/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

Micron Technology (MU) is a global semiconductor leader specializing in advanced memory and storage solutions, including DRAM, NAND, and NOR used in data centers, smartphones, PCs, automotive, and artificial intelligence (AI) infrastructure. Through its Micron and Crucial brands, the company supplies high‑performance products that power cloud computing, high‑bandwidth AI workloads, edge devices, and embedded systems across a wide range of industries.

Micron was founded in 1978 with its headquarters in Boise, Idaho. The company operates across the United States, Japan, Taiwan, Singapore, Malaysia, China, and India, serving customers worldwide through a global sales and support network.

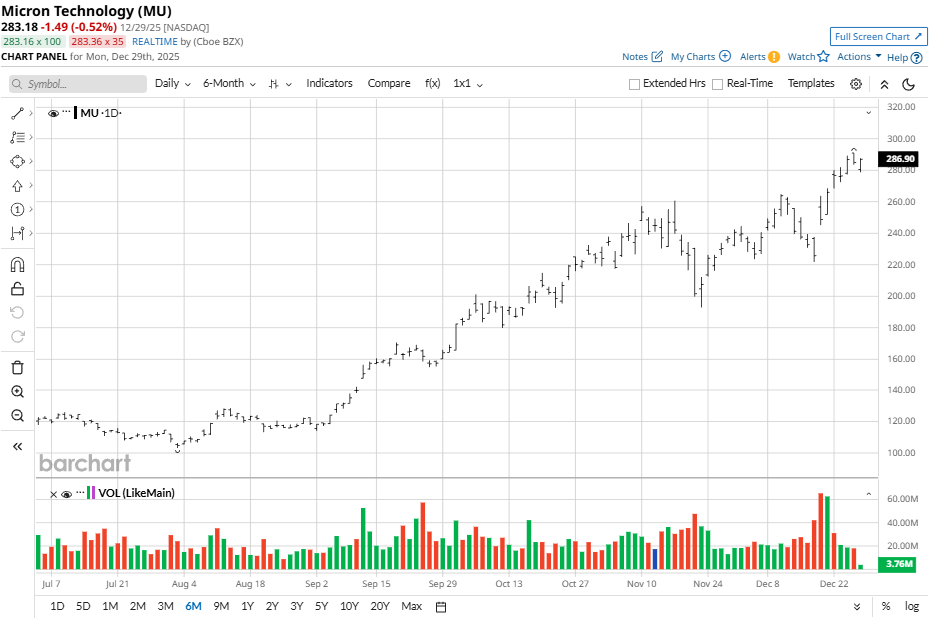

Micron Stock Gains Momentum

Micron Technology trades near its 52‑week high of roughly $298, and well above its low of about $62, reflecting a powerful AI-driven rerating. The stock is up about 4% over five days, roughly 22% over one month, and up more than 70% over three months as investors price in surging DRAM and HBM demand for data centers and AI accelerators.

Over the past year, Micron has returned more than 237%, massively outperforming the S&P 500’s ($SPX) gains. Shares trade well above their 50‑day and 200‑day moving averages, with an elevated beta signaling higher volatility but strong momentum versus the broader index.

Micron Posts Solid Results

Micron Technology delivered record fiscal first-quarter 2026 results on Dec. 17, with the company delivering revenue of $13.64 billion, up 57% year-over-year (YOY) and 21% sequentially, far above prior guidance of $12.2 billion to 12.8 billion and Street estimates near that range. GAAP EPS came in at $4.60 (non‑GAAP $4.78), more than 50% sequential growth and well ahead of consensus in the mid-$3 range, marking Micron’s third consecutive quarter of record earnings as AI memory demand inflects.

Gross margin expanded to about 50%, driven by tighter DRAM supply, higher pricing, and a richer mix of high‑bandwidth and data‑center products. Operating income jumped to roughly $6.14 billion, while operating cash flow reached $8.41 billion. Free cash flow hit a record $3.9 billion despite $4.5 billion of capex.

Cash and investments totaled around $12 billion, leaving Micron with a net cash position even after shareholder returns and aggressive AI‑node investments. All business units like Cloud, Core Data Center, Mobile/Client, and Auto/Embedded, posted double‑digit sequential revenue growth and robust margin gains.

For the ongoing Q2 2026, Micron guided to another step-function jump in performance, with revenue of $18.7 billion, non-GAAP gross margin around 68%, and non-GAAP EPS of roughly $8.40. Management expects strength to continue through fiscal 2026 as AI and data‑centric workloads drive structurally higher memory intensity, positioning Micron for sustained high margins, record free cash flow, and ongoing capacity and R&D investment rather than providing a specific full‑year Q4 point estimate at this stage.

Memory Stock to Rise in 2026?

MU stock looks increasingly compelling as memory pricing power returns heading into 2026. A new report that Samsung and SK Hynix are increasing fifth-generation HBM3E contract prices by nearly 20% for 2026 deliveries confirms that high-bandwidth memory is shifting back into an upcycle, with disciplined supply and AI demand giving vendors renewed leverage. Micron, now a top‑tier HBM and DRAM supplier into AI data centers, is a direct beneficiary of this pricing reset, which bolsters both revenue visibility and margin durability.

How did the market react to this news? Micron shares climbed more than 3% after the report, signaling that investors are starting to re-rate the entire memory complex on a multi‑year AI thesis rather than a short, volatile cycle.

Should You Buy MU Stock?

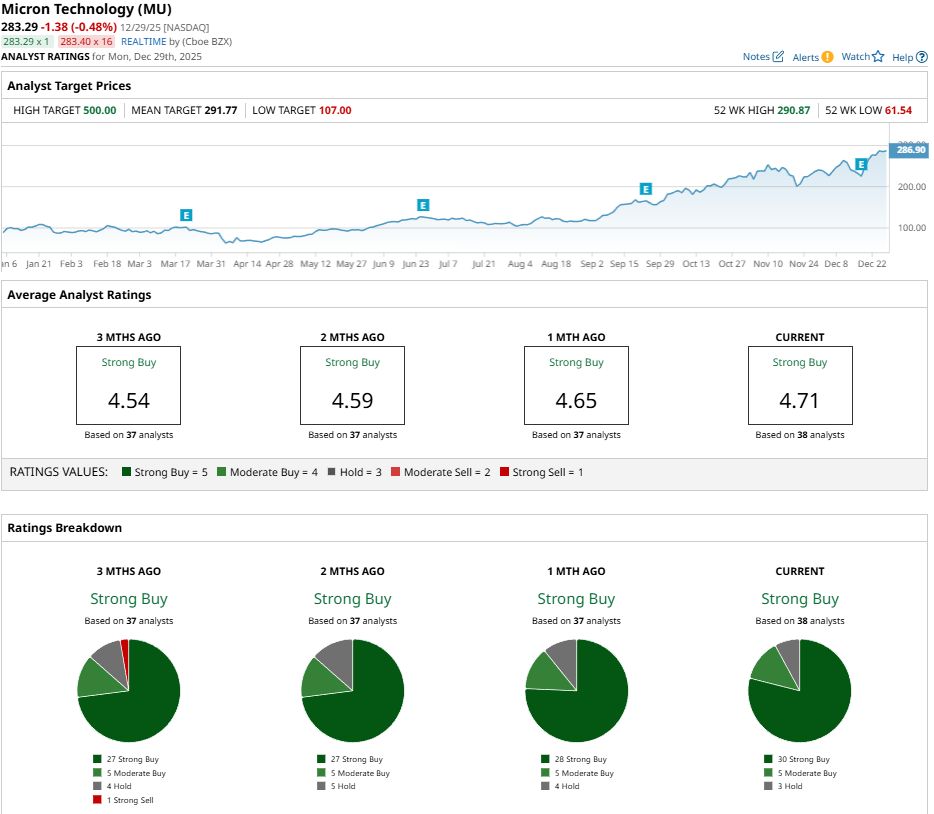

Micron Technology is rallying on the stock market, and the sentiment is shared among analysts with a consensus “Strong Buy” rating and a mean price target of $291.77. That target reflects a slight 2% potential upside from the current market rate.

MU stock has been rated by 38 analysts, receiving 30 “Strong Buy” ratings, five “Moderate Buy” ratings, and three “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)