Mid-America Apartment Communities, Inc. (MAA) is a real estate investment trust (REIT) that owns, manages, acquires, develops and redevelops multifamily apartment communities primarily across the Southeastern, Southwestern and Mid-Atlantic United States, focusing on delivering long-term, risk-adjusted returns for shareholders. MAA is headquartered in Germantown, Tennessee, and has a market cap of $16.3 billion.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Mid-America Apartment Communities fits this criterion perfectly, signifying its substantial size, stability, and influence in the residential REIT industry. The company is a prominent and established residential REIT operating with a clear, successful strategy focused on high-growth regional markets.

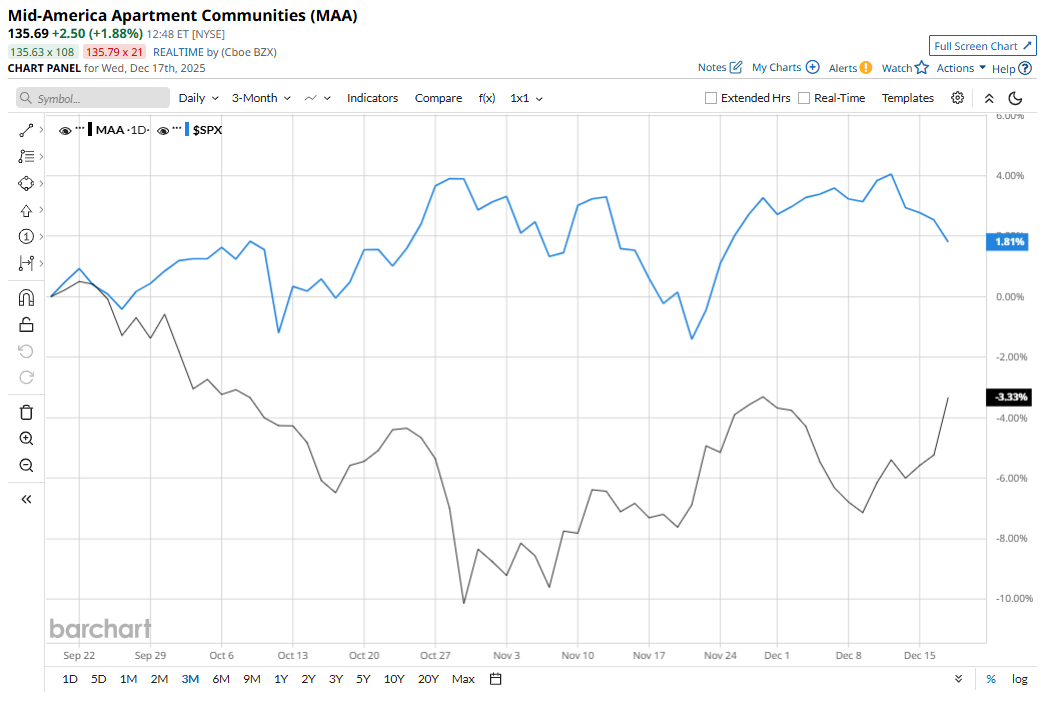

The stock is trading 22.2% below its 52-week high of $173.38, which it hit on March 4. MAA has declined 3.4% over the past three months, underperforming the S&P 500 Index’s ($SPX) 2.1% gains during the same time frame.

In the longer term, MAA is down 12.2% on a YTD basis and 13% over the past 52 weeks. In comparison, SPX surged 14.6% in 2025 and has climbed 11.4% over the past year.

The stock has been largely trading below the 50-day and 200-day moving averages since mid-May.

Mid-America Apartment Communities has faced continuing pressure on its stock in 2025 largely due to weak rental market conditions in key Sun Belt regions and an elevated supply of apartment units. The company reported declines in its same-store Net Operating Income (NOI), further dampening investor sentiment. In the most recent quarter (Q3 2025), MAA reported that its same-store net NOI declined year-over-year by 1.8% for the quarter.

MAA now expects same-store NOI to decline between 1.85% and 0.85%, reflecting continued pressure on property income. Also, Core FFO per share is expected in the range of $8.68 to $8.80. This represents a modest downward revision from the prior guidance range.

Additionally, its rival, Invitation Homes Inc. (INVH), has underperformed MAA and SPX, declining 14.8% YTD and 16% over the past year.

Analysts are moderately optimistic about MAA’s prospects, and the stock has a consensus rating of “Moderate Buy” from 28 analysts in coverage. Its mean price target of $148.12 suggests an upside of 11.2%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)