/Spotify%20logo%20by%20Bastian%20Riccardi%20via%20Unsplash.jpg)

As the streaming landscape continues to evolve, Spotify Technology S.A. (SPOT), long known for its audio-first offerings, is boldly repositioning itself as a full-blown multimedia platform. After years of dominance in music and podcasts, the company is now placing a major bet on music videos and creator-driven video content, aiming to challenge giants like YouTube and TikTok. The move is expected later this month.

Meanwhile, Spotify has reportedly secured licensing deals with major labels for audiovisual content, expanded its video catalogue to music tracks and podcasts, and is offering new ad-format and monetization tools for creators and advertisers alike.

In addition, Spotify is deepening its video footprint through partnerships, most notably an October deal with Netflix (NFLX) to bring select video podcasts to Netflix’s platform starting in the U.S. in early 2026, with international markets to follow.

With its stock price having taken a breather recently, in part reflecting investor uncertainty, is the video pivot enough to justify renewed optimism?

About Spotify Stock

Spotify is a leading global audio-streaming and media company that offers music and podcasts to users worldwide. Based in Luxembourg, it has a market cap of around $116.3 billion, reflecting its status as one of the major players in the global streaming industry. Over the years, Spotify has expanded its services beyond music, adding podcasts, audiobooks, and now it's doubling down on video and audiovisual content.

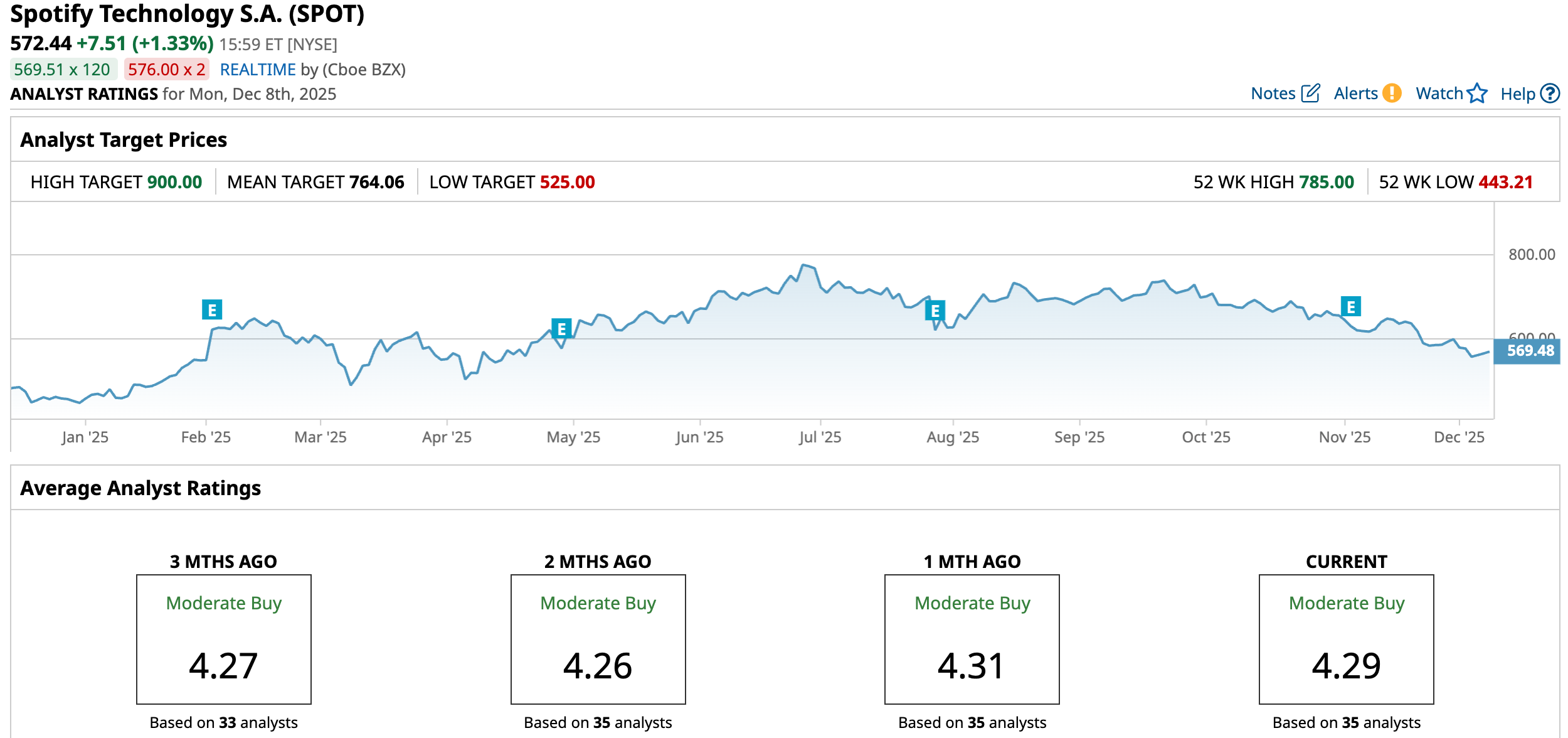

The stock price performance of Spotify in 2025 has been dramatic, characterized by strong upside and significant swings. SPOT surged early in the year amid renewed optimism about user growth, profitability, and expansion beyond music. The stock reached a 52-week high of $785 on June 27, a reflection of bullish sentiment and lofty expectations. Since that peak, however, shares have retreated, closing the last session at $564.93, putting SPOT around 28% below that high point.

Nevertheless, year-to-date (YTD), the stock has delivered 26.98% returns, while over the past 52 weeks, it has surged 13.93%.

Meanwhile, the latter half of 2025 is testing patience. Caution remains around the speed at which Spotify can convert its expanding user base into consistent, sustainable profits, especially amid evolving competitive and macroeconomic pressures. The stock is down 20.91% over the past three months.

The stock trades at a premium compared to industry peers at 72.70 times forward earnings.

Steady Q3 Results

Spotify released its third-quarter 2025 earnings on Nov. 4. The results painted a strong picture: the company reported Monthly Active Users (MAUs) reaching 713 million, up 11% year-over-year (YOY). Meanwhile, its premium subscriber base rose to 281 million, a 12% increase over the previous year.

Spotify’s total revenue climbed roughly 12% YOY, bringing in around €4.3 billion ($5 billion). Gross margin improved to 31.6%, beating guidance by about 50 basis points.

Also, notably, operating income soared to €582 million ($677.9 million), significantly above the guidance, while free cash flow also hit a quarterly record high at €806 million ($938.9 million), underscoring a strong balance sheet and healthy liquidity.

On the profitability side, Spotify swung from prior-quarter losses to post a net profit of €899 million ($1.1 billion), or €3.28 per share, well ahead of analyst expectations.

In the quarter, Spotify rolled out around 30 product updates, including “lossless” audio, improved playlist-mixing tools, expanded mobile-free tier capabilities, messaging between users, and enhanced discovery controls. The firm is clearly leaning into a multi-format vision and laying the groundwork for broader content and monetization strategies.

Furthermore, Spotify, for the next quarter (Q4 2025), expects MAUs to rise to 745 million and premium subscribers to grow to 289 million (implying around 8 million net adds). Revenue guidance for Q4 stands at €4.5 billion, with a targeted gross margin of about 32.9%.

Analysts predict EPS to be around $7.72 for fiscal 2025, up 29.8% YOY, before surging by a solid 83.9% annually to $14.20 in fiscal 2026.

What Do Analysts Expect for Spotify Stock?

Recently, Erste Group has cut its rating on Spotify from “Buy” to “Hold,” warning that revenue growth is likely to slow in 2026. The firm noted that Spotify has delivered solid revenue growth and modestly lowered operating costs, helping margins improve, but analyst Hans Engel flagged weakening U.S. consumer confidence as a potential drag on next year’s performance.

On the other hand, Deutsche Bank reaffirmed its “Buy” rating on Spotify and maintained a $775 price target, highlighting meaningful growth driven by subscription price increases.

Also, last month, Bernstein SocGen reaffirmed its “Outperform” rating on Spotify with a $830 price target. The firm is upbeat on Spotify’s latest strategic move: the launch of its Premium Platinum tier in five Asia-Pacific markets, a high-priced plan offering HiFi audio, AI DJ, and other premium features. Bernstein sees this as the start of a “superfan era,” unlocking new pricing power for the platform.

Alongside the Platinum rollout, Spotify has sharply raised Standard-tier prices in these regions and introduced a Lite tier to retain budget users. Bernstein believes this expanded tiering structure gives Spotify a valuable new revenue lever heading into 2026.

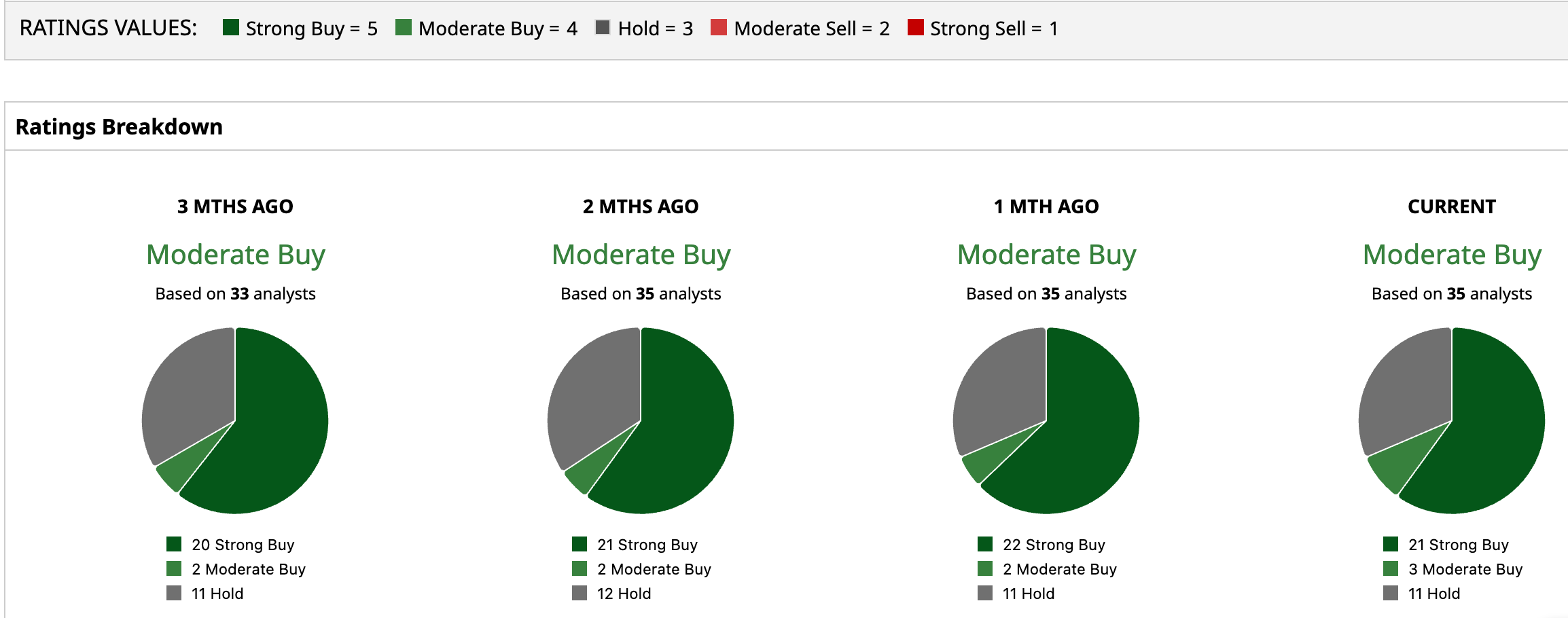

Overall, SPOT has a consensus “Moderate Buy” rating. Of the 35 analysts covering the stock, 21 advise a “Strong Buy,” three suggest a “Moderate Buy,” and the remaining 11 analysts are on the sidelines, giving it a “Hold” rating.

The average analyst price target for SPOT is $764.06, indicating a potential upside of 33.5%. The Street-high target price of $900 suggests that the stock could rally as much as 57%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)