With a market cap of $102.3 billion, Automatic Data Processing, Inc. (ADP) is a global provider of cloud-based human capital management (HCM) and business outsourcing solutions that help organizations manage their workforce efficiently. Its core services include payroll processing, tax and compliance administration, benefits and retirement plan management, time and attendance tracking, talent and performance management, and HR outsourcing offerings.

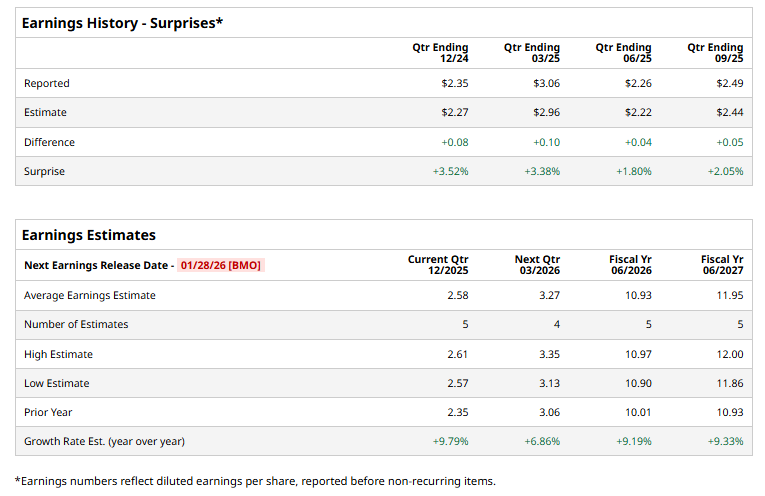

The HCM giant is set to announce its second-quarter results before the markets open on Wednesday, Jan. 28. Ahead of the event, analysts expect ADP to deliver an adjusted profit of $2.58 per share, up 9.8% from $2.35 per share reported in the year-ago quarter. The company has a robust earnings surprise history and has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For FY2026, ADP’s adjusted EPS is expected to come in at $10.93, up 9.2% from $10.01 reported in 2025. In fiscal 2027, its earnings are expected to further surge 9.3% year over year to $11.95 per share.

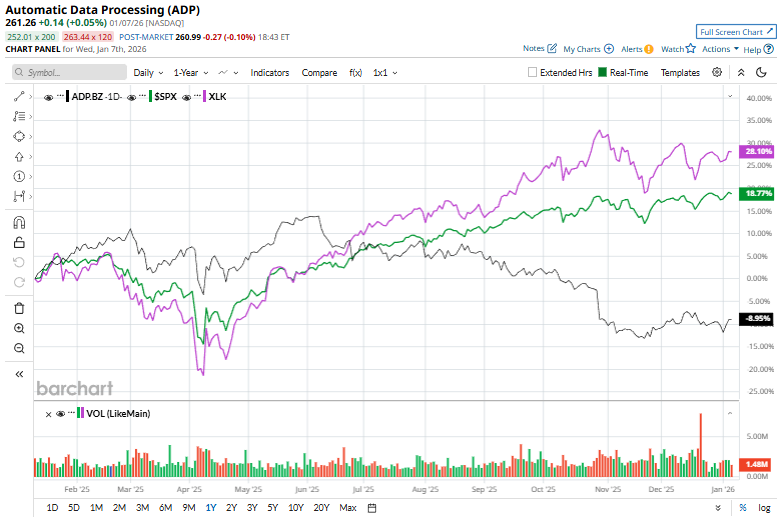

ADP stock prices have dipped 9.4% over the past 52 weeks, notably underperforming the Technology Select Sector SPDR Fund’s (XLK) 25.3% surge and the S&P 500 Index’s ($SPX) 17.1% returns during the same time frame.

Automatic Data Processing has lagged the broader market primarily due to its defensive, slower-growth profile in a period when investors have favored higher-beta, faster-growing technology and AI-linked stocks. While ADP delivers consistent earnings and cash flows, its revenue and EPS growth tend to be steady rather than accelerating, limiting upside during risk-on market phases.

As a result, analysts remain cautious about the stock’s prospects. ADP maintains an overall consensus “Hold” rating. Of the 17 analysts covering the stock, opinions include two “Strong Buys,” 13 “Holds,” one “Moderate Sell,” and one “Strong Sell.” Its mean price target of $290.93 suggests an 11.4% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)