/NVR%20Inc_%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

NVR, Inc. (NVR) ranks among the premier U.S. homebuilders, excelling in the design, construction, and marketing of single-family detached homes, townhomes, and condominiums, predominantly through a pre-sold delivery model.

Operating nationwide under distinct brands like Ryan Homes and NVHomes, the company emphasizes streamlined operations, economies of scale, and exceptional customer satisfaction to drive growth. Headquartered in Reston, Virginia and with a market capitalization of $21 billion, NVR maintains a disciplined approach to land acquisition and inventory management.

NVR is set to report its fourth-quarter results for fiscal 2025 soon. Ahead of the results, Wall Street analysts are not optimistic about the company’s bottom-line trajectory.

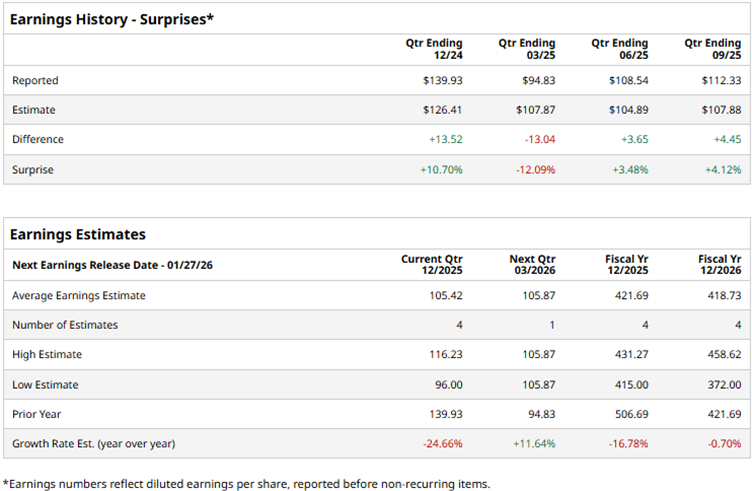

For the quarter about to be reported, analysts expect NVR’s profit to decline by 24.7% year-over-year (YOY) to $105.42 per diluted share. For the current fiscal year, profit is projected to decrease 16.8% annually to $421.69 per diluted share. It should also be noted that the company has a solid track record of beating consensus estimates in three of the past four quarters.

The company’s stock has dropped 10.8% over the past 52 weeks and has declined slightly over the past six months, amid margins squeezed by higher lot costs and pricing pressure from affordability challenges. On the other hand, the S&P 500 Index ($SPX) has gained 15.7% and 14.7% over the same periods, indicating that the stock is underperforming the broader market.

NVR’s business nature categorizes it as a consumer cyclical company. Compared with the Consumer Discretionary Select Sector SPDR Fund (XLY), the stock has also underperformed its sector, with the ETF gaining 6.6% over the past 52 weeks and 14% over the past six months.

On Oct. 22, NVR reported its third-quarter results for the current year. The company’s homebuilding revenue decreased by 4.4% YOY to $2.56 billion. The homebuilding segment was impacted by cancellations, with the Q3 2025 cancellation rate at 19%, up from 15% in Q3 2024. The company’s EPS for the quarter was $112.33, down 13.9% YOY but above the expected $107.88. NVR’s stock dropped 1.2% intraday on Oct. 22.

Wall Street analysts are tepid on NVR’s stock, assigning it a consensus “Hold” rating, based on eight analyst ratings. The ratings configuration is more bullish than it was a month ago, with two “Strong Buy” ratings now, up from one. The ratings are completed by five “Holds” and one “Strong Sell.”

The mean price target of $8,683 implies an 18.3% upside from current levels, while the Street-high price target of $9,300 implies a 26.7% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)