/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Trust Elon Musk to always try to set the narrative. Even after Tesla (TSLA) reported its first-ever full-year revenue decline in 2025 and the second consecutive year of automotive sales as well, Musk's assertions about “Amazing Abundance,” humanoid robots, and full self-driving (FSD) have been the talk of the Street primarily.

Also, Musk announced that the models of Tesla, which put it on the map in the first place—Model S and Model X—would be discontinued, and the Fremont facility used for the production of these vehicles will now be used for manufacturing the Optimus humanoid robots.

Furthermore, the company will undertake a capex spend of about $20 billion in 2026, a significant leap from the previous year's figure of $8.5 billion. The goal is to shift the company’s foundation from a traditional automaker to a physical AI and robotics powerhouse.

So, the headlines may look impressive, but what about the here and now, which is marked by pressure on the company's financials? The stock is up just 8% over the past year, and the massive capex outlay will only exert pressure on the company's dwindling margins. However, for long-term investors convinced of the Tesla story or for value pickers who believe the stock is undervalued, is this turbulent time in the company's history a favorable time to load up on its shares? Let's try to answer this and find out.

Financials Weakening (With a Caveat)

Thanks to the Musk cult and the virtue of the quality of the vehicles, Tesla's revenue and earnings have jumped by CAGRs of 24.63% and 34.50%, respectively. However, it appears that a return to such impressive growth rates is a difficult proposition for the company now.

Even after the company reported a beat on both the revenue and earnings front in Q4, the larger picture is this: both declined from the previous year, with the latter experiencing the fourth consecutive quarter of yearly fall. Total revenues for the quarter came in at $24.9 billion, down 3% from the previous year, with automotive revenues falling by 11% from the previous year to $17.7 billion. Meanwhile, earnings slipped by an even sharper 17% in the same period to $0.50 per share. Although it came in higher than the consensus estimate of $0.45 per share, it remained unchanged sequentially. Overall, over the past nine quarters, Tesla's earnings have beaten estimates on just three instances.

Margins dwindled as well to 5.7% from 6.2% in the year-ago period, with net cash from operating activities slipping by 21% from the previous year to $3.8 billion in Q4 2025. Overall, Tesla closed the quarter with a cash balance of $44.1 billion, higher than its short-term debt levels of $31.7 billion.

Notably, total production and deliveries continued to decline after a temporary bump due to the ending of the federal tax credits for EVs. While the total production of 434,358 vehicles represented a yearly de-growth of 5%, total deliveries fell by 16% in the same period to 418,227 vehicles.

However, green shoots emerged as well. Active FSD subscriptions jumped by 38% on a year-over-year (YoY) basis to 1.1 million, with the energy segment seeing particularly consistent traction. Supercharger stations and Supercharger connectors, vital to Tesla's identity as a full-stack EV player, rose by 17% and 19% from the previous year to 8,182 and 77,682, respectively. In fact, the energy segment saw its revenues increase by 27% from the previous year to $12.8 billion.

Shifting focus towards valuations, Tesla is perhaps one of those few companies with a market cap of more than a hundred billion dollars and still trading at a forward P/E exceeding a hundred times. In fact, its forward P/E at 198.35 is considerably ahead of the sector median of 17.88. Forward P/S and P/CF of 13.35 and 105.36 also exceed the sector medians of 0.97 and 1.95, respectively. Yet, to be fair to Tesla, Wall Street still essentially values it solely as a car company, which is becoming less and less relevant, considering its shift towards AI and robotics.

Fab Ambitions

Gauging from Musk's repeated pronouncements at different forums, it looks like his strategy to pocket his bumper $1 trillion pay package will be headlined by FSD and Optimus. But, how will he power them? That aspect has not often been discussed.

In the latest earnings call, Musk mentioned building a fabrication unit to achieve his AI ambitions, stating, “And in fact, I think it's going to make sense, and this is definitely going to be a sort of a controversial thing, but I think Tesla needs to build a Terafab.” Looking to build this Terafab in three or four years, this fab will include logic, memory, and packaging capabilities while also reducing the company's dependence on its chip partners like Nvidia (NVDA), TSMC (TSM), and Micron (MU).

Speaking of chips, the current AI4 chip is also serving Tesla well. Although it lags Nvidia's Drive Thor in terms of raw performance (2,000 FLOPS for the Thor vs. 100-150 TOPS for the AI4), it carries out the specific tasks required for its autonomous vehicles with great precision. AI4 utilizes GDDR6 memory (the same used in high-end gaming GPUs) to achieve about 384 GB/s of bandwidth. This outperforms the base configurations of Nvidia Thor (~273 GB/s), allowing Tesla to process massive streams of raw 5MP video with lower latency.

Moreover, the AI5 is also in the works. Musk said that “completing the AI5 chip design and having it be a great chip is arguably the #1 most critical thing to get done.” Highlighting the chip's importance to the Tesla AI story, Musk revealed that he has been working on getting the chip ready by working on Saturdays. However, there was no indication that the chip will be sold externally (like Google's TPUs), and it will be used primarily internally in Optimus, FSD, and the company's data centers.

In essence, the AI5 represents a fundamental architectural departure from the current AI4 platform. While the AI4 was built as a 7nm node, the AI5 will be a dual-sourced endeavor leveraging 3nm and 2nm nodes. This will allow for a massive increase in transistor density, enabling Tesla to integrate more logic blocks without a proportional increase in the chip’s physical footprint. Performance-wise, the AI5 is targeting for 1,500-4,000 TOPS, an improvement of 10x-40x on the AI4. However, the cost will increase by a mere 250% for producing the AI5, making the chip a possible cost-efficient upgrade on the AI4.

Finally, coming to Optimus, the latest iteration in Optimus Gen 3 has already commenced mass production with a target of producing 50,000 units in 2026 and an aggressive goal to reach a run rate of 1 million units annually by the end of the year. While internal factory deployment is the priority for 2026, Tesla expects to begin external sales to other companies in late 2026, with broader consumer availability targeted for 2027. The Gen 3 model will provide more hand dexterity (22 degrees vs. 11 degrees for the Gen 2), will be lighter (125 lbs vs 160 lbs), faster (8.5 mph vs. 3 mph), and have improved battery life (8 hours vs. 2-4 hours). Expected costs of the Gen 3 are also lower at $20,000-$30,000 per unit, compared to the $40,000–$50,000 cost for the Gen 2.

Thus, as usual, many will look at the future of Tesla with starry eyes, with all these developments. However, the company should start looking to arrest the decline in its still-core business of automobiles. While this will provide the much needed boost to its financials again, it will also assist in furthering its ambitions of AI, robotics and a possibe development of a fab unit in the future.

Analyst Opinion on TSLA Stock

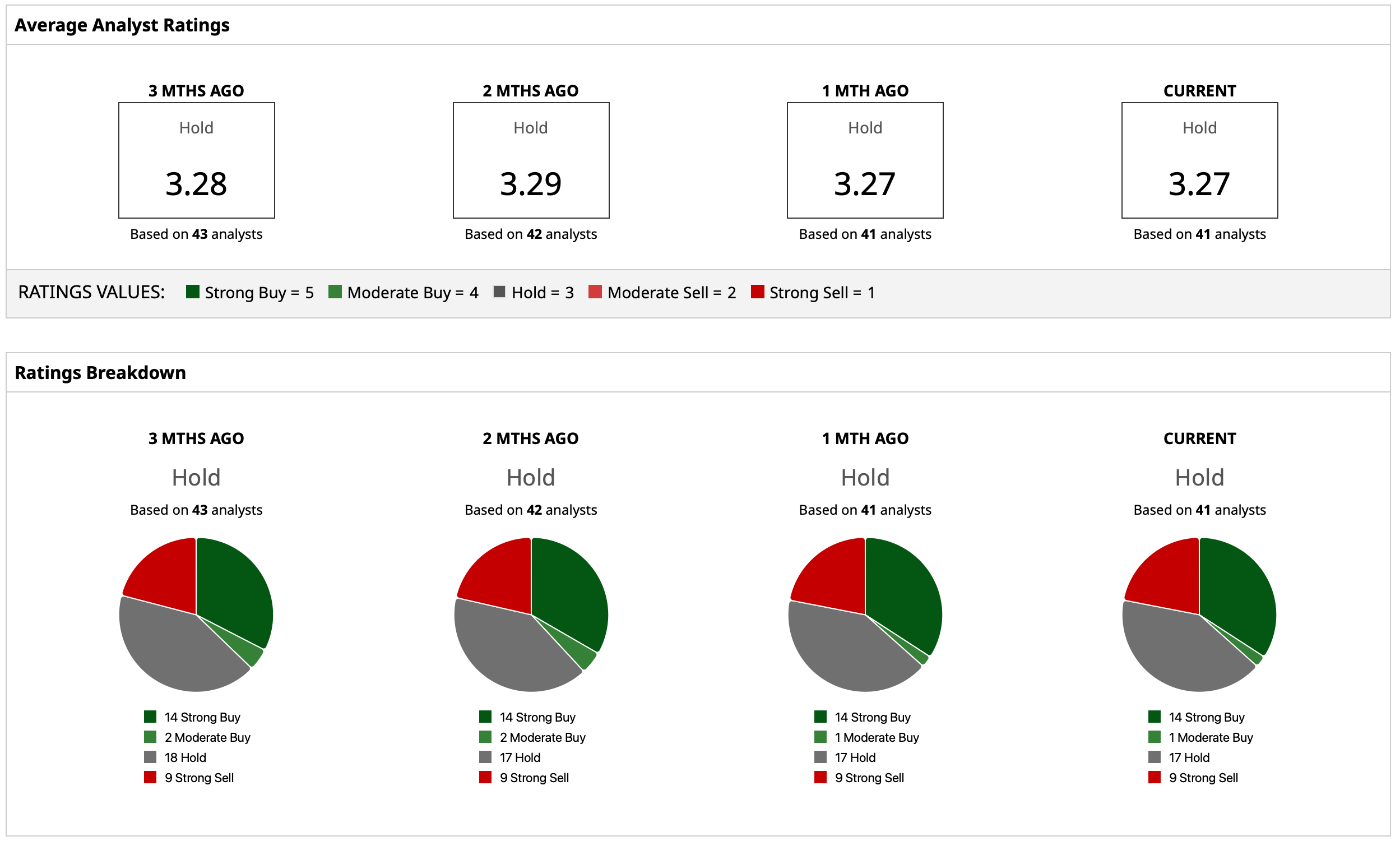

Taking all of this into account, analysts have attributed a rating of “Hold” for the stock, with a mean target price that has already been surpassed. The high target price of $600 denotes an upside potential of about 38% from current levels. Out of 41 analysts covering the stock, 14 have a “Strong Buy” rating, one has a “Moderate Buy” rating, 17 have a “Hold” rating, and nine have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)