/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

Semiconductor stocks have been volatile lately, and Intel (INTC) is no exception. After a strong rally in 2025, fueled by a new CEO and AI optimism, Intel’s stock has swung on mixed results. The chipmaker reported solid Q4 2025 results, topping estimates on both revenue and EPS, but its cautious 2026 guidance and manufacturing constraints rattled investors.

Just as Intel shares sold off on those worries, a new twist emerged. Reports say Nvidia (NVDA) is exploring Intel’s foundry services for its 2028 “Feynman” GPUs. This unexpected potential partnership has rekindled optimism about Intel’s foundry strategy and put INTC back in the headlines. This is not the first time that Nvidia has joined forces with Intel. In late 2025, Intel and Nvidia announced a pact to co-develop AI CPUs and GPUs, with Intel building Nvidia-custom x86 CPUs and GPU+CPU “SoCs,” and Nvidia taking a $5 billion Intel stake.

The question now is: Is Intel’s stock a buy-and-hold as it pursues this long-term opportunity? Let's break it down.

Intel in a Nutshell

Backed by the U.S. government, Intel is a pioneer of x86 PC and server processors that power much of the computing world. It designs and manufactures CPUs for PCs, servers, and edge devices, and it is aggressively rebuilding a foundry business to make chips for others. What makes Intel unique is its massive R&D and fabrication capacity in the U.S., plus deep ties in the tech ecosystem, assets it hopes to leverage as AI drives demand for custom chips.

Intel also inked foundry deals with the big cloud players. Microsoft (MSFT) and Amazon (AMZN) are locked in to produce custom chips on Intel’s 18A process; details were under wraps, but both signed long-term fabrication contracts. Intel even supplied Gaudi AI accelerators to IBM’s (IBM) cloud (the Watsonx AI platform). These partnerships illustrate that Intel’s fabs are attracting marquee customers beyond its own chips.

Valued at around $244 billion by market cap, Intel’s stock was dead in the water at the start of 2025 but roared back, surging roughly 147% over the past 52 weeks, far outpacing rivals like AMD (AMD) and even Nvidia. The turnaround was driven by the arrival of CEO Lip-Bu Tan, who rapidly cut costs and refocused efforts, and by high-profile deals (including a $5 billion Nvidia investment). By year-end, Intel’s market cap doubled off its lows. Early 2026 saw some giveback; INTC pulled back into the low $40s after cautious Q1 guidance but has bounced as new strategic news emerged.

From a valuation standpoint, Intel looks expensive. Its price-to-sales ratio of about 3.7x and price-to-book of roughly 2x are both near multi-year highs. By comparison, many high-growth peers trade at much richer levels, with AMD and Nvidia often fetching price-to-book multiples of 5x to 7x. In short, Intel is not bargain-basement cheap; its stock price already implies a fair bit of turnaround progress.

Nvidia & Intel: New Foundry Runs

So the big news revolving around the market is that Nvidia may send some 2028 GPU production to Intel. Reports citing DigiTimes say Nvidia’s next-gen Feynman GPUs will keep their custom dies at TSMC (TSM), but up to 25% of final packaging (using Intel’s EMIB advanced packaging) could be done at Intel, assuming yields improve. Apple (AAPL) is also “reportedly involved in low-volume production runs” at Intel, though it will still rely on TSMC for its leading chips. These developments are largely symbolic in the near term, since volumes will be small and years away. However, they validate Intel’s foundry roadmap and help Intel meet U.S. supply requirements. Upon those reports, Intel’s stock jumped sharply, on hopes that big tech customers are finally giving Intel a chance as a chipmaker.

In practical terms, a 2028 partnership won’t move the needle on the next few quarters, but it shines a positive light on Intel’s turnaround. It suggests Intel’s leading-edge 18A/14A process may be credible, which could attract other customers.

For investors of INTC, this news is a long-term tailwind, a potential upside catalyst well off on the horizon. The near-term stock swings will still depend on Intel’s execution, which is currently hampered by the tight supply of 18A chips and cautious guidance.

Intel Beats Expectations Despite Revenue Dip

Intel delivered a mixed Q4 that offers a clear picture of where the turnaround stands and where the pain points still live. In the quarter ending Jan. 22, the company reported revenue of $13.67 billion, down about 4% year over year, and earnings per share (EPS) of $0.15. Both numbers beat consensus estimates, which looked for $13.37 billion in sales and $0.08 in EPS.

Performance by segment was uneven. Data Center and AI revenue was about $4.74 billion, showing strength in servers. Foundry revenue reached roughly $4.51 billion, a sign that Intel’s contract manufacturing push is beginning to scale. Client revenue for PC chips was softer at about $8.19 billion, underscoring persistent weakness in the PC market.

Cash flow looked healthy. Intel generated operating cash flow of around $4.3 billion in Q4 and about $9.7 billion for the full year 2025, finishing the year with about $37.4 billion in cash and short-term investments. Former CFO George Davis described that balance as a liquidity fortress, and the cushion should let Intel work through yield issues without tapping new debt.

Management sounded upbeat on the long term. CEO Lip-Bu Tan said the first 18A process products have shipped and highlighted the large AI opportunity. CFO David Zinsner warned that supply will be tight in Q1 2026 at the lowest level before improving in Q2 as 18A yields climb. Intel guided Q1 revenue to between $11.7 billion and $12.7 billion and expects breakeven GAAP EPS, with gross margin around 34.5%.

What Analysts Are Saying About INTC Stock

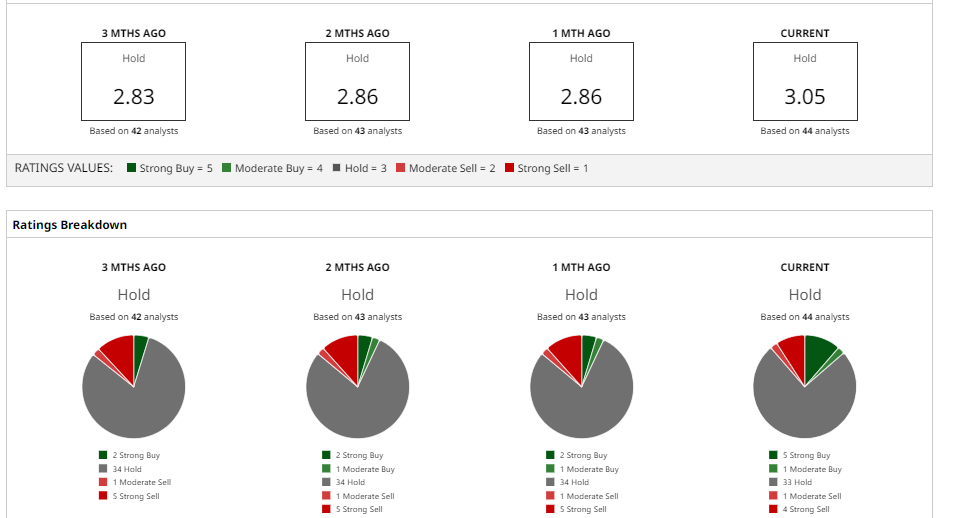

Wall Street is divided on Intel's near-term outlook. Following the Q4 report, Morgan Stanley increased its 12-month target to $41 from $38 but retains an “Equal Weight” rating.

On the other side, Citigroup downgraded Intel from “Neutral” to “Sell” and increased its target price to $48 to $50, noting the beat, but it had execution risk in the manufacturing. Citic Securities also upgraded Intel to “Buy” with a high target price of $60, considering the supply shortage a short-term issue.

Overall, analyst consensus remains a cautious “Hold” with an average target of around $44, which implies around an 8% downside risk.

The fourth quarter beat and long-term AI opportunity at Intel are generally commended by the analysts, but the only big caveat is a potential supply/demand mismatch in the short term. As one analyst said, the rally priced in a turnaround; hence, the lukewarm guidance elicited a sharp turnaround in sentiment. The new trend is evident as the firms that emphasize the better performance of Intel and its connection with partners are more optimistic, and the firms that underline yield or risks in the PC market are more neutral to bearish.

The Bottom Line

In my opinion, the Nvidia Foundry news is a plus point that should be regarded as a long-term reward. To patient long-term investors, the restructuring and these strategic relationships, like Nvidia's $5 billion stake, AI chip deals are an attractive turnaround narrative at Intel. Compared to current levels, it can grow upwards provided that Intel can make it work and most of the value lies in the someday of 18A yields and the scale of foundries.

But in the near term, INTC stock is probably not going to be stable because of near-term uncertainties like supply-chain bottlenecks and poor PC sales. So it looks like the investment in Intel is not a sure thing, but a pure risky bet on execution.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)