/Mastercard%20Incorporated%20card%20logo%20-by%20jbk_photography%20via%20iStock.jpg)

Global payments technology company Mastercard (MA) delivered a solid showing last year, holding up well despite market swings thanks to strong consumer spending, steady innovation, and resilient earnings. As digital payments continued to grow and transaction volumes remained healthy, the company proved it could navigate a choppy market while still delivering reliable performance. However, that momentum has hit a speed bump at the start of 2026.

Mastercard’s stock slid after President Donald Trump proposed a one-year 10% cap on credit-card interest rates in the U.S., sparking a broad sell-off across major banks and card-industry players, including Mastercard. With no clear details yet on how the cap would be enforced, uncertainty has taken hold, and banking industry experts are warning that the move could bring unintended consequences for consumers and the wider U.S. economy.

While the proposal is designed to ease the burden on consumers, investors fear it could seriously pressure the profitability of card companies. Banks and analysts argue that such a cap would make large parts of the credit-card business unprofitable, especially for customers with weaker credit profiles. So, with MA shares now under pressure from this latest development, is this pullback a smart buying opportunity, or a sign to stay cautious?

About Mastercard Stock

Founded in 1966, New York-based Mastercard is a global payments technology company that operates one of the world’s largest payment networks, connecting consumers, businesses, banks, and governments across more than 210 countries and territories. Rather than issuing cards or lending money, Mastercard provides the technology that powers secure digital payments, enabling everything from everyday purchases to large cross-border transactions while helping keep the global economy moving.

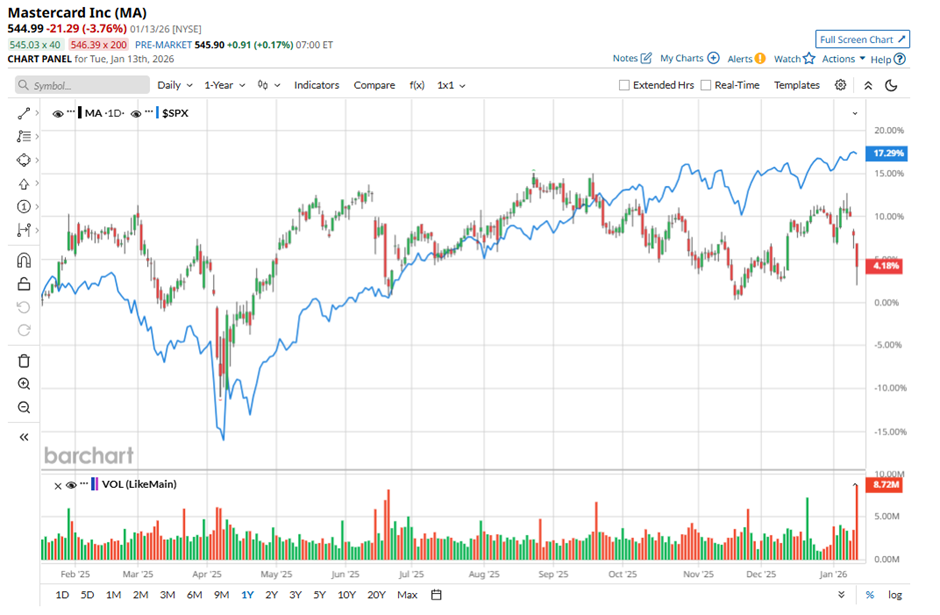

In addition to handling payments, it delivers fraud protection, data analytics, and modern digital solutions that help make buying and selling easier and more accessible for everyone. With a towering market capitalization of about $484.86 billion, payment powerhouse Mastercard delivered a decent performance in 2025, with its shares climbing roughly 8%, edging out rival Visa (V), which gained about 6.8% over the same period.

The stock’s steady advance reflected strong fundamentals and continued momentum in global digital payments. But now, that confidence has been shaken in recent days. Ever since President Trump unveiled plans to impose a one-year 10% cap on credit-card interest rates, Mastercard shares have come under pressure, sliding nearly 6.3% over the past five days.

The pullback has left the stock trailing the broader S&P 500 Index ($SPX), which showed a -0.38% drop over the same stretch, highlighting just how sharply investors are reacting to the growing regulatory uncertainty.

A Closer Look at Mastercard’s Q3 Performance

Mastercard delivered a strong set of results in its fiscal 2025 third-quarter earnings report, released in October, beating Wall Street’s expectations and highlighting the company’s continued momentum. Net revenue climbed 17% year-over-year (YOY) to $8.6 billion, topping analysts’ estimate of $8.5 billion. Management credited the impressive top-line growth to healthy consumer and business spending and the continued strength of Mastercard’s differentiated services portfolio.

Looking deeper, payment networks net revenue rose 12%, driven by solid underlying trends, including 9% growth in gross dollar volume, 15% growth in cross-border volume, and a 10% increase in switched transactions. Even more impressive was the performance of Mastercard’s value-added services and solutions, where net revenue surged 25%, or 22% on a currency-neutral basis.

This included a three percentage point boost from acquisitions, with the remaining growth fueled by expanding demand for security, digital and authentication solutions, consumer acquisition and engagement services, business and market insights, and pricing.

By Sept. 30, 2025, Mastercard customers had issued 3.6 billion Mastercard and Maestro-branded cards worldwide, underscoring the company’s massive global footprint. Profitability also improved meaningfully, with adjusted EPS rising 13% YOY to $4.38, beating the consensus estimate of $4.31. Operating income jumped 26%, while operating margin expanded to 58.8%, up from 54.3% in the year-ago quarter.

Shareholder returns remained a major focus. During the quarter, Mastercard repurchased 5.8 million shares for $3.3 billion and paid out $687 million in dividends. In a December press release, the company also announced a 14% increase in its quarterly dividend, raising it to $0.87 per share, and approved a $14 billion share-repurchase program, further highlighting its strong financial position and commitment to rewarding shareholders.

How Are Analysts Viewing Mastercard Stock?

TD Cowen recently reaffirmed its confidence in Mastercard, raising its price target to $668 from $654 and keeping a “Buy” rating on the payments powerhouse. The firm highlighted steady, broad-based consumer spending that continues to support Mastercard’s growth, even as global markets wrestle with geopolitical tensions and macroeconomic uncertainty. While the firm noted a modest foreign-exchange headwind during the quarter, it said earnings expectations remain well calibrated ahead of the upcoming report, which is set to be released later this month.

Additionally, it weighed in on key industry issues, including the pending merchant litigation settlement, and addressed investor concerns around President Trump’s proposed 10% cap on credit-card interest rates. Importantly, TD Cowen noted that the cap would not directly affect Mastercard, since the company earns assessment and transaction fees, not interest, underscoring why the firm believes the long-term investment case remains intact.

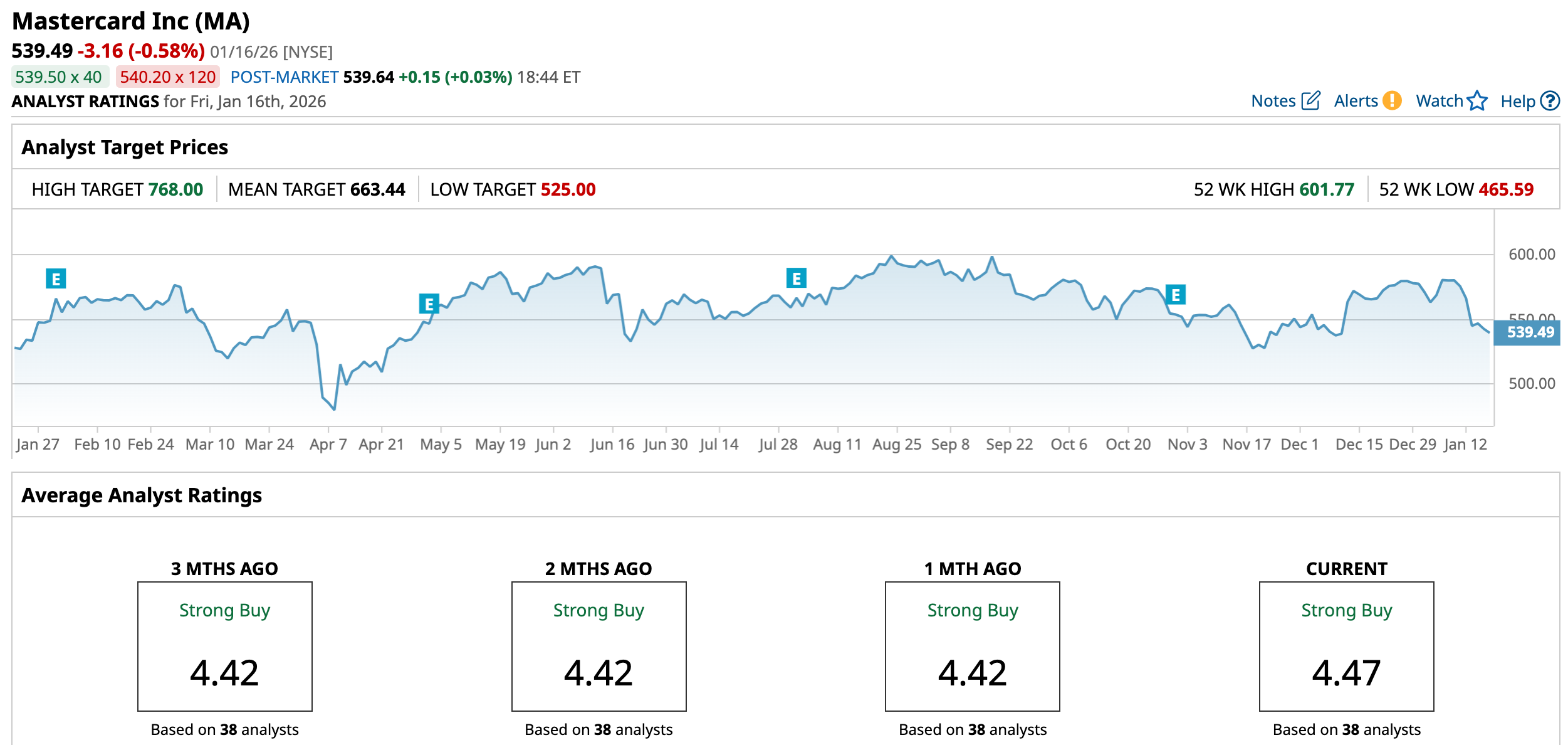

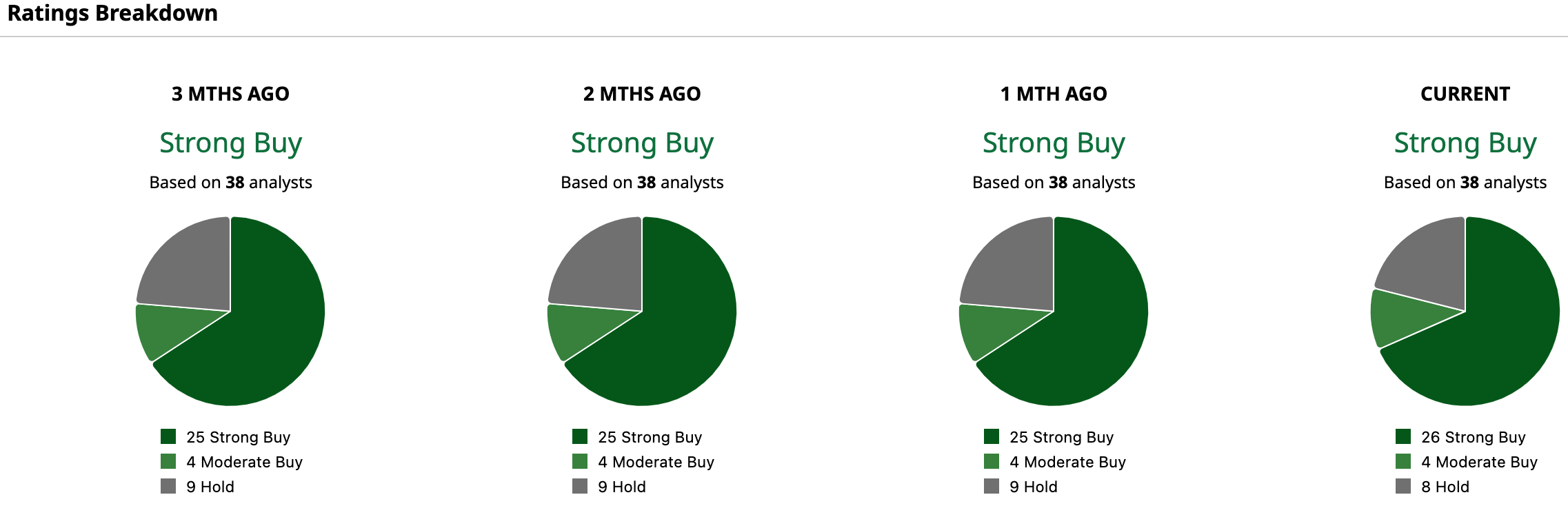

Even amid the recent turbulence, Wall Street’s confidence in Mastercard remains strikingly strong. The stock carries a powerful “Strong Buy” consensus, with 26 of 38 analysts pounding the table with “Strong Buy” ratings, four calling it a “Moderate Buy,” and just eight sitting on the fence with “Hold” recommendations.

The Street’s average price target of $663.44 implies a healthy 22.98% upside, while the most bullish forecast of $768 suggests Mastercard could surge by nearly 42.36% from current levels, signaling that many analysts see this pullback as an opportunity, not a warning sign.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)