/Generac%20Holdings%20Inc%20logo%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

Generac Holdings Inc. (GNRC), headquartered in Waukesha, Wisconsin, designs, manufactures, and sells energy technology products worldwide. Founded in 1959, it focuses on backup power for homes, businesses, and factories, including automatic standby generators, portable models, and PWRcell energy storage. The company has a market capitalization of $9.44 billion.

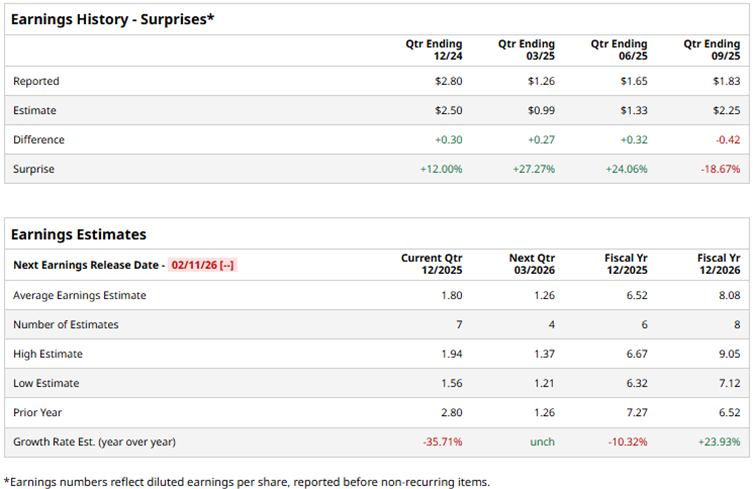

Generac is set to report its fourth-quarter results for fiscal 2025 soon. Ahead of the results, Wall Street analysts expect the company to report a profit of $1.80 per diluted share for Q4, down 35.7% year-over-year (YOY). However, the company has a solid track record of exceeding consensus estimates, topping them in three of the four trailing quarters. For the full fiscal year 2025, Wall Street analysts expect Generac’s diluted EPS to decrease by 10.3% annually to $6.52, followed by a 23.9% YOY improvement to $8.08 in fiscal 2026.

An earnings miss in the third quarter has capped gains. Generac’s stock has gained only marginally over the past 52 weeks and 9.6% over the past six months. On the other hand, the broader S&P 500 Index ($SPX) has increased by 16.9% and 10.8% over the same periods, respectively. Therefore, GNRC has underperformed the broader market over the past year.

Next, we compare the stock’s performance with that of its own sector. The State Street Industrial Select Sector SPDR ETF (XLI) has gained 21.9% over the past 52 weeks and 11% over the past six months. Therefore, Generac has also underperformed its sector over the specified periods.

On Oct. 29, Generac reported its third-quarter results for fiscal 2025, which were subdued and missed analyst expectations. As a result, the stock dropped 8.3% intraday on Oct. 30. The company’s net sales declined by 5% YOY to $1.11 billion, while its adjusted EPS dropped 18.7% from the prior-year period to $1.83.

However, Generac has started this year with a positive development. This month, the company announced that it has acquired a new facility in Sussex, Wisconsin, potentially expanding its manufacturing footprint for its Commercial & Industrial (C&I) products.

Wall Street analysts have been bullish about Generac Holdings’ future. Among the 21 analysts covering the stock, the consensus rating is “Moderate Buy.” The rating configuration is more bullish than it was a month ago, with 14 “Strong Buy” ratings now, up from 11. The ratings are rounded off by one “Moderate Buy” and six “Holds.” The mean price target of $206.29 implies a 28.2% upside from current levels, while the Street-high price target of $236 implies 46.7% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)