/Baxter%20International%20Inc_%20logo%20on%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $10.1 billion, Baxter International Inc. (BAX) is a global healthcare company that provides a broad portfolio of medical products, technologies, and pharmaceuticals used across hospitals, clinics, and home care settings. It operates worldwide through multiple segments, delivering solutions ranging from IV therapies and injectable drugs to advanced surgical and patient monitoring systems.

Shares of the Deerfield, Illinois-based company have lagged behind the broader market over the past 52 weeks. BAX stock has decreased 40.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.3%. However, the stock has risen 3.5% on a YTD basis, outpacing SPX's 1.4% return.

Looking closer, shares of the drug and medical device maker have underperformed the State Street Health Care Select Sector SPDR ETF's (XLV) 4.2% increase over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $0.69, Baxter’s shares plunged 14.5% on Oct. 30 as revenue of $2.84 billion missed forecasts. The company cut its full-year adjusted EPS guidance to $2.35 - $2.40 and reduced expected sales growth to 4% - 5% amid hurricane-related disruptions at its North Cove facility. Continued weakness in its infusion pump portfolio, including a shipment hold on the Novum IQ pump tied to two deaths, fueled investor concerns.

For the fiscal year that ended in December 2025, analysts expect BAX’s adjusted EPS to grow 24.9% year-over-year to $2.36. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

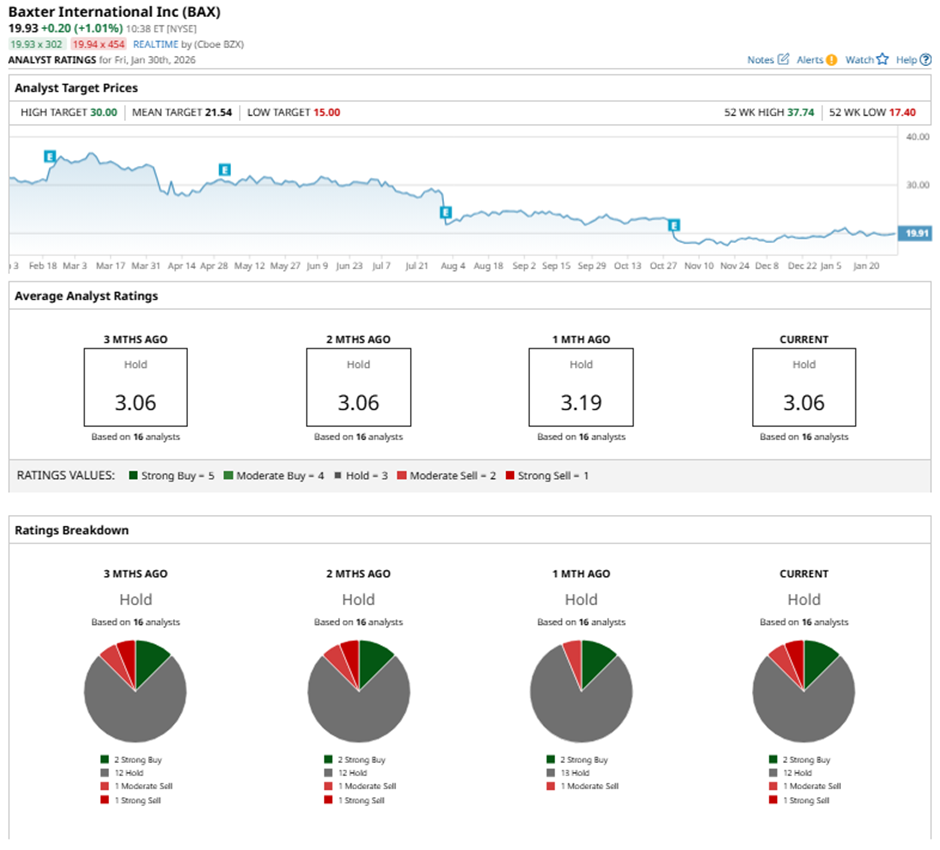

Among the 16 analysts covering the stock, the consensus rating is a “Hold.” That’s based on two “Strong Buy” ratings, 12 “Holds,” one “Moderate Sell,” and one “Strong Sell.”

On Jan. 9, Barclays analyst Matt Miksic cut Baxter’s price target to $30 and maintained an “Overweight” rating.

The mean price target of $21.54 represents a 8.1% premium to BAX’s current price levels. The Street-high price target of $30 suggests a 50.5% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)