European technology stocks are facing a critical moment of reassessment, but Wedbush Securities analyst Dan Ives sees compelling opportunities emerging from the turbulence. The Wall Street tech optimist told CNBC that Europe's sector is experiencing a "moment of validation" despite growing investor frustration about the region's ability to cultivate major tech players.

Ives specifically highlights Swedish fintech disruptor Klarna (KLAR) and music streaming leader Spotify (SPOT) as two European companies worth attention at current valuations. While KLAR stock is down 33% from all-time highs, SPOT stock has pulled back 26% from record levels. According to Ives, the ongoing drawdowns offer investors attractive entry points if they are willing to look past near-term volatility.

Is Klarna Stock a Good Buy Right Now?

Valued at a market cap of $11.4 billion, Klarna provides payment, advertising, and digital retail banking solutions to consumers and merchants. Klarna delivered a strong third quarter in its debut earnings report as a public company. Its global sales rose 28% year-over-year (YoY) to $903 million, while revenue from the U.S. grew by 51%.

The Swedish fintech now serves 114 million active consumers and 850,000 merchants across 26 markets, positioning itself as a major challenger to traditional credit cards and payment networks.

The company's fair financing product emerged as a standout performer, which grew 139%, driven by doubling the number of merchants offering the service to 150,000. This explosive growth created a temporary lag in profitability as Klarna provisions for potential credit losses up front while earning revenue over time as consumers repay loans.

Klarna's physical card continues to gain traction, with 3.2 million active users globally. Its card customers generate an average revenue of $130 per user, compared to $28 for general active users.

The company highlighted strong demand for its debit card, which offers credit card perks that let users choose between debit and credit at checkout, targeting what it calls self-aware avoiders who want control over their spending. The fintech celebrated issuing over $500 billion in credit since its inception, with credit losses below 70 basis points, outperforming traditional credit card charge-off rates.

Klarna announced a forward-flow agreement with Elliott Investment Management valued at $6.5 billion to fund fair financing growth in a capital-efficient manner. The company also expanded default distribution partnerships with payment processors, including Clover (CLOV), adding a record 235,000 merchants in the quarter as it pursues the ambitious goal of matching Visa's (V) 150 million acceptance points.

Revenue per employee jumped to $1.1 million as artificial intelligence drives operational efficiency gains. Compared with the prior year, headcount declined 47% through natural attrition, while compensation per employee increased to align incentives.

Analysts tracking Klarna forecast revenue to increase from $2.67 billion in 2024 to $7.5 billion in 2029. In this period, adjusted earnings are forecast to grow to $3.99 per share in 2029 compared to a loss of $0.53 per share in 2024. If the fintech stock is priced at 15 times forward earnings, which is reasonable, it should double over the next three years.

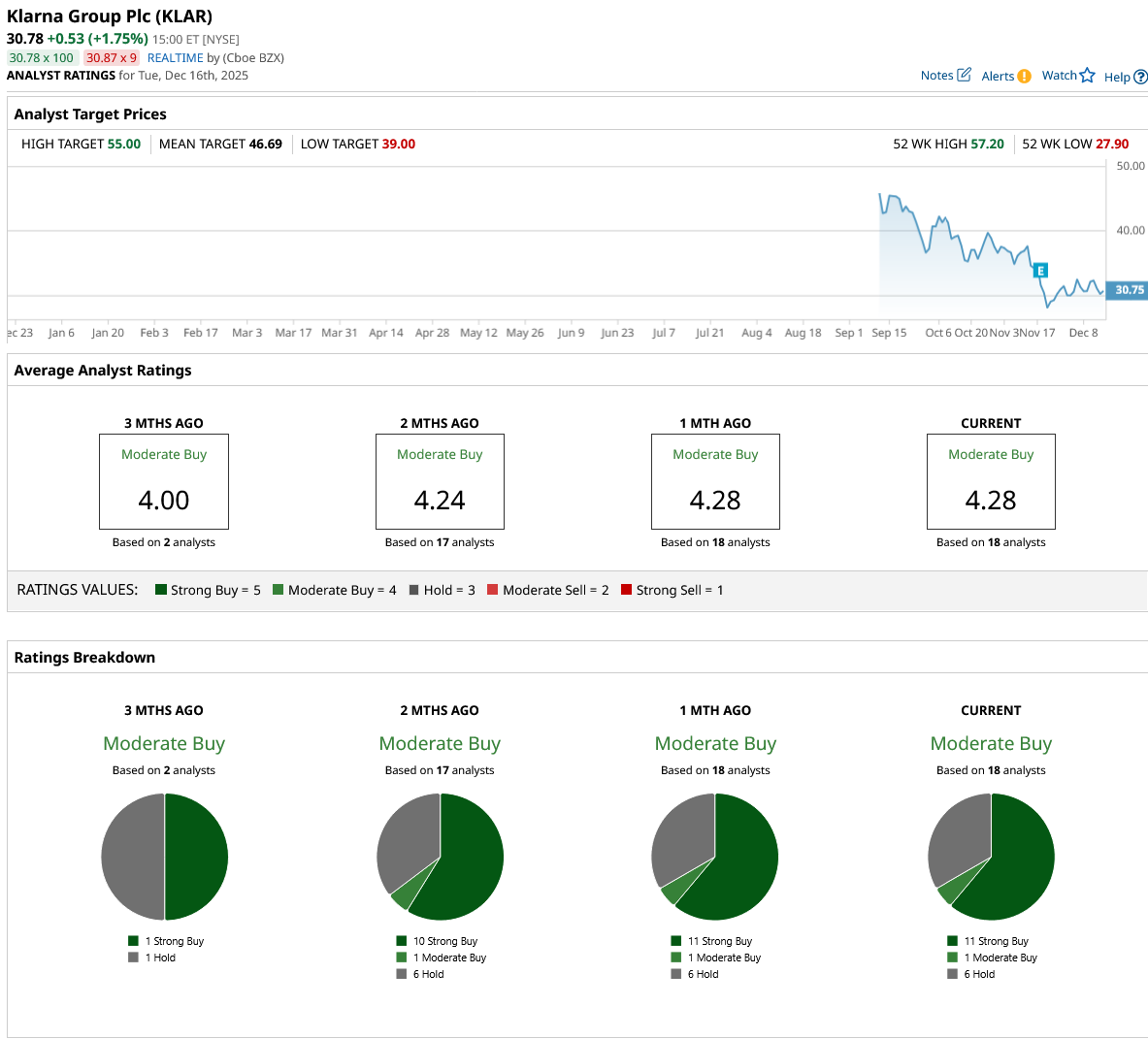

Out of the 18 analysts covering Klarna stock, 11 recommend “Strong Buy,” one recommends “Moderate Buy,” and six recommend “Hold.” The average KLAR stock price target is $47, above the current price of $31.

Is Spotify Stock Undervalued?

Valued at almost $120 billion by market cap, Spotify is the largest music streaming platform in the world. Spotify's new CFO, Christian Luiga, expressed strong confidence in the company's growth trajectory despite recent leadership changes that rattled investors.

The streaming giant has added nearly 300 million users since its 2022 Investor Day and now serves 289 million paying subscribers, still just 3% of the global population. Spotify’s engagement trends remain healthy across the platform, with users spending more time listening as it expands beyond music into audiobooks and podcasts.

The company discovered that adding verticals increases total consumption and reduces customer churn rather than cannibalizing music streaming. Users who engage with multiple content types generate significantly higher revenue, which creates a natural pathway for monetization growth.

Spotify completed licensing renewals with all major labels during 2025, negotiations Luiga described as intensive but productive. The agreements enable continued innovation, including the rollout of 30 new features this fall and the expansion of the enhanced free tier that funnels 60% of premium subscribers. The company paid out $10 billion to rights holders last year while simultaneously improving profitability.

Price increases rolled out across more than 150 countries showed no material impact on churn rates. This validates management's focus on maintaining a gap between customer value and subscription price.

Analysts tracking Spotify forecast revenue to increase from $16.28 billion in 2024 to $31.64 billion in 2029. In this period, free cash flow is forecast to grow from $2.37 billion to $6.8 billion. If SPOT stock is priced at 30 times forward FCF, it could surge 71% over the next three years.

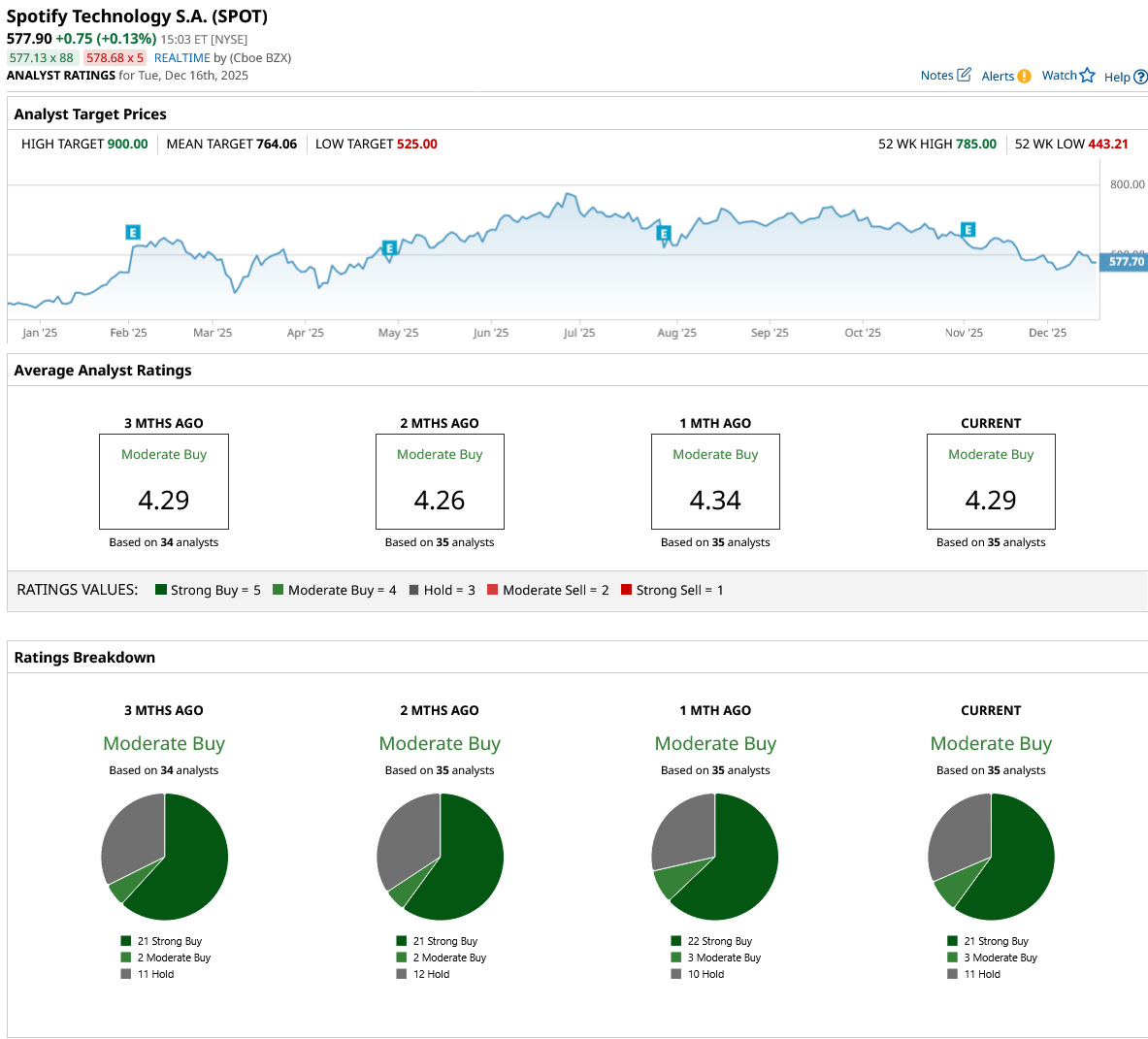

Out of the 35 analysts covering SPOT stock, 21 recommend “Strong Buy,” three recommend “Moderate Buy,” and 11 recommend “Hold.” The average SPOT stock price target is $764, above the current price of $578.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)