The first ETF, the S&P 500 SPDR (SPY) debuted way back in 1993. More than 4,000 products later, the ETF industry is pumping new funds out at a rapid rate. As with any business, there are some which rise to the top and others that never get traction.

Sometimes, it's just a matter of exposure. And other times, it is due to exposure. No, that’s not a misprint. I wrote “exposure” twice.

Some ETFs never get visibility because they are issued by smaller firms with light marketing budgets. They can’t compete head to head with deep-pocketed competitors. And in today’s digital economy, getting seen is more than half the battle for ETFs.

Other times, it is a matter of the exposure within an ETF’s portfolio. Back in 2010 or so, after the Global Financial Crisis, funds that protected well on the downside were in heavy demand. Yet by the time many came to market, investors had already moved on to the next bull market opportunity.

So the unique traits of those ETFs that helped them battle the bear were ignored. Exposure to hedging mechanisms and “tail risk” features was the wrong type of exposure at the wrong time. In that sense, where assets under management pays the bills for ETF firms, timing is everything.

However, not all ETFs have had to close up shop due to being out of sync with a market cycle for too long. Many funds with more than 20-year track records are still small, but could be setting up for a big 2026.

Here are three I picked out. Even if few notice these, you just did. So keep these in mind entering the new year. You might just have the old first-mover advantage with these, given how off the radar they are versus most ETFs.

3 ‘Old’ ETFs to Watch for 2026

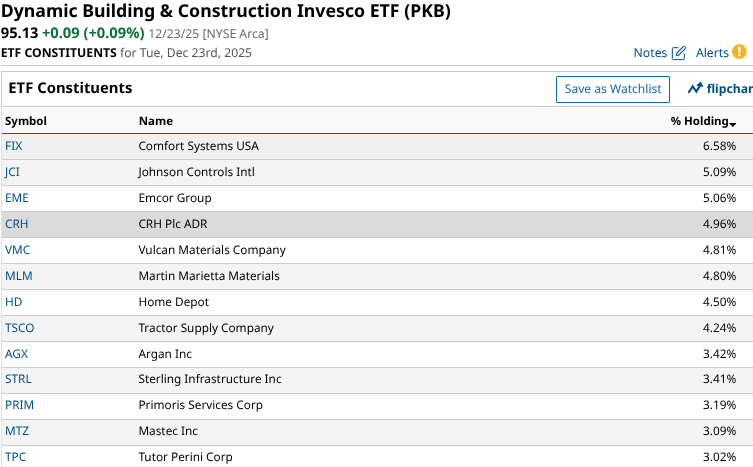

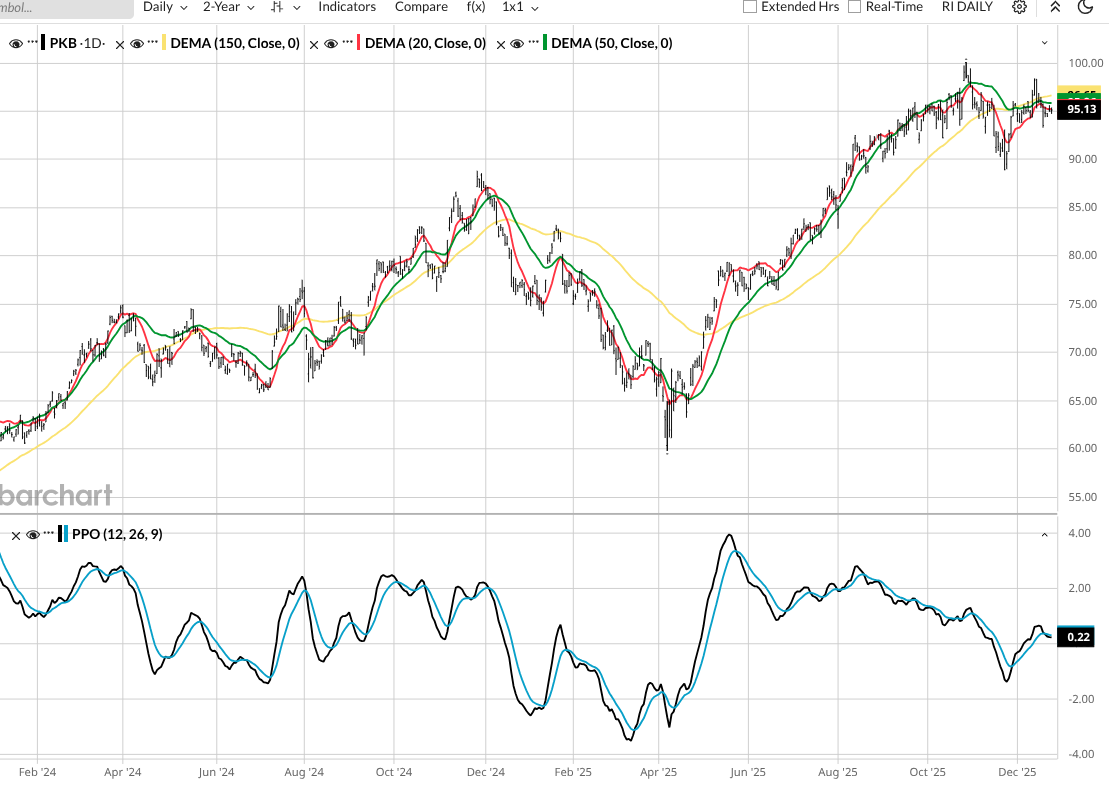

Invesco Dynamic Building & Construction ETF (PKB) starts this trio. The jury’s still out on the direction of long-term interest rates. But if it turns out to be lower, the knee-jerk reaction has typically been to favor companies in this sector.

And for those keen to the idea of buying stocks which are large-cap but not the very biggest, since that cohort had lagged the S&P 500 Index ($SPX) for a while, this might be a place to look. There are only a couple of household names here.

PKB has stagnated after a nice run with the broad market after April’s low. Keep your eye on this rate-sensitive ETF, which debuted more than 20 years ago.

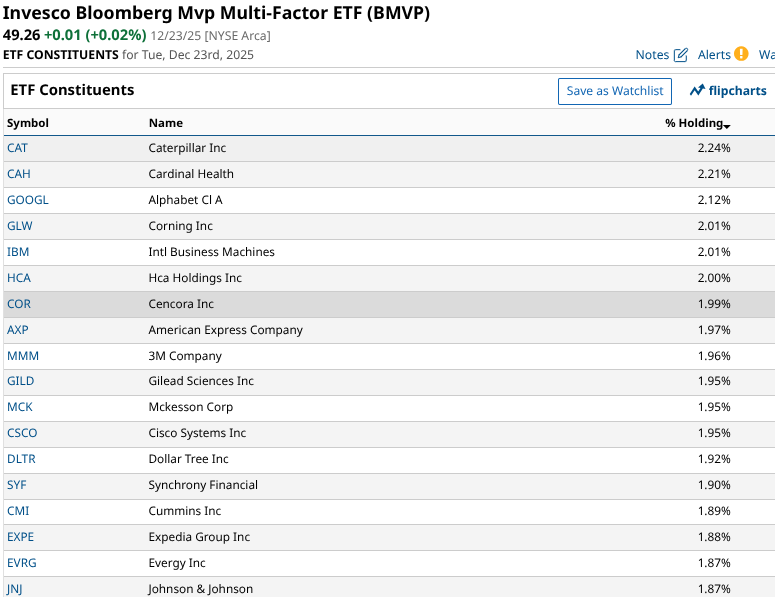

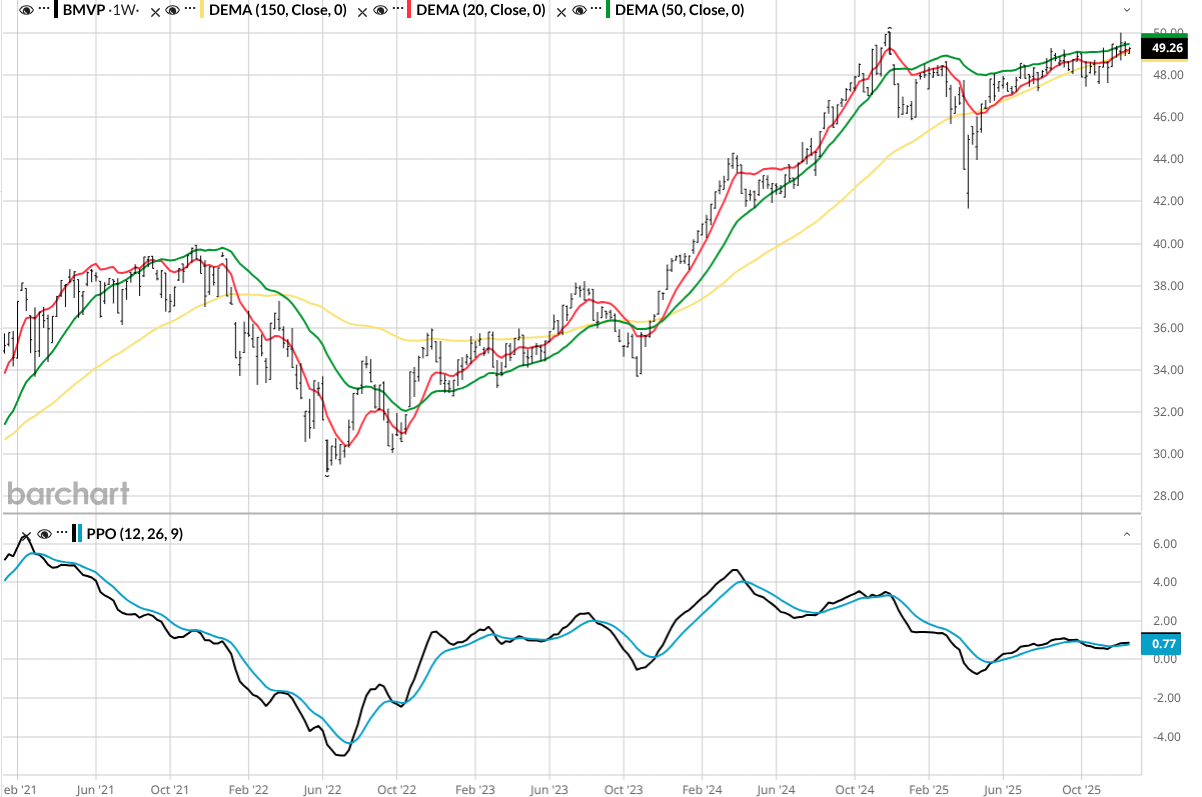

If markets were rational, the Invesco Bloomberg Mvp Multi-Factor ETF (BMVP) would probably be a much more well-known ETF, after more than 20 years in operation. This is run by the outstanding equity analyst group at Bloomberg, whose leader, Gina Martin Adams, was a podcast guest of mine earlier this year. This is one sharp group, but when the stock market prefers AI to, well, everything, including value stocks, high-quality names, and other “classic” factors, the performance will not stand out enough to attract more than the $100 million or so in assets this one has. Here are some BMVP’s top holdings.

This last under-the-radar, long-tenured ETF does not have a long list of stock holdings. In fact, no stock holdings at all. The Japanese Yen Trust CurrencyShares (FXY) is dedicated to tracking the value of the Japanese yen. Currency ETFs like this one have garnered only limited appeal over time.

However, the U.S. dollar ($DXY) is showing signs of fatigue, if not downright danger, as we head into 2026. Japan’s bond yields have rallied to more than 2% for the first time in many years. So in a dollar destruction scenario, FXY could return to the spotlight.

As always, headline-tracking is fun, and momentum investing can be profitable during bull markets. However, if 2026 turns out to be a different part of the cycle, we might need to turn back to veteran hands.

In the case of these 3 veteran ETFs, and others like them, these oldies could become goodies.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.