/Uber%20Technologies%20Inc%20logo%20outside%20offices-by%20Sundry%20Photography%20via%20iStock.jpg)

For a long time, Uber (UBER) critics called the company’s “growth at all costs” strategy a poor business model. Some said it will die under the weight of venture capital and subsidies. But prudent stock market professionals always pointed out the importance of Uber’s data. That importance is becoming relevant now as data-hungry AI models look for high-quality data to build and offer new products.

In a recent development, Nvidia (NVDA) and Mercedes (MBGYY), in a bid to start a new robotaxi company, have partnered with UBER. The reason for the partnership is obvious. Uber sits on billions of miles of real-life data. Anyone who wants to build the next infrastructure layer of autonomous transport hopes to get their hands on this data, and Uber isn’t just handing it over to any other company. By collaborating with Nvidia and Mercedes, two of the top companies in their respective domains, it has indicated that it aims to be a part of the new ecosystem.

About Uber Stock

Uber Technologies develops and operates its proprietary technology applications across the world. It is commonly known for its ride-hailing and delivery services, and its name has become synonymous with ride-hailing, much like Alphabet's (GOOG) (GOOGL) Google name became associated with searching for anything online. The firm is headquartered in San Francisco, California.

UBER’s one-year returns of 22% are nothing special, but they have still marginally outperformed the broader market. This is perfect for those waiting for Uber’s autonomous driving thesis to play out.

Much like Tesla (TSLA) on many occasions in the past decade, Uber’s valuation is a much-debated topic. For example, the company’s forward price-to-book value of 5.74x is trading at a 25% discount to the five-year average. Yet it is impossible to come up with the correct book value for the valuable data that it holds. A forward P/E of 23.3x compared to the 5-year average of 33.66x is similarly trading at a discount. Either investors doubt its role in the future of autonomous driving due to the existing players in the domain, like Tesla and Alphabet, or they simply overpaid in the past. No matter what your opinion about it, there is no doubt that the stock is cheap and could be at an inflection point pertaining to the use of the data it sits on.

Another reason for the valuation discount could be the consensus EPS growth rate in 2026. The firm is expected to register a negative 33% earnings growth this year. But markets are future-looking, and at some point in this quarter or the next, investors will start looking at the expected 25% growth in 2027 and 18% growth in 2028 and be willing to pay a higher price for that growth. Accumulation right now could be the right way to go rather than trading the stock.

Negative Reaction to Q3 Earnings

Uber announced its Q3 2025 earnings on Nov. 4, and the stock tanked despite an earnings beat. CEO Dara Khosrowshahi pointed out that the company registered the strongest growth since late 2023 and that the trip volume increase was the largest ever, excluding the Covid-19 recovery period. Net income increased 3x to $6.6 billion.

Management raised an interesting point on the earnings call that is relevant to those thinking of buying the stock on the Nvidia/Mercedes partnership news. It said autonomous vehicles won’t be profitable for a few years going forward. This means investors cannot expect any significant earnings bump on the back of autonomous driving projects. Going forward, investors will not only need to keep an eye on how Uber’s autonomy plans work out but also keep a close eye on competitors Alphabet and Tesla.

Q4 2025 earnings are coming out on Feb. 4, and with the company having beaten Wall Street expectations in the last four quarters, investors can look forward to a similar earnings beat.

What Are Analysts Saying About UBER Stock?

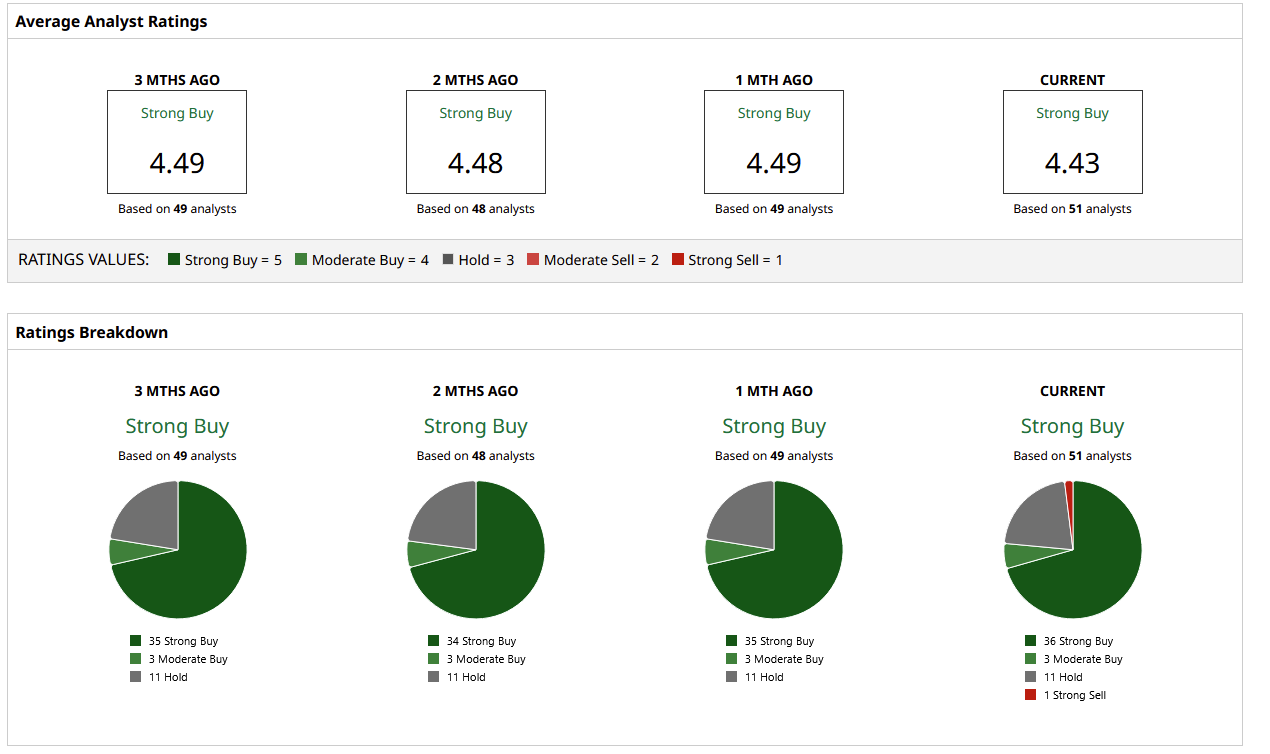

UBER is a consensus “Strong Buy” on Wall Street, as per 51 analysts that cover the stock. Last week, Bank of America Securities maintained its “Buy” rating on the stock but lowered the price target from $119 to $110. This is quite close to the mean target price of $111.50, which offers 39% upside from here on.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)