Virginia-based Altria Group, Inc. (MO) manufactures and sells smokeable and oral tobacco products. Valued at $104.1 billion by market cap, the company offers cigarettes primarily under the Marlboro brand, large cigars and pipe tobacco under the Black & Mild brand, moist smokeless tobacco and snus products under the Copenhagen, Skoal, Red Seal, and Husky brands, and more.

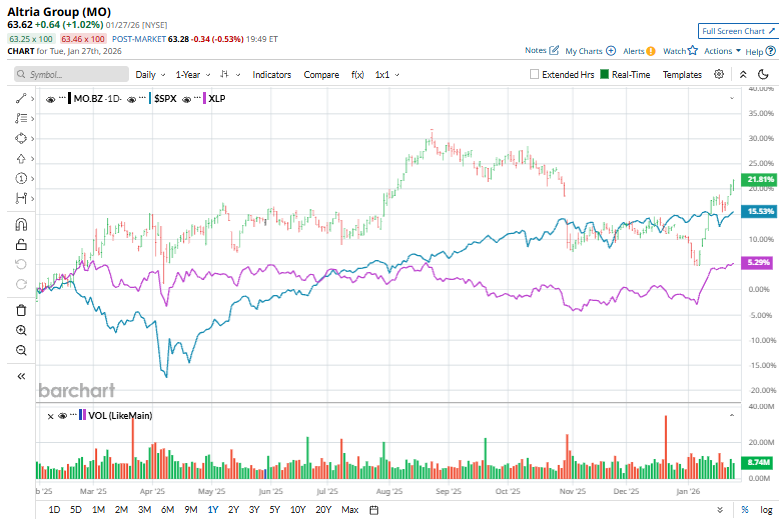

Shares of this leading tobacco company have outperformed the broader market over the past year. MO has gained 19% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.1%. However, over the past six months, MO stock has soared 6.3%, trailing the SPX’s 9.2% gains on a

Zooming in further, MO’s shares have outpaced the Consumer Staples Select Sector SPDR Fund (XLP). The exchange-traded fund has climbed 3.9% over the past year and 2.4% over the past six months.

On Dec. 10, shares of Altria Group climbed marginally higher after the company announced a regular quarterly dividend of $1.06 per share. The dividend is scheduled to be paid on January 9, 2026, to shareholders of record as of December 26, 2025, underscoring Altria’s continued commitment to returning capital to shareholders through its long-standing, income-focused dividend policy.

For FY2025 that ended in December, analysts expect MO’s EPS to grow 6.3% to $5.44 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

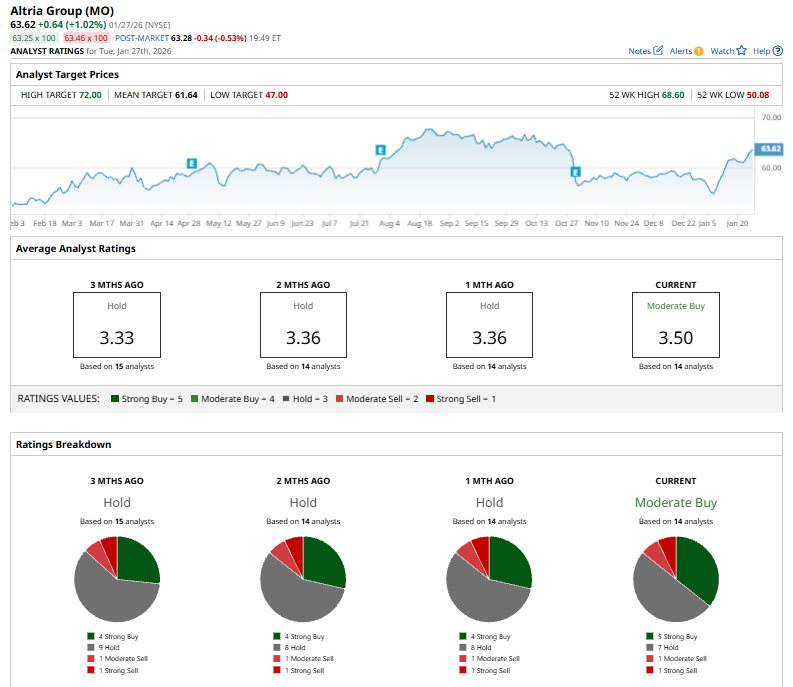

Among the 14 analysts covering MO stock, the consensus is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, seven “Holds,” one “Moderate Sell,” and one “Strong Sell.”

The current consensus is bullish than a month ago when the stock had an overall “Hold” rating.

On Jan. 27, UBS analyst Faham Baig reaffirmed a “Buy” rating on Altria Group while raising the price target to $67 from $63, reflecting growing confidence in the company’s performance outlook.

While the stock currently trades above its mean price target of $61.64, the Street-high target of $72 represents a 13.2% premium to MO’s current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)