(UNG) (BOIL) (KOLD) (NGF26) (NFF26) (TGF26)

“How a near record late December negative NAO index helped natural gas prices bottom for now”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Edited by Scott Mathews

- December 26, 2025

To View Video > > > > > PLEASE CLICK HERE

The video above addresses these points:

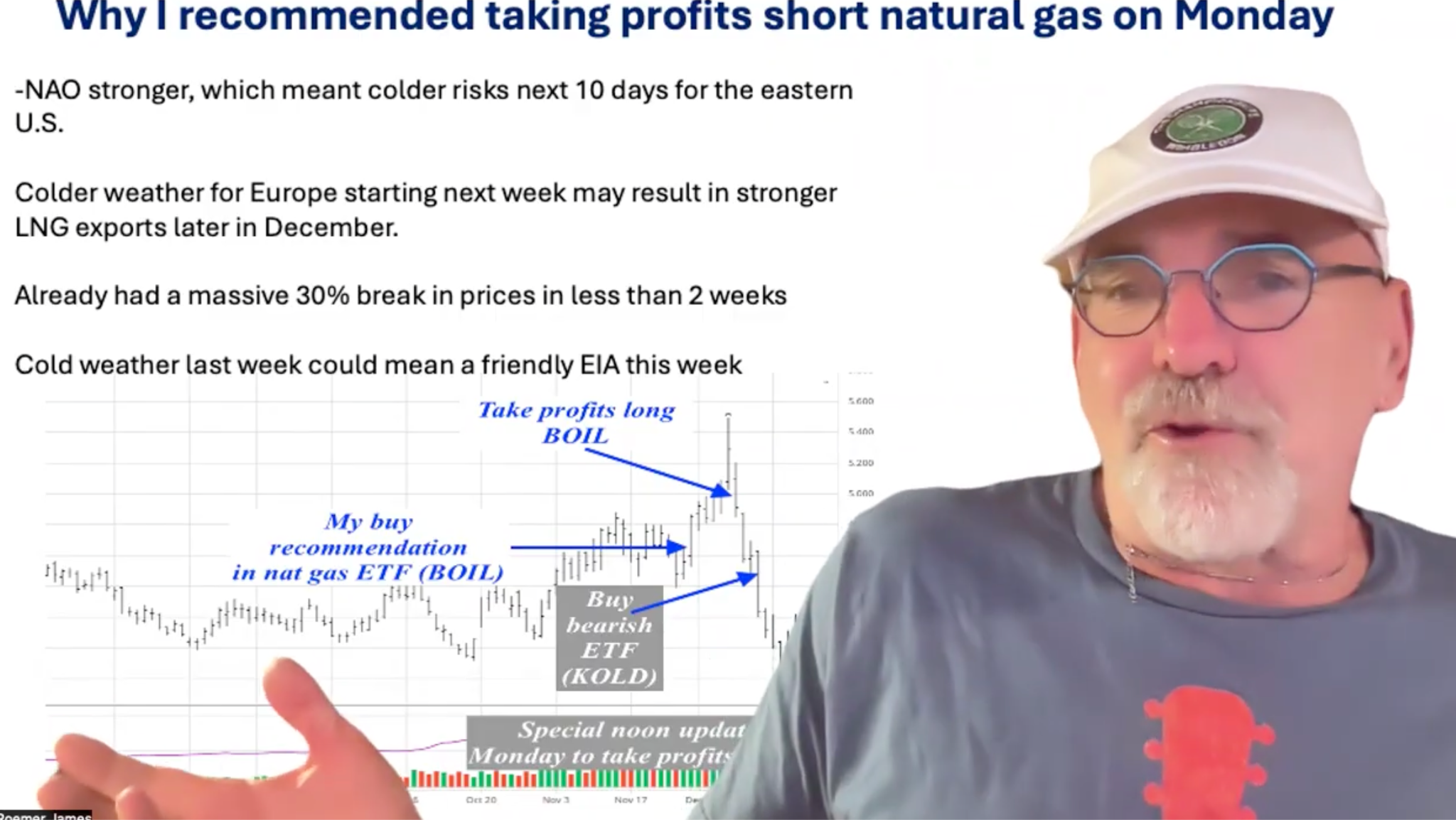

1) How a warm late December and early January outlook for key natural gas demand areas was thwarted by a negative NAO index near Greenland;

2 ) Why I recommended to clients (near the low in natural gas prices) to cover recently recommended short positions; and

3) Actual trading strategies presented to our WeatherWealth subscribers. These include coffee, natural gas and silver (all winners in recent months).

Please feel free to request a 2-week free trial period to WeatherWealth by clicking here

One trade alone…

(such as catching the 30% break in natural gas prices prior to this recent rally,

or jumping on the silver rally early, or the bearish soybean trend for weeks)…

is enough to pay for a subscription for several years in a matter of weeks.

(Past performance is not indicative of future results)

Remember when trading commodities, always use risk management, such as stop-loss orders and position sizing, and consider using spreads to isolate the seasonal component of a particular market move.

Also, you can sign up for FREE reports about many commodities and the weather’s impact here:

https://weatherwealth.substack.com/.

Thanks For Your Interest In Commodity Weather Intelligence !!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)