Greenwich, Connecticut-based Interactive Brokers Group, Inc. (IBKR) operates as an automated electronic broker. Valued at $128.3 billion by market cap, the company specializes in executing and clearing trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, and exchange-traded funds, as well as offers custody, prime brokerage, securities, and margin lending services.

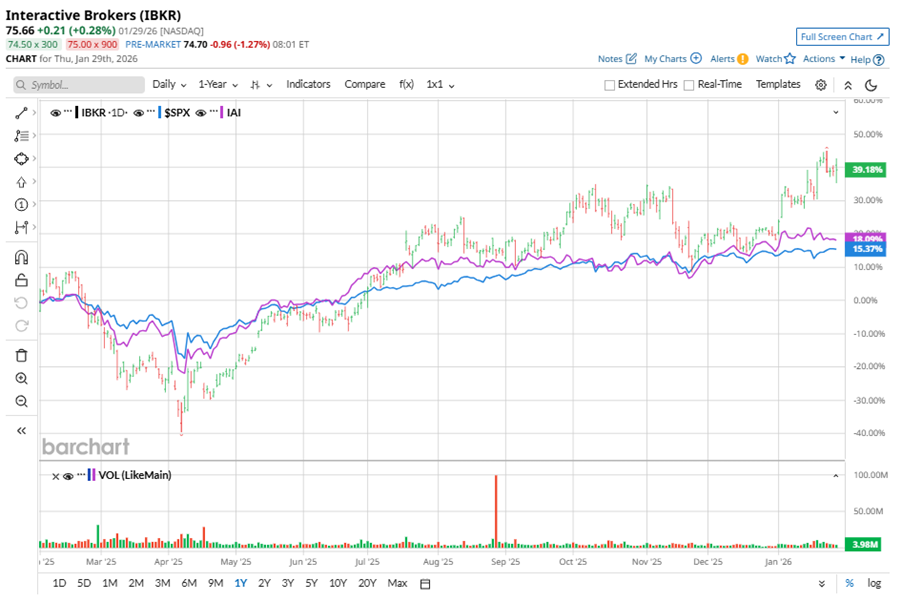

Shares of this leader in the digital brokerage space have outperformed the broader market over the past year. IBKR has gained 43.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.4%. In 2026, IBKR stock is up 17.7%, surpassing the SPX’s 1.8% rise on a YTD basis.

Zooming in further, IBKR’s outperformance is also apparent compared to iShares U.S. Broker-Dealers & Securities Exchanges ETF (IAI). The exchange-traded fund has gained about 19% over the past year. Moreover, IBKR’s double-digit gains on a YTD basis outshine the ETF’s 3% returns over the same time frame.

IBKR's strong performance is driven by over 1 million net new accounts in 2025, more than $780 billion client assets, and higher trading activity across equities, options, and futures. The company’s CEO Milan Galik credits tech, fair pricing, and global access for attracting clients.

On Jan. 20, IBKR shares closed down by 2.5% after reporting its Q4 results. Its net revenue stood at $1.6 billion, up 18.5% year over year. The company’s adjusted EPS increased 27.5% from the year-ago quarter to $0.65.

For the current fiscal year, ending in December, analysts expect IBKR’s EPS to grow 7.3% to $2.35 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

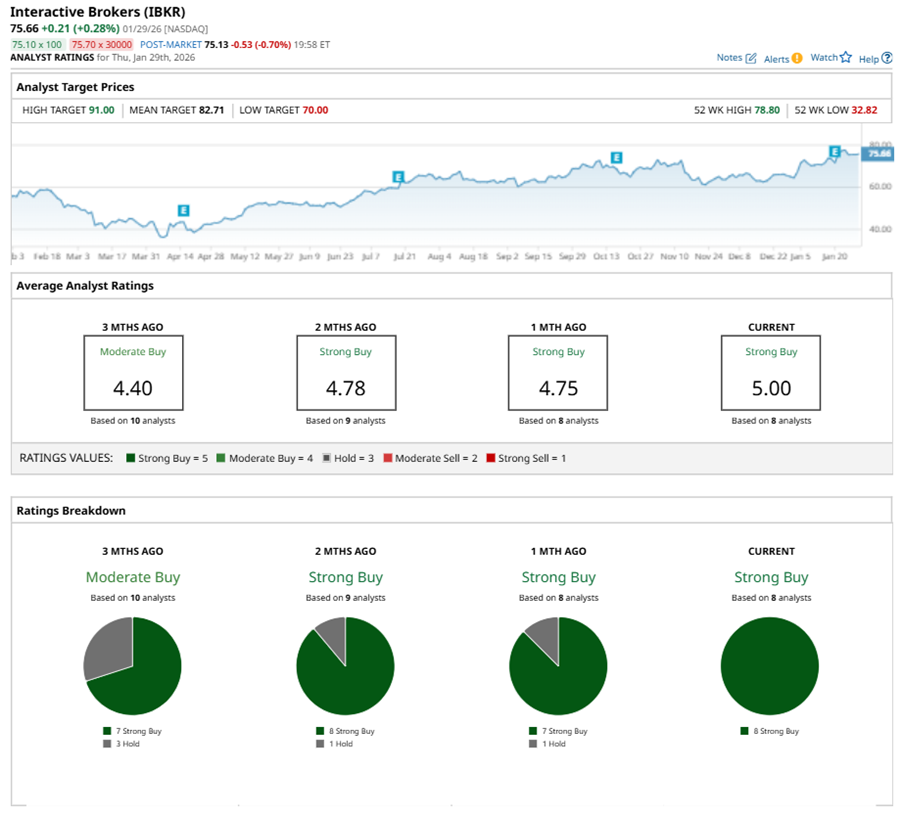

Among the eight analysts covering IBKR stock, the consensus is a “Strong Buy.” That’s based on all the analysts giving a “Strong Buy” rating.

This configuration is more bullish than a month ago, with seven analysts suggesting a “Strong Buy.”

On Jan. 21, James Yaro from The Goldman Sachs Group, Inc. (GS) reiterated a “Buy” rating on IBKR with a price target of $89, implying a potential upside of 17.6% from current levels.

The mean price target of $82.71 represents a 9.3% premium to IBKR’s current price levels. The Street-high price target of $91 suggests an ambitious upside potential of 20.3%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)