/Tapestry%20Inc%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $26.6 billion, Tapestry, Inc. (TPR) is a global accessories and lifestyle brand company operating across North America, Greater China, the rest of Asia, and other international markets through its three core brands: Coach, Kate Spade, and Stuart Weitzman. It designs and sells handbags, accessories, footwear, and ready-to-wear products through retail stores, outlets, e-commerce platforms, and shop-in-shop locations worldwide.

Shares of the New York-based company have significantly outperformed the broader market over the past 52 weeks. TPR stock has climbed 90.9% over this time frame, while the broader S&P 500 Index ($SPX) has increased 13.1%. In addition, shares of the company are up 9.7% on a YTD basis, compared to SPX’s marginal rise.

Focusing more closely, shares of the maker of high-end shoes and handbags have also outpaced the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 3.4% return over the past 52 weeks.

Shares of Tapestry surged 7.1% on Feb. 5 after the company reported Q2 2026 results that beat Wall Street expectations, with adjusted EPS of $2.69 and revenue of $2.5 billion. Investor sentiment was further boosted by strong operating performance, including a 620-basis-point expansion in GAAP operating margin, pro forma revenue growth of 18%, and standout 25% growth at the Coach brand. Additionally, Tapestry raised its full-year fiscal 2026 outlook, projecting EPS of $6.40 - $6.45.

For the fiscal year ending in June 2026, analysts expect TPR’s EPS to grow 10.6% year-over-year to $5.64. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

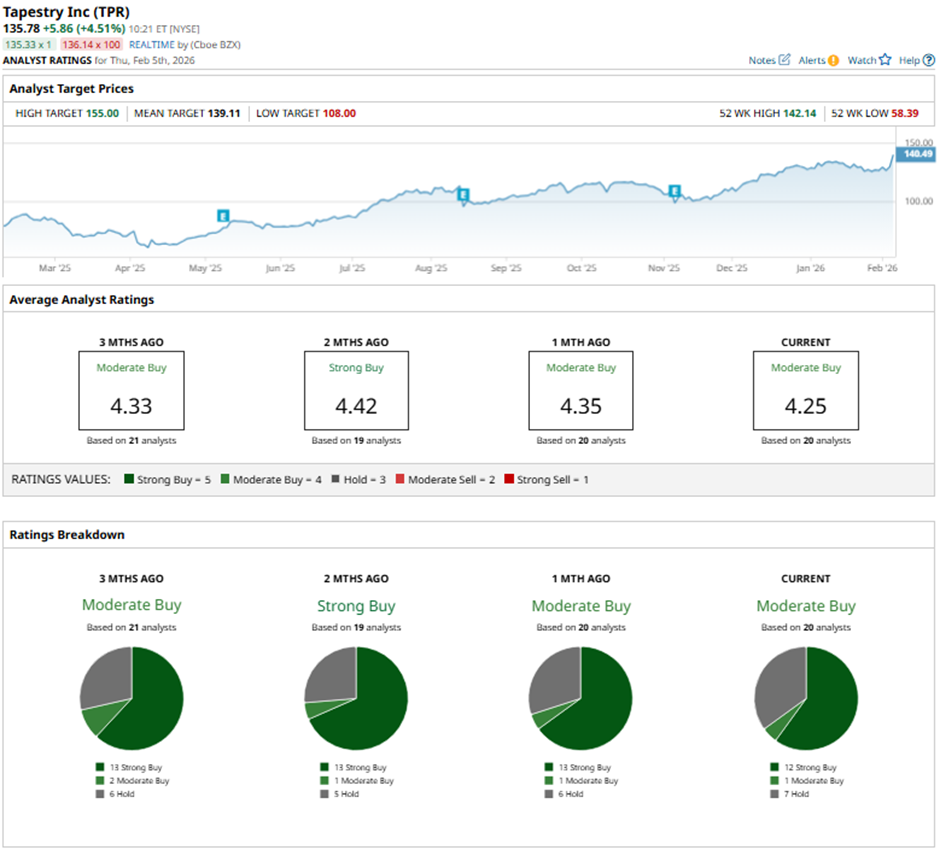

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

On Jan. 30, UBS analyst Jay Sole maintained a “Hold” rating on Tapestry and set a price target of $125.

The mean price target of $139.11 represents a premium of 2.5% to TPR's current levels. The Street-high price target of $155 implies a potential upside of 14.2% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)