The market shows renewed appetite for risk, as Bitcoin (BTCUSD) climbed above $95,000 and reached $97,000 this week. After a period of underperformance, cryptocurrencies are once again on the rise. This rally has coincided with cooling U.S. inflation signals, stable employment figures, and strong inflows into crypto ETFs.

Bitcoin treasury and analytics company MicroStrategy, now operating as Strategy (MSTR), is pouring money into the cryptocurrency, showing robust optimism in digital assets. In fact, MSTR CEO Michael Saylor expects Bitcoin prices to reach $1 million by 2029.

At this juncture, should you buy, sell, or hold MSTR stock?

About Strategy Stock

Headquartered in Tysons Corner, Virginia, Strategy is the world's first and largest Bitcoin treasury company. Originally focused on enterprise analytics software since its 1989 founding, the company strategically pivoted to adopt Bitcoin as its primary treasury reserve asset, building substantial holdings.

This shift positions Strategy to offer investors exposure to Bitcoin through a range of securities while advancing analytics innovation. The company has a market capitalization of $49.1 billion.

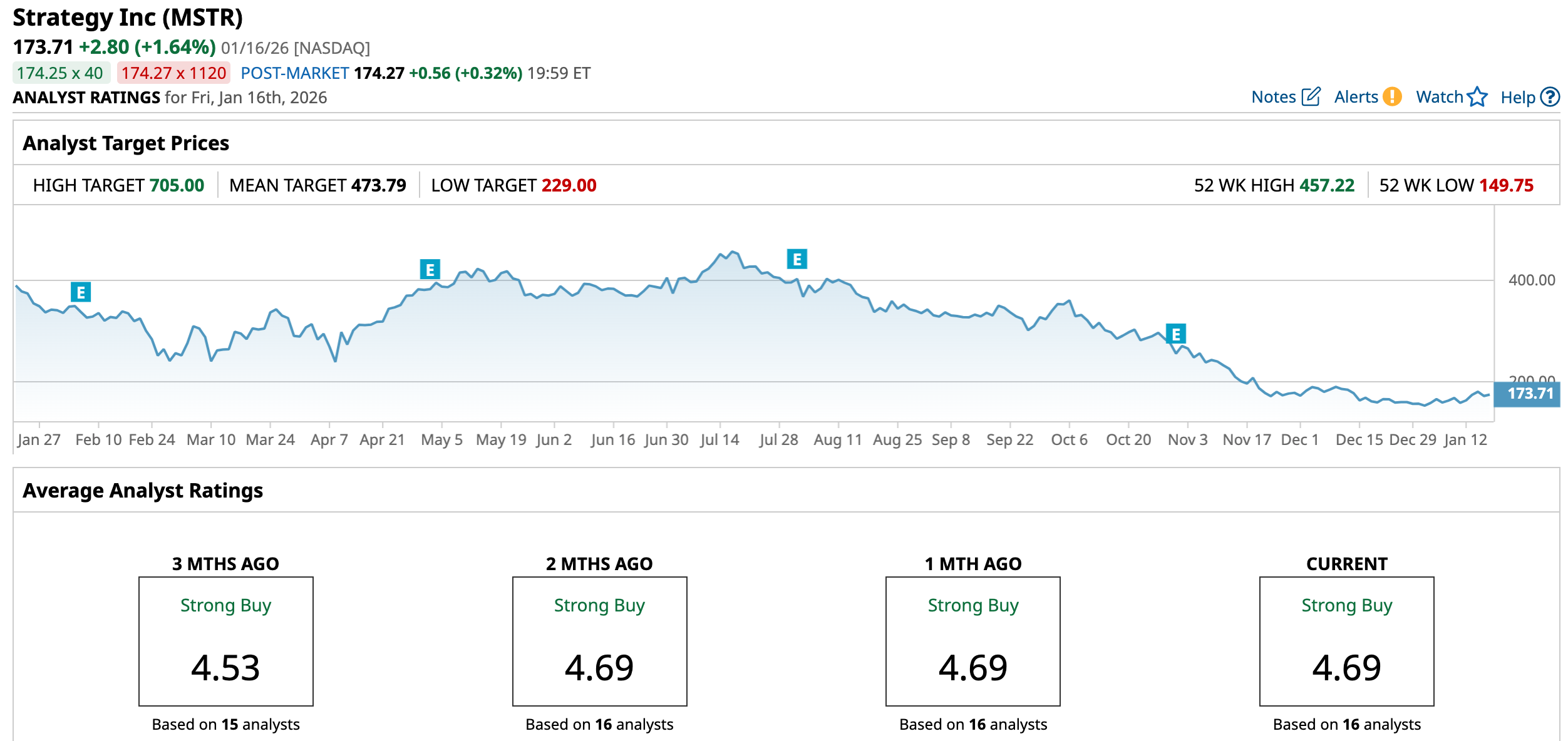

As Bitcoin was going through a tough period, Strategy’s stock also felt its impact. Over the past 52 weeks, the stock has declined 52.67%, and over the past six months, 61.9%. Just for comparison, the broader S&P 500 Index ($SPX) has increased by 16.89% and 10.8% over the same periods, respectively.

It had reached a 52-week high of $457.22 in July 2025, but is down 62% from that level. However, as Bitcoin has resurged following the “crypto winter,” the stock has gained 10.4% over the past five days. It is up by 16% from its 52-week low of $149.75 reached on Jan. 2, 2026.

MSTR’s stock is trading at a discount to its peers. Its price-to-earnings ratio of 6.25x is considerably lower than the industry average of 32.73x.

Strategy’s Q3 Top Line Was Better Than Expected

On Oct. 30, Strategy reported its third-quarter results for fiscal 2025. The company’s total revenue increased 10.9% year-over-year (YOY) to $128.69 million, exceeding Wall Street analysts’ estimate of $117.10 million. This was based on Strategy’s total product licenses and subscription services revenue, which grew 62.9% annually to $63.35 million.

Strategy's income from operations surged, turning a $432.58 million loss in Q3 2024 into a $3.89 billion profit in Q3 2025, which included an unrealized gain on the company’s digital assets of $3.90 billion. Its bottom line shifted from a $1.72 loss per share to an $8.42 EPS.

Following its results, the company announced it had established a U.S. dollar reserve of $1.44 billion. The reserve would be used to pay the dividends of its preferred stock and interest on its outstanding indebtedness. It was funded by the proceeds of a sale of Class A common stock.

Wall Street analysts have a tepid view about Strategy’s bottom line trajectory. For the fourth quarter, its loss per share is expected to increase significantly YOY to $18.06. For fiscal 2025, its loss per share is also expected to grow considerably YOY to $30.86. However, loss per share for fiscal 2026 is projected to decrease by 32.4% annually to $20.87.

What Do Analysts Think About Strategy’s Stock?

Last month, Citi analyst Peter Christiansen reiterated a “Buy” rating on the stock but lowered the price target from $485 to $325. The analyst noted that the price target was reduced due to the firm’s updated outlook on digital asset valuation. However, Christiansen expects legislative reforms to serve as a catalyst for the stock’s growth heading into 2026.

In the same month, analysts at Bernstein lowered the firm’s price target from $600 to $450, while maintaining an “Outperform” rating on the stock. Yet, analysts maintained that concerns about Strategy’s financial stability were overstated. Bernstein experts believe that the company is rapidly transforming into a Bitcoin-reserved financial operating business that can offer fixed-income yields and savings products to investors.

Cantor Fitzgerald analysts lowered the stock’s price target from $560 to $229 but maintained a bullish “Overweight” rating. Analysts cited a recalculation of the company’s Bitcoin holdings as the reason for this reduction, but they maintain a long-term bullish view on Bitcoin and remain optimistic about MSTR.

In November, analysts at Monness, Crespi, Hardt upgraded the stock from “Sell” to “Neutral.” The analysts cited a lower premium relative to MSTR’s Bitcoin holdings and reduced downside risk.

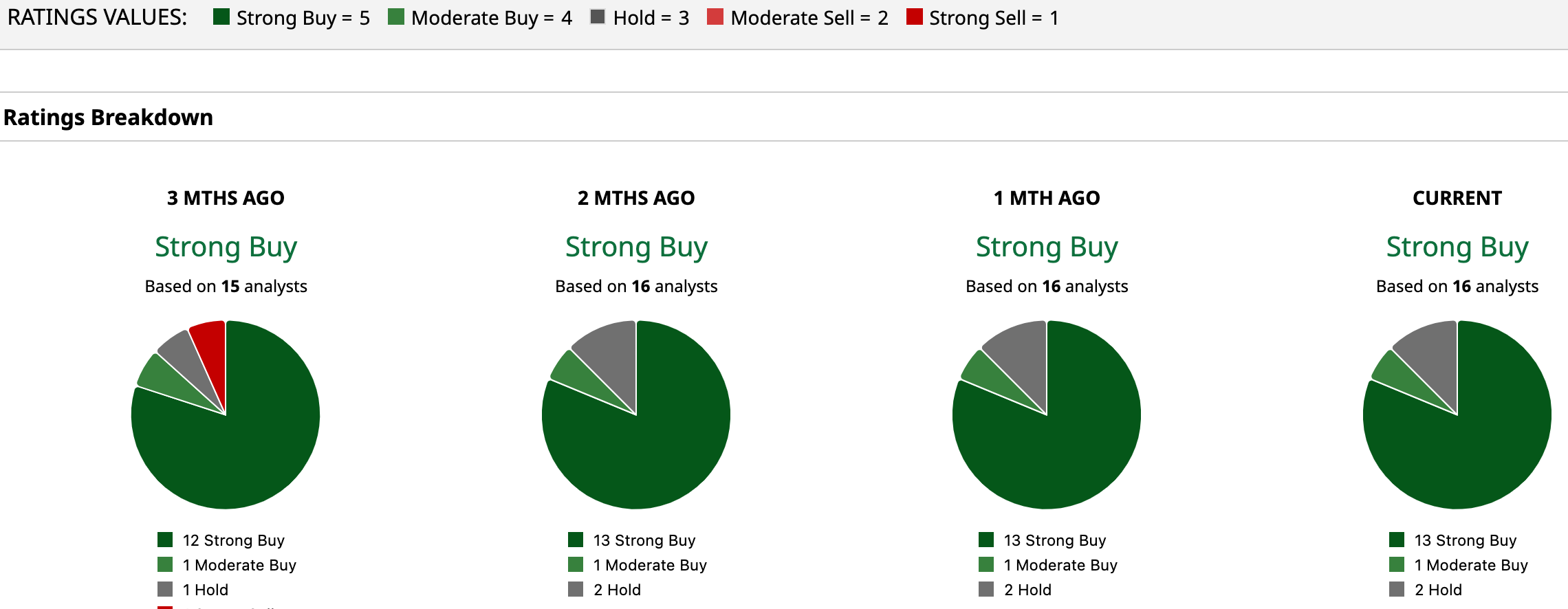

MSTR has become a popular stock on Wall Street, with analysts awarding it a consensus “Strong Buy” rating. Of the 16 analysts rating the stock, a majority of 13 analysts have rated it a “Strong Buy,” one analyst suggests a “Moderate Buy,” while two analysts are playing it safe with a “Hold” rating. The consensus price target of $473.79 represents a 172.8% upside from current levels. The Street-high price target of $705 indicates a 305.9% upside.

Key Takeaways

The fate of Strategy largely depends on the volatility of Bitcoin, a volatile asset. The stock faces downside risk, especially if crypto enters a prolonged downturn. However, analysts remain bullish on the stock, expecting significant upside. Therefore, investors may wish to consider it in hopes of significant gains.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)