/Computer%20memory%20by%20Zoomik%20via%20Shutterstock.jpg)

A stock that just doubled in a month is life-changing for existing investors, attractive for onlookers, and scary for those looking to get in at current prices. Sandisk (SNDK) is one such stock, up almost 100% in just a month and up roughly 1,000% in six months. The company is known for its various memory devices, and the reason for SNDK stock's surge is the ongoing demand for and shortage of memory products in the market.

There are multiple ways to look at the question of buying SNDK stock now. But one reason why the rally could be expected to continue is the way the industry reacts to such demand. Right now, the memory industry is facing extremely high demand. Usually, any industry would scramble to increase its production capacity to protect its market share. However, chipmaking isn’t just another business. It requires manufacturing at a high level of precision and technologies that not every company can acquire, certainly not a fresh entrant. Moreover, slight changes in global supply and demand can have a huge impact on memory chip prices.

Chipmakers are already well aware of the boom and bust cycle of this industry. Less than a year ago, the same industry was struggling to deal with an oversupply of the same product in the market. Therefore, industry leaders are unlikely to give in to the temptation of rushing to increase capacity despite the fact that demand is likely to stay in the foreseeable future.

For investors, this means the pricing power and margins are likely to stay. Whether those stable margins are fully priced in or not is the million-dollar question and requires a deeper look at Sandisk stock’s valuation.

About Sandisk Stock

Sandisk makes data storage devices and solutions using NAND flash technology. The firm sells its products globally and is an integral part of the supply chain of devices like PCs, smartphones, tablets, wearables, and even automotive applications. Sandisk is based in Milpitas, California.

SNDK stock is up 100% year-to-date (YTD), outperforming many benchmarks and peers by a long way. According to a report by Bloomberg, shorts have already lost over $3 billion in the stock’s upward move.

Here’s one perspective for those entering SNDK stock right now. A rally like this reaches its peak way before the public euphoria and optimism does. If SNDK stock were near its peak, you wouldn’t be able to know that by asking the investor standing next to you. But you can look at the stock’s valuation to see how far stretched it has become.

SNDK is trading at a forward price-to-earnings (P/E) ratio of 43.4 times. That is by no means outrageous, but still a significant premium to peers like Micron (MU) and Western Digital (WDC), which are trading at 12.3 times and 34.1 times, respectively. Sandisk’s gross margin of around 28% is also the lowest of the three, with the other two enjoying gross margins above 40%.

The company’s forward P/E can be justified considering the fact that it is expected to grow its earnings by 552% in fiscal 2026 and by 111% in fiscal 2027. However, negative growth in 2028 and 2029 do not paint a great long-term picture. If the demand for memory chips goes down earlier than expected, it could spell disaster for SNDK stock shareholders. Therefore, the higher valuation compared to peers offers a much bigger risk. If an investor wants to play the memory demand, Micron’s earnings outlook and lower valuation offer a better risk-adjusted return.

Sandisk Guides For a Strong Quarter

Sandisk reported its fiscal first-quarter 2026 earnings on Nov. 6. Revenue for the quarter came in at $2.31 billion, up 21% sequentially. Diluted EPS was $1.22. Sandisk's datacenter segment climbed 26% sequentially while BiCS8 technology “accounted for 15% of total bits shipped.”

The company expects Q2 revenue to be in the range of $2.55 billion to $2.65 billion. This should translate to an EPS of $3.20 at the midpoint, per the company. However, more than the earnings, analysts are looking at how the memory demand pans out, as that will ultimately decide Sandisk’s fate in the near term.

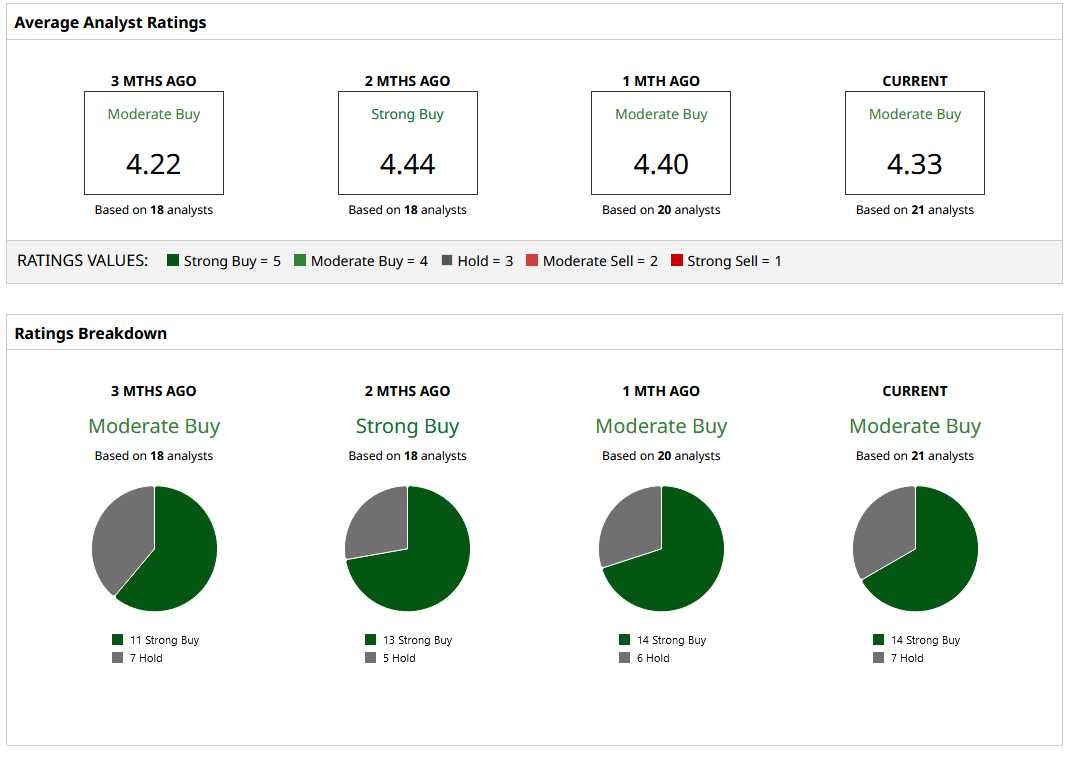

What Are Analysts Saying About SNDK Stock?

SNDK stock is covered by 21 analysts on Wall Street and has a consensus “Moderate Buy” rating. Of that group of analysts, 13 rate SNDK as a “Strong Buy” while eight believe it is a “Hold.” The mean target price of $359.06 is well below the current share price. However, the highest target price of $580 still offers 22% potential upside.

The $580 price target was recently assigned by Bernstein on Jan. 14. Considering how quickly things are changing in the memory market, investors can expect more analysts to update their price targets along the way.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)