/Emerson%20Electric%20Co_%20magnified%20logo%20by-%20Casimiro%20PT%20via%20Shutterstock.jpg)

With an impressive market cap of $64.6 billion, Emerson Electric Company (EMR) is a global technology and engineering company based in Missouri. It offers innovative solutions across industrial, commercial, and residential markets through Final Control, Measurement & Analytical, Discrete Automation, Safety & Productivity, Control Systems & Software, and Test & Measurement segments.

Shares of this industrial heavyweight have outperformed the broader market over the past year. EMR has soared 17% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.4%. However, over the past six months, Emerson Electric stock rose 2.1%, trailing the SPX’s 9.4% return.

Narrowing the focus, EMR has lagged behind the sector-specific Industrial Select Sector SPDR Fund (XLI), which has gained 20.4% over the past year and 8.6% over the past six months.

Over the past year, Emerson Electric’s stock has outpaced broader market benchmarks primarily because of steady operational performance, consistent sales and earnings growth, and strong investor confidence in its industrial automation and control businesses. Additionally, demand for its automation solutions and resilient end markets has helped buoy the stock relative to the broader indices.

For the current year ending in September 2026, analysts expect EMR to deliver an adjusted EPS of $6.48, up 8% year-over-year. Moreover, the company has a solid earnings surprise history. It has surpassed or met the Street’s bottom-line estimates in each of the past four quarters.

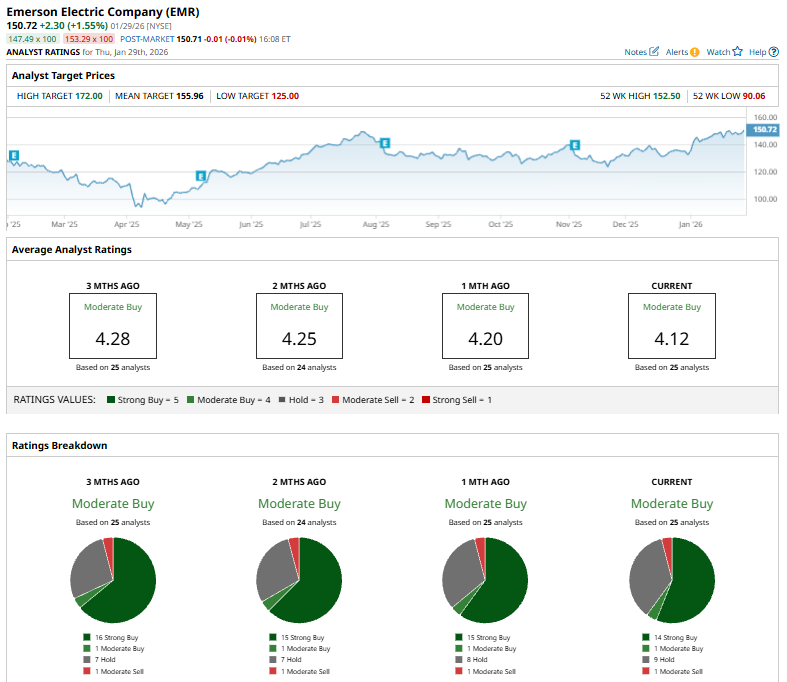

Among the 25 analysts covering the EMR stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buys,” one “Moderate Buy,” nine “Holds,” and one “Moderate Sell.”

This configuration is slightly bearish than a month ago, when 15 analysts gave “Strong Buy” recommendations.

On Jan. 27, Oppenheimer analyst Christopher Glynn downgraded Emerson from “Outperform” to “Perform,” citing valuation concerns, noting that the company’s growth prospects are now largely reflected in its share price.

EMR’s mean price target of $155.96 suggests an 8.2% upside potential. Meanwhile, the street-high target of $172 represents a notable 23.2% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)