/MGM%20Resorts%20International%20hotel%20by-%20atosan%20via%20iStock.jpg)

With a market cap of $9.2 billion, MGM Resorts International (MGM) is a global gaming and entertainment company operating casino resorts and digital gaming platforms across the United States, China, and other international markets. Through segments including Las Vegas Strip Resorts, Regional Operations, MGM China, and MGM Digital, the company offers integrated resort experiences and online gaming services such as sports betting and iGaming via BetMGM.

Shares of the Las Vegas, Nevada-based company have lagged behind the broader market over the past 52 weeks. MGM stock has fallen marginally over this time frame, while the broader S&P 500 Index ($SPX) has increased 16.5%. In addition, shares of the company are down 7.2% on a YTD basis, compared to SPX’s 2% rise.

Looking closer, shares of the casino and resort operator have underperformed the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 7.1% return over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 revenue of $4.25 billion on Oct. 29, MGM shares fell 1.6% the next day as adjusted EPS of $0.24 missed Wall Street expectations and declined sharply from $0.54 a year earlier. Investors were also concerned about a net loss of $285 million, driven largely by a $256 million non-cash goodwill impairment and roughly $93 million in other Empire City–related write-offs. Additionally, Las Vegas Strip Resorts underperformed, with net revenues down 7% year-over-year to $2 billion and Segment Adjusted EBITDAR falling 18% to $601 million, overshadowing strength in MGM China and BetMGM.

For the fiscal year that ended in December 2025, analysts expect MGM’s adjusted EPS to decrease 7.7% year-over-year to $2.39. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

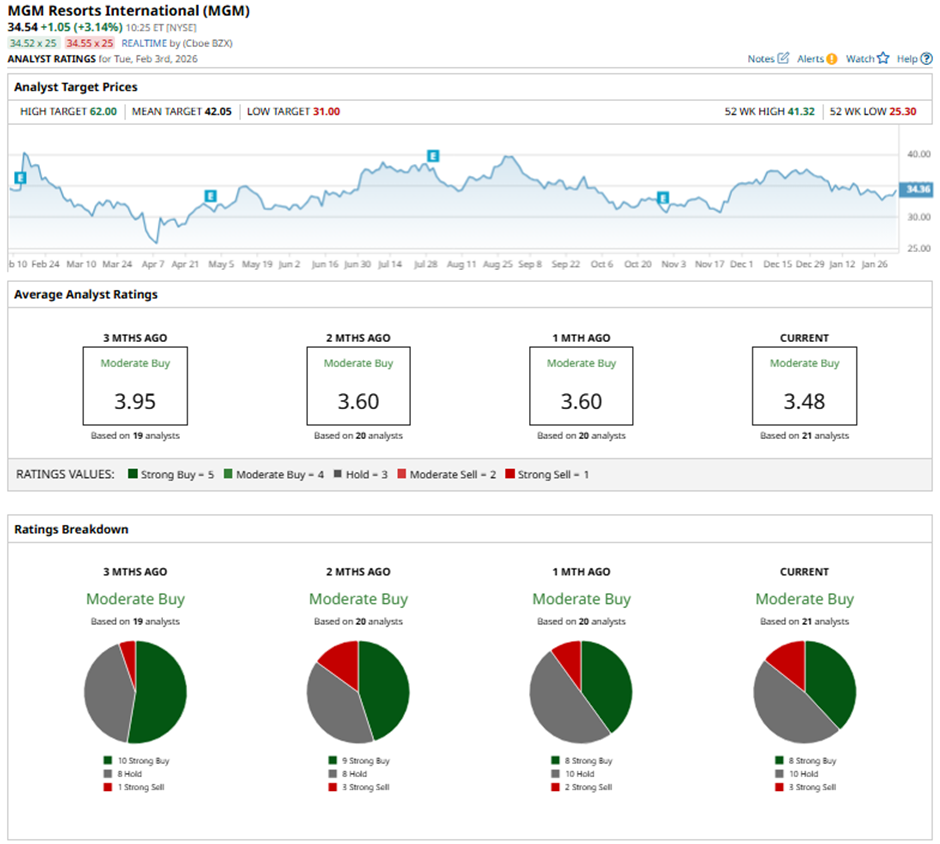

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, 10 “Holds,” and three “Strong Sells.”

On Dec. 15, 2025, Goldman Sachs analyst Lizzie Dove raised its price target on MGM Resorts to $33 but maintained a “Sell” rating.

The mean price target of $42.05 represents a premium of 21.7% to MGM's current price. The Street-high price target of $62 suggests a 79.5% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)