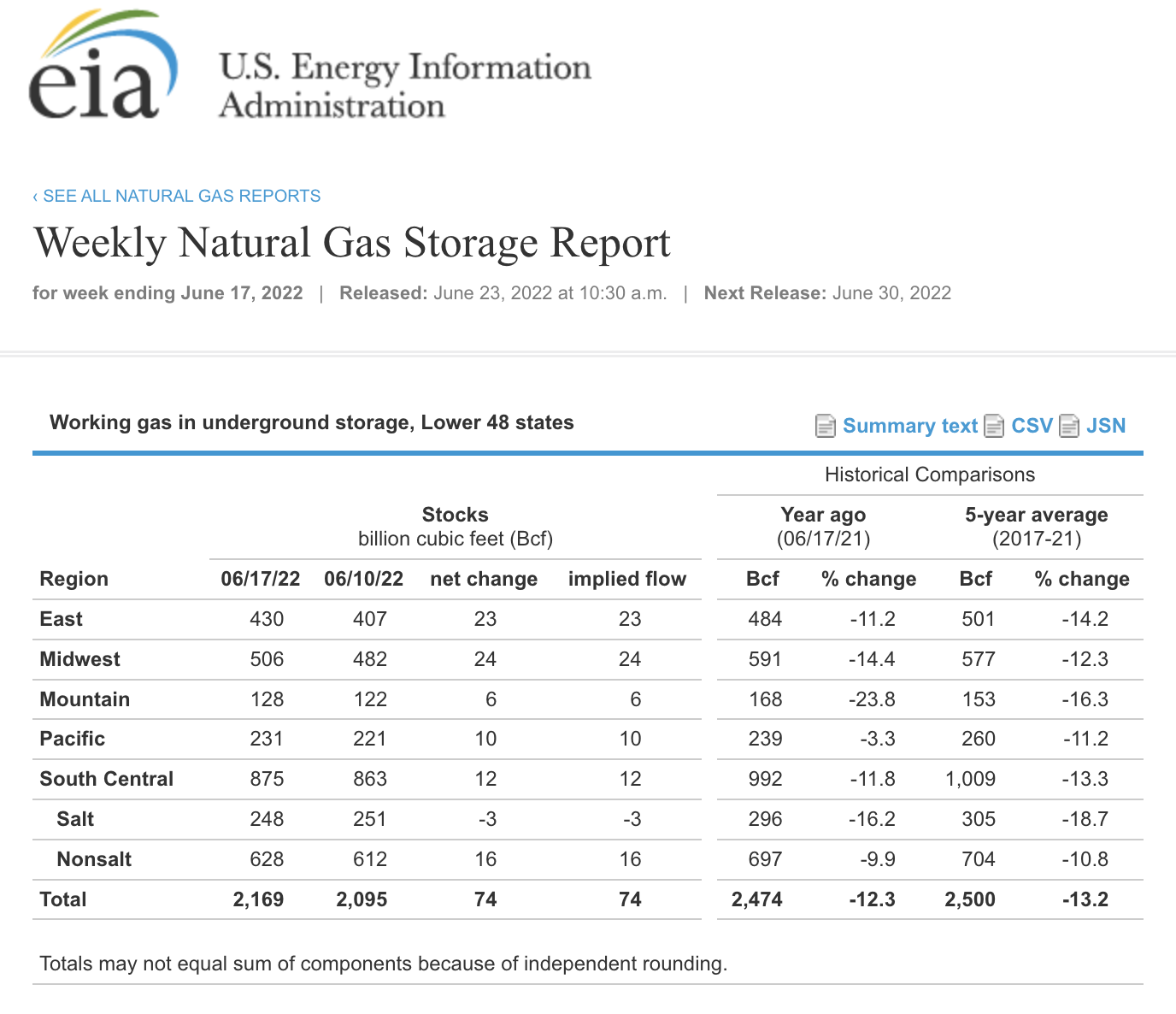

The 2005 and 2008 highs in the NYMEX natural gas market that pushed prices above the $10 per MMBtu level came as Hurricanes Katrina and Rita hit the US Gulf Coast with a vengeance. The NYMEX natural gas delivery point is in Erath, Louisiana, where the storms wreaked havoc with the pipelines and other natural gas infrastructure. We are now in the heart of the 2022 hurricane season, with natural gas futures highly sensitive to news from Europe. Moreover, stockpiles remain low, according to the Energy Information Administration.

Source: EIA

The chart illustrates that at 2.169 trillion cubic feet, natural gas in storage across the US on June 17 was 12.3% below last year’s level and 13.2% under the five-year average.

A hot summer that increases the demand for air-conditioning and the threat of any storms heading for the US Gulf Coast could quickly lift the price of natural gas in the current environment. Meanwhile, the low inventory level restricts the potential flow of US LNG to Europe to replace the declining Russian supplies.

The coming winter season could be wild

Natural gas futures tend to reach seasonal highs in October through January as the winter heating demand season gets underway and stockpiles decline. With prices already north of $6 after peaking at $9.664 a few short weeks ago, a double-digit natural gas price could be on the horizon during the coming winter season. The January 2023 NYMEX futures price was above the $7 per MMBtu level on June 29.

It is impossible to pick tops or bottoms in any market as prices tend to rise and fall to irrational, unreasonable, and illogical levels during bullish and bearish periods. Natural gas’s penchant for price variance makes it a wild and bucking bullish and bearish bronco. Volatility comes with a high-risk level, but it also creates many opportunities for disciplined traders. Approach natural gas with a plan for risk and reward and stick to the program. Taking small losses prevents financial devastation and allows continued participation.

I expect natural gas prices to trade at over $10 per MMBtu over the coming months, but that does not mean the price cannot drop to $5 or lower before an explosive rally. For those looking to participate in the wild and volatile US natural gas market without venturing into the futures or futures options arena, the UNG is an unleveraged product, and the BOIL and KOLD ETFs are short-term leveraged bullish and bearish tools that move with the futures market.

Be careful in natural gas as it has a long history of carrying out stubborn traders and investors who think they know better than the market. Respect natural gas with a logical risk-reward approach, and it will return the favor by providing exciting returns over time.

More Energy News from Barchart

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/Seagate%20Technology%20Holdings%20Plc%20office-by%20JHVEPhoto%20via%20Shutterstock.jpg)