/GE%20HealthCare%20Technologies%20Inc%20sign%20on%20building%20-by%20Poetra%20RH%20via%20Shutterstock.jpg)

Chicago, Illinois-based GE HealthCare Technologies Inc. (GEHC) develops, manufactures, and markets products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients. Valued at $37.5 billion by market cap, the company offers imaging, ultrasound, maternal, ventilator, and patient monitoring equipment, as well as performance management, cybersecurity, technical training, site planning, integrated asset optimization, and clinical network solutions.

Shares of this leader in precision care have underperformed the broader market over the past year. GEHC has declined 5.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.2%. However, in 2026, GEHC’s stock rose marginally, surpassing the SPX’s marginal dip on a YTD basis.

Narrowing the focus, GEHC’s outperformance is apparent compared to the iShares U.S. Medical Devices ETF (IHI). The exchange-traded fund has declined about 11% over the past year. Moreover, GEHC’s marginal returns on a YTD basis outshine the ETF’s 6.8% losses over the same time frame.

On Feb. 4, GEHC shares closed up by 4.9% after reporting its Q4 results. Its adjusted EPS of $1.44 beat Wall Street expectations of $1.43. The company’s revenue was $5.7 billion, topping Wall Street forecasts of $5.6 billion. GEHC expects full-year adjusted EPS in the range of $4.95 to $5.15.

For the current fiscal year, ending in December, analysts expect GEHC’s EPS to grow 10.2% to $5.06 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

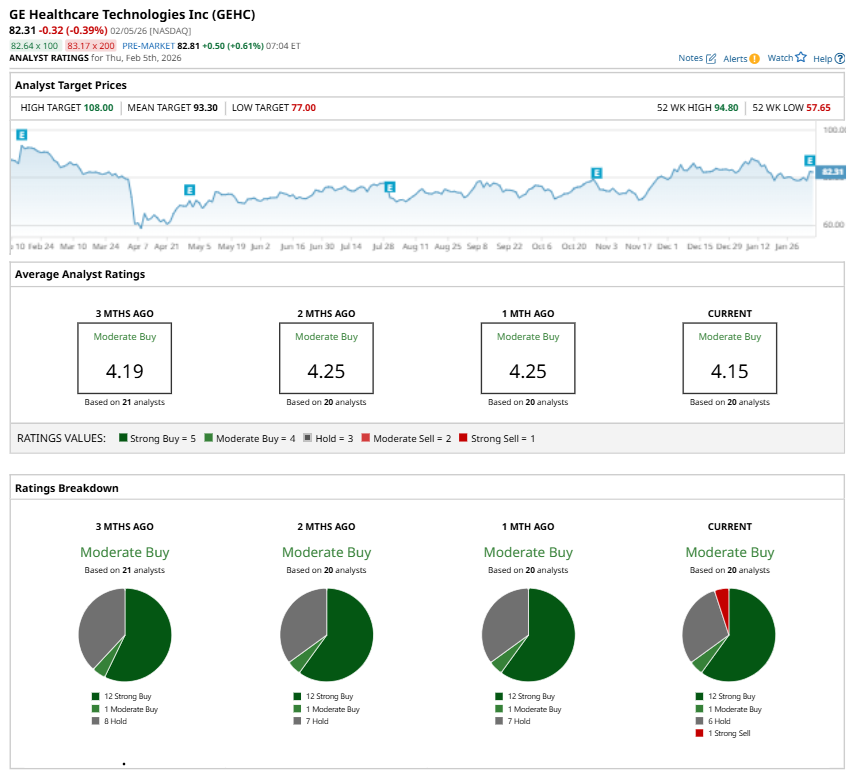

Among the 20 analysts covering GEHC stock, the consensus is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” six “Holds,” and one “Strong Sell.”

The configuration has been relatively stable over the past three months.

On Feb. 5, Stifel Financial Corp. (SF) analyst Rick Wise kept a “Buy” rating on GEHC and raised the price target to $98, implying a potential upside of 19.1% from current levels.

The mean price target of $93.30 represents a 13.4% premium to GEHC’s current price levels. The Street-high price target of $108 suggests an upside potential of 31.2%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)