/Autozone%20Inc_%20big%20rig%20by-%20DakotaSmith%20via%20iStock.jpg)

With a market cap of $60.8 billion, AutoZone, Inc. (AZO) is a leading retailer and distributor of automotive replacement parts and accessories serving customers in the United States, Mexico, and Brazil. It offers a broad range of automotive hard parts, maintenance products, accessories, and related services for various types of vehicles.

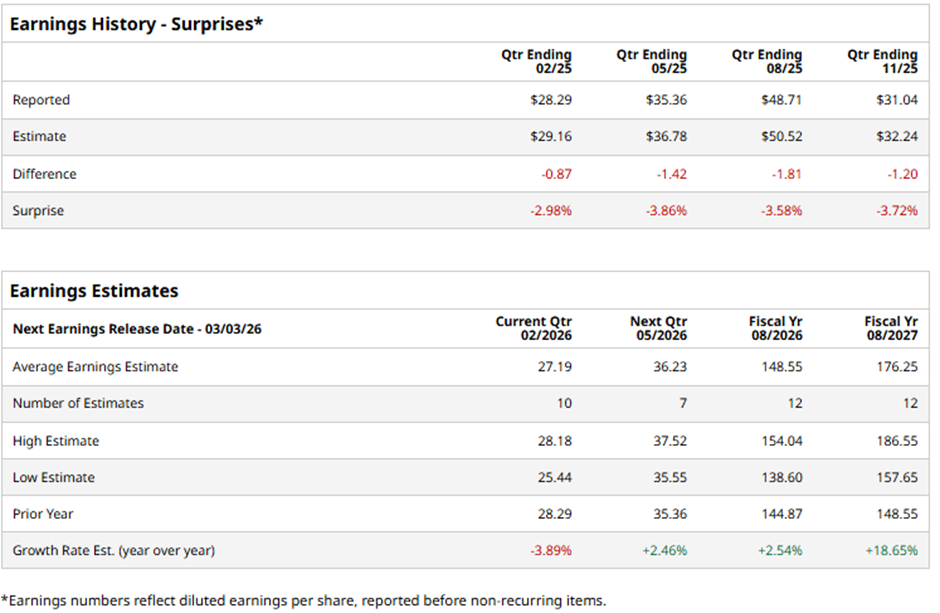

The auto parts retailer is expected to announce its fiscal Q2 2026 results soon. Ahead of this event, analysts expect the company to report a profit of $27.19 per share, down 3.9% from $28.29 per share in the year-ago quarter. It has missed Wall Street's earnings estimates in the last four quarters.

For fiscal 2026, analysts expect the Memphis, Tennessee-based company to report an EPS of $148.55, up 2.5% from $144.87 in fiscal 2025. In addition, EPS is anticipated to grow 18.7% year-over-year to $176.25 in fiscal 2027.

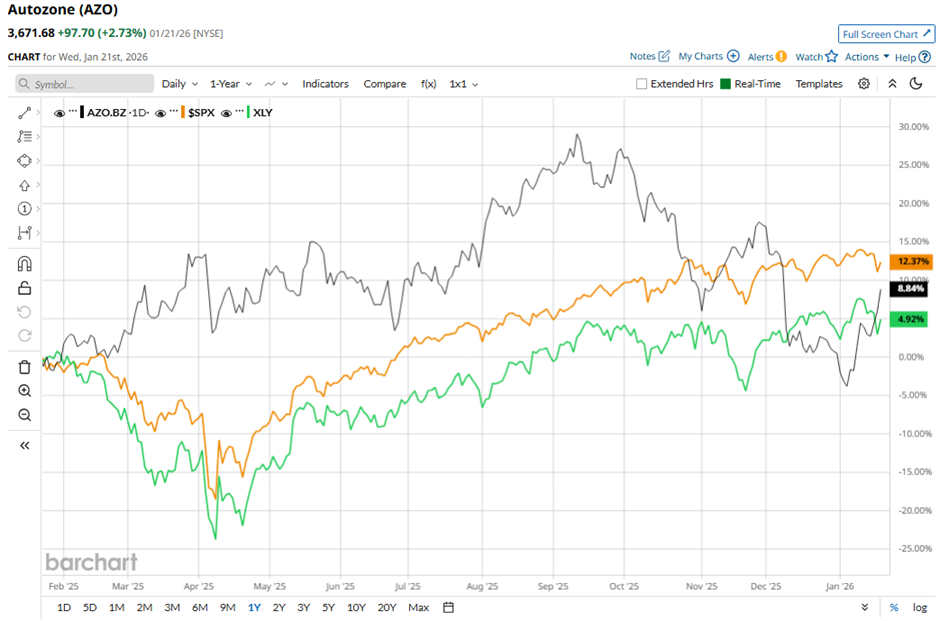

Shares of AZO have risen 11.3% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 13.7% gain. However, the stock has outpaced the State Street Consumer Discretionary Select Sector SPDR ETF's (XLY) 5.2% return over the period.

Shares of AutoZone tumbled 7.2% on Dec. 9 after the company reported Q1 2026 EPS of $31.04 and revenue of $4.63 billion, both below forecasts. Despite an 8.2% increase in net sales and a 4.7% total company same-store sales gain, profitability weakened as operating profit declined 6.8% to $784.2 million and net income fell to $530.8 million. Investors were further concerned by a 203-basis-point drop in gross margin to 51%, driven largely by a 212-basis-point non-cash LIFO impact and higher operating expense leverage tied to growth investments.

Analysts' consensus view on AZO’s stock is bullish, with a "Strong Buy" rating overall. Among 29 analysts covering the stock, 21 recommend "Strong Buy," two suggest "Moderate Buy," and six indicate “Hold.” The average analyst price target for AutoZone is $4,265.35, suggesting a potential upside of 16.2% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)