A bear call spread is a type of vertical spread, meaning that two options within the same expiry month are being traded.

One call option is being sold, which generates a credit for the trader. Another call option is bought to provide protection against an adverse move.

The sold call is always closer to the stock price than the bought call.

As the name suggests, this trade does best when the stock declines after the trade is open.

However, there can be many cases where this trade can make a profit if the stock stays flat and even if it rises slightly.

We’ll look at lots of examples later in this post, including how to manage the trade when it goes against you.

Bear call spreads are risk defined trades, there are no naked options here, so they can be traded in retirement accounts such as an IRA.

Traders should have a bearish outlook on the stock and ideally look to enter when the stock has a high implied volatility rank.

Let’s take a look at Barchart’s Bear Call Spread Screener for June 28th:

As you can see, the screener shows some interesting Bear Call Spread trades on stocks such as MSFT, TSLA, NVDA, AAPL, META, AMZN, NIO, BAC and NFLX.

Below are the full parameters for this scan:

- Dayes to expiration: 0 to 60 days

- Security Type: Stock

- Volume Leg 1: 100

- Open Interest Leg 1: 500

- Moneyness Leg 1: -5.00% ot 5.00%

- Probability: Above 25%

- Volume Leg 2: 100

- Open Interest Leg 2: 500

- Ask Price Leg 2: Greater than 0.05

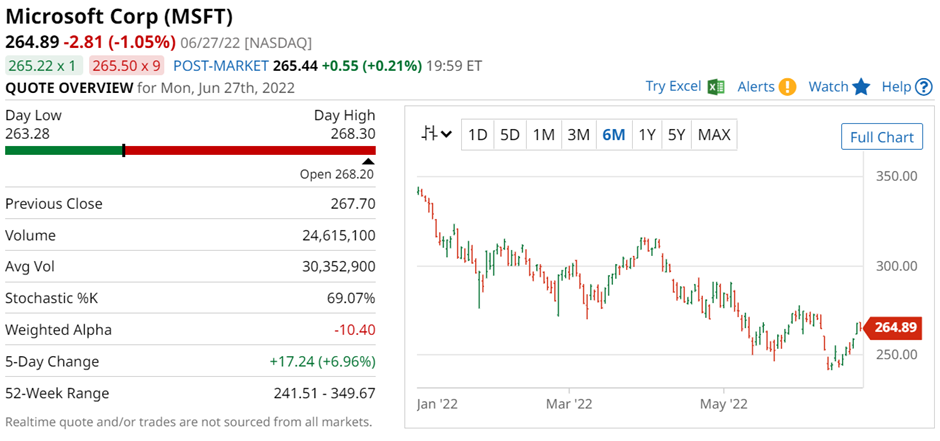

Let’s look at the first line item – a Bear Call Spread on MSFT.

Using the August 19 expiry, the trade would involve selling the 265 call and buying the 270 call. That spread could be sold for around $2.45 which means the trader would receive $245 into their account. The maximum risk is $255 for a total profit potential of 96.08% with a probability of 53%.

The breakeven price is 267.45. This can be calculated by taking the short call strike and adding the premium received.

As the spread is $5 wide, the maximum risk in the trade is 5 – 2.45 x 100 = $255.

The Barchart Technical Opinion rating is an 88% Sell with a weakening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

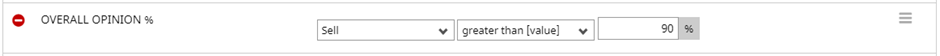

Let’s strengthen the screener by adding only stock with a 90% or greater Sell Rating.

This gives us these results:

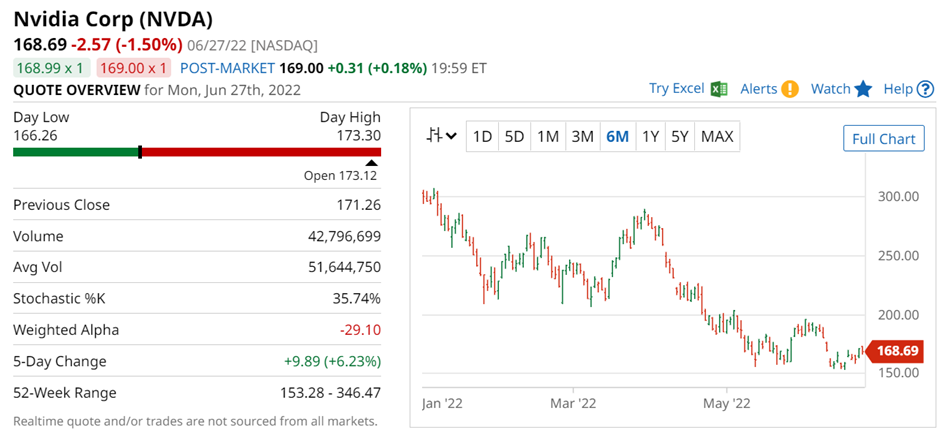

Let’s analyze the first result – a Bear Call Spread on NVDA.

This Bear Call Spread on NVDA involves selling the 170 August call and buying the 175 call.

That spread could be sold for around $2.20 which means the trader would receive $220 into their account. The maximum risk is $2.80 for a total profit potential of 78.57% with a probability of 53.9%.

The breakeven price is 172.20.

NVDA is rated a Strong Sell and the Barchart Technical Opinion rating is a 100% Sell with a Strengthening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

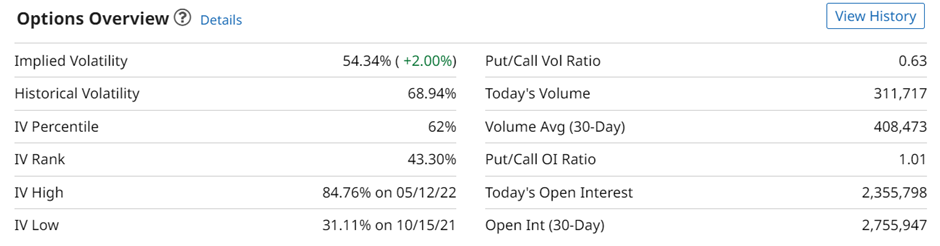

NVDA is showing an IV Percentile of 62% and an IV Rank of 43.30%. The current level of implied volatility is 54.34% compared to a 52-week high of 84.76% and a low of 31.11%.

Mitigating Risk

Thankfully, Bear Call Spreads are risk defined trades, so they have some build in risk management. The most the MSFT example can lose is $255.

Position sizing is important so that a 100% loss does not cause more than a 1-2% loss in total portfolio value.

Bear Call Spreads can also contain early assignment risk, so be mindful of that if the stock breaks through the short strike and it’s getting close to expiry.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

*Disclaimer: On the date of publication, Steven Baster did have (either directly or indirectly) positions in some of the securities mentioned in this article. All information and data in this article is solely for informational purposes. Data as of after-hours, June 27th, 2021.

More Stock Market News from Barchart

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)