With a market cap of $8.3 billion, Alexandria Real Estate Equities, Inc. (ARE) is a best-in-class, mission-driven life science REIT company making a positive and lasting impact on the world. It is the preeminent owner, operator, and developer of collaborative Megacampus ecosystems in leading AAA life science innovation clusters across the United States.

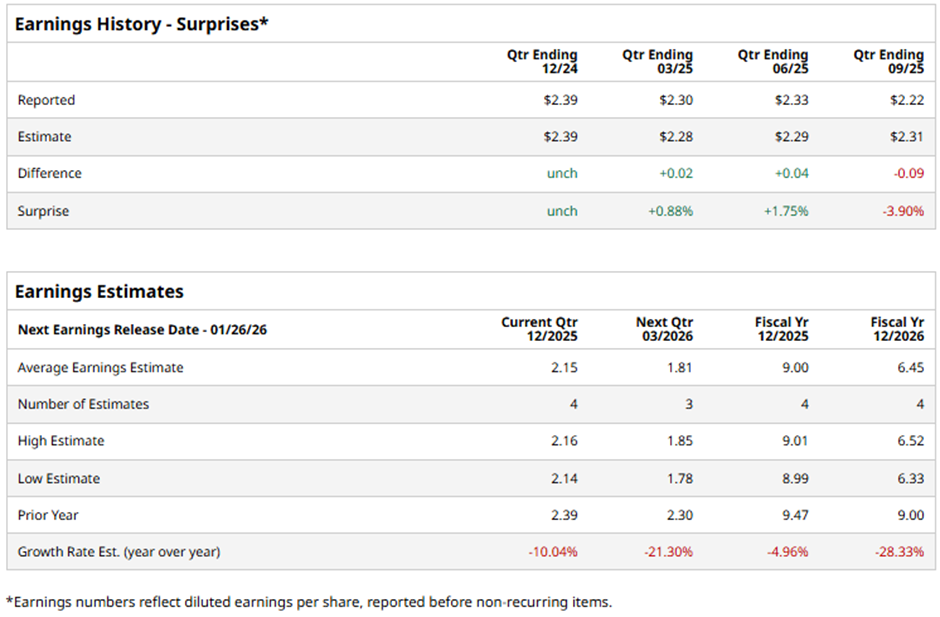

The Pasadena, California-based company is expected to release its fiscal Q4 2025 results after the market closes on Monday, Jan. 26. Ahead of this event, analysts project ARE to report an AFFO of $2.15 per share, reflecting a decrease of 10% from $2.39 per share in the year-ago quarter. It surpassed or met Wall Street's bottom-line estimates in three of the last four quarterly reports while missing on another occasion.

For fiscal 2025, analysts forecast the life science real estate company to report AFFO of $9 per share, down nearly 5% from $9.47 per share in fiscal 2024.

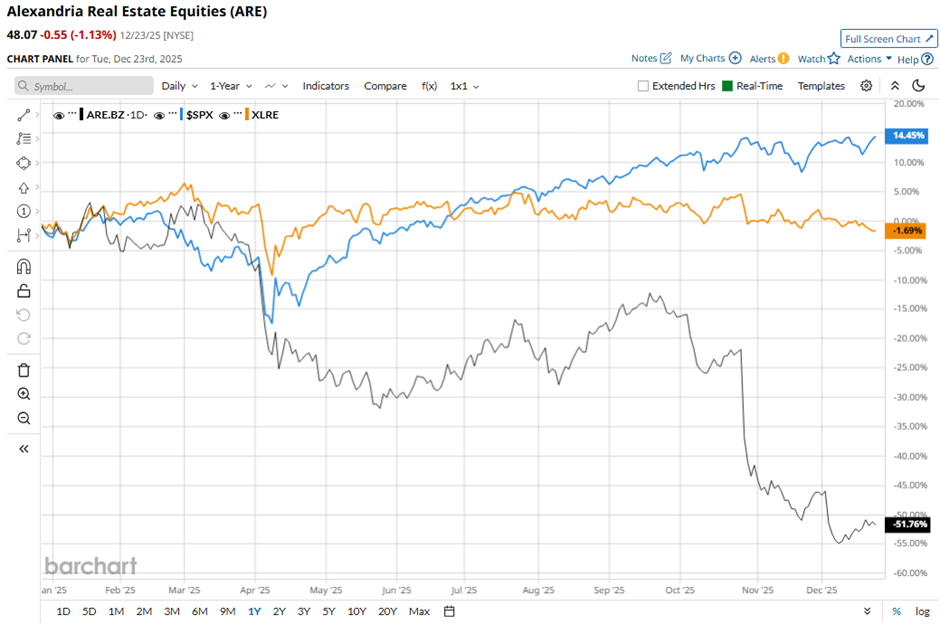

ARE stock has fallen 51.4% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 15.7% increase and the State Street Real Estate Select Sector SPDR ETF's (XLRE) marginal decline over the same time frame.

Shares of Alexandria Real Estate tumbled 19.2% following its Q3 2025 results on Oct. 27, with AFFO of $2.22 per share and revenue of $751.9 million, both came in below forecasts. Investor sentiment was further hurt by a reported net loss of $234.9 million, or $1.38 per share, driven largely by a massive $323.9 million real estate impairment in the quarter. In addition, the company cut its 2025 outlook, lowering the midpoint of adjusted FFO guidance to $9.01 per share due to slower leasing demand and delayed asset dispositions.

Analysts' consensus view on ARE stock is cautious, with a "Hold" rating overall. Among 15 analysts covering the stock, four suggest a "Strong Buy," nine give a "Hold," and two have a "Strong Sell." This configuration is less bullish than three months ago, with six analysts suggesting a "Strong Buy."

The average analyst price target for Alexandria Real Estate Equities is $58.75, indicating a potential upside of 22.2% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)