Yesterday’s options volume was relatively slow at 50.92 million, well below the 30-day average of 59.63 million. The call volume exceeded the put volume by 1.5 times, a sign that the bulls remain optimistic about the markets' near-term direction.

ETF options were hectic on Wednesday, accounting for 54% of the volume. Among ETFs, there were 32 unusually active put options with volume-to-open-interest (Vol/OI) ratios of 10.0 or higher.

For today’s commentary, I thought I’d focus on three of the hottest ETFs right now: SPDR Gold Trust (GLD), iShares MSCI Brazil ETF (EWZ), and the VanEck Semiconductor ETF (SMH). Each of them is up at least 10% over the past month, well above the 0.7% gain for the SPDR S&P 500 ETF Trust (SPY).

While I continue to worry about excessive valuations for stocks, especially large- and mega-caps, GLD, EWZ, and SMH all look like attractive bets for short-term income and long-term gains.

Here are the three puts to sell to accomplish this goal.

SPDR Gold Trust (GLD)

GLD tracks the price of physical gold bullion, allowing investors to invest in gold itself without taking actual possession or storing it. The ETF has total assets of $185.92 billion.

We all have seen the run gold has taken over the past two years. At the end of 2023, GLD’s share price was $191.17. Yesterday, it closed at $494.56. As I write this early in Thursday trading, it’s up over $500. It is on a roll. When it stops, nobody knows.

What we do know is that investors continue to buy gold as a protection against the erosion of the U.S. dollar.

“Dollar weakness is supercharging the rise in gold ... adding fuel to the fire for the crazy rise in precious metals,’ said Robin Brooks, senior fellow at the Brookings Institution,” Yahoo Finance reported.

GLD has an attractive expense ratio of 0.40% and excellent liquidity, making it appealing to those looking to diversify their portfolios amid perceived weaknesses in the U.S. or the U.S. dollar.

In yesterday’s options trading, GLD had nine puts with Vol/OI ratios of 10.0 or higher. I’m looking to sell a put with an annualized income of 10% or more that offers a better entry point for acquiring GLD stock.

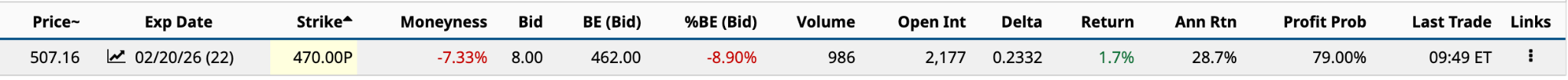

The Feb. 20 $470 strike provides the best bet.

As you can see from above, the annualized return by selling the $470 put is 28.7%, providing a profit probability -- trading above the $462 breakeven at expiration -- of 79.00%.

Worst case: you have to buy shares at $462, which is nearly 9% below its current share price.

iShares MSCI Brazil ETF (EWZ)

EWZ gives you exposure to 46 Brazilian large- and mid-cap stocks. The top three sectors by weight are financials (38.7%), materials (14.2%), and energy (12.6%).

It tracks the performance of the MSCI Brazil 25/50 Index, meaning no single stock can account for more than 25% of its $9.03 billion in net assets, and all stocks with a weighting of 5% or more can’t cumulatively exceed 50%.

Brazil is South America’s largest economy and the second-largest in the Western Hemisphere, ahead of my native Canada. If South America is to become a global economic power, Brazil must continue to evolve and grow.

I believe it will. In June 2024, I suggested that EWZ’s share price had bottomed and was ready to rebound in the second half. That didn’t happen. Instead, it fell another 20% to finish 2024 at $22.51. It’s gained about 67% in the 13 months since.

While there is political risk in owning emerging-market stocks, especially those in South America, the stocks held are among Brazil’s best companies. Long-term, EWZ is a winner.

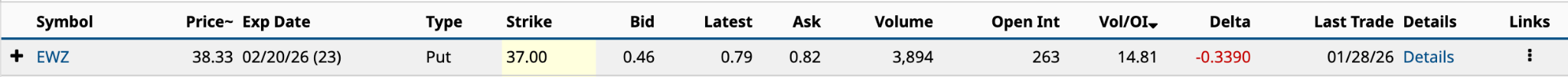

In yesterday’s options trading, EWZ had one put with a Vol/OI ratio of 10.0 or higher. That would be the Feb. 20 $37 strike price at 14.81.

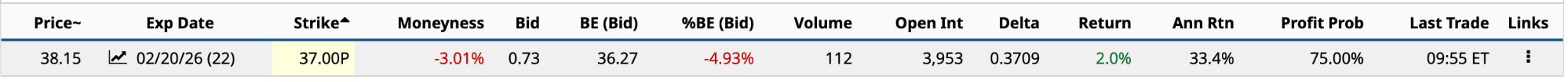

As you can see below, the annualized return by selling the $37 put is 33.4%, providing a profit probability of 75.00%.

Just 3.01% OTM (out-of-the-money), selling the $37 put is better suited to those accustomed to having shares assigned at expiration. With an expected move on the downside to $36.16, you might be forced to buy them at a slight paper loss.

In the long run, it will be worth it.

VanEck Semiconductor ETF (SMH)

SMH tracks the performance of the MVIS US Listed Semiconductor 25 Index, a collection of 25 leading semiconductor stocks. Its top three holdings: Nvidia (NVDA) (18.68% weighting), Taiwan Semiconductor Manufacturing Co (TSM) (10.19%), and Broadcom (AVGO) (7.01%).

The ETF continues to benefit from the secular trend toward AI and automation. While thematic or sector funds can be a waste of time, given broader funds usually already have significant tech exposure, SMH appears to be an exception to the rule.

However, there is no question that semiconductor stocks have elevated valuations. The ETF’s trailing 12-month P/E ratio as of Dec. 31 is 42.75x, about double the S&P 500's.

Of the three ETFs mentioned, SMH has the lowest year-to-date return at 13.63%. That’s still far superior to the gains for the S&P 500. Further, it has generated annual returns over 20% in seven of the last 10 years.

Given the strength of AI, do you really see a severe correction in the works? I sure don’t. Now, having said that, I wouldn’t put more than 5% of your total portfolio in it, but the upside remains compelling.

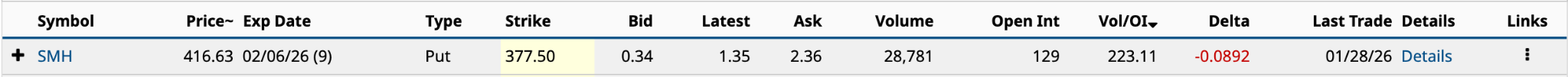

In yesterday’s options trading, SMH had several unusually active options, but only one put with a Vol/OI ratio of 10.0 or higher. But it was a whopper at 233.11.

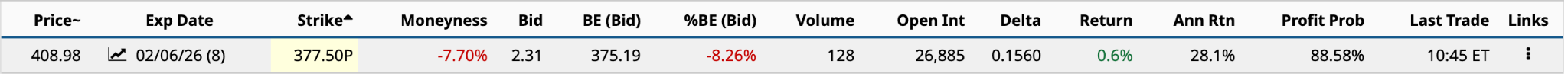

As you can see below, the annualized return by selling the $377.50 put is 28.1%, providing a profit probability of 88.58%.

Of the three, I’d say SMH has the least probability of the shares being assigned at expiration a week from this Friday. The Barchart Technical Opinion says it is a 100% Strong Buy in the near term. Therefore, consider this one the income-only scenario.

A possible strategy would be to continue selling SMH puts about 7-10% OTM with slightly longer DTEs (days to expiration) to ultimately get a better entry point for buying its stock than over $400.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)