AI demand is expected to stay elevated in 2026 and beyond. Companies need more and more computing power, which in turn means energy demand to enable this compute will also stay high. Having said that, this cannot simply translate to stock price appreciation for companies powering these data centers. That’s not how the market works. There is a certain amount of optimism that stocks have already priced in. For companies like Oklo (OKLO), which do not yet have any revenue, it becomes hard to assess what exactly is priced in.

While all energy stocks have benefited from this AI boom, nuclear energy has received special attention from President Donald Trump. OKLO’s small modular reactor has helped it become a strong candidate and one that deserves further scrutiny, especially after losing more than half its value in a matter of months.

About Oklo Stock

Oklo is an advanced nuclear technology company headquartered in Santa Clara, California. It is known for developing safer and smaller nuclear power plants that can operate for up to 20 years without the need for refueling.

OKLO stock was a notable performer of 2025, up 6.5x at one point during the year. However, in the last quarter of the year, its stock lost more than half its value, disappointing investors who entered late in the rally.

The dip in stock price came not necessarily because of stretched valuation, but because of a lack of focus on nuclear energy after the initial government support. Joseph Shangraw, an analyst at Wood Mackenzie, has pointed out that coal-fired plants and data centers are keeping the workforce busy for now. Despite climate concerns, coal stocks have risen while nuclear energy stocks haven’t. One could see that as a buying opportunity but cannot ignore the fact that it also means earnings estimates haven’t moved upwards for these stocks.

If the focus stays on providing the necessary capacities to data centers and coal plants, it would be they that emerge as the ultimate winners, not nuclear stocks. This scenario would not bode well for OKLO investors, and therefore, they need to be aware of how the industry progresses rather than just keeping an eye on their own company. In other words, the “easy” gains may already be behind us when it comes to OKLO.

Oklo Exceeds Analysts’ Earnings Expectations

Oklo reported its Q3 earnings on Nov. 11 and posted an EPS of -$0.2. This missed analyst expectations of -$0.13 by over 50%. The earnings are set to stay down, with Q4 EPS estimates of -$0.17 and fiscal 2026 estimates of -$0.63.

On a positive note, management believes the cash burn rate is within previously estimated ranges, and the $1.2 billion cash reserves are helping the company focus on its R&D strategy. Both the CEO and CFO emphasized that investors need to look beyond the traditional performance metrics and focus on the regulatory progress, nuclear power projects execution, and R&D.

For a company like Oklo, an earnings miss may not be that significant. The management’s focus on the company’s progress rather than numbers also makes sense. But for investors, considering the downside before entering the stock is the key to long-term returns. There is no doubt that Oklo continues to be a risky bet on AI.

What Analysts Are Saying About OKLO Stock

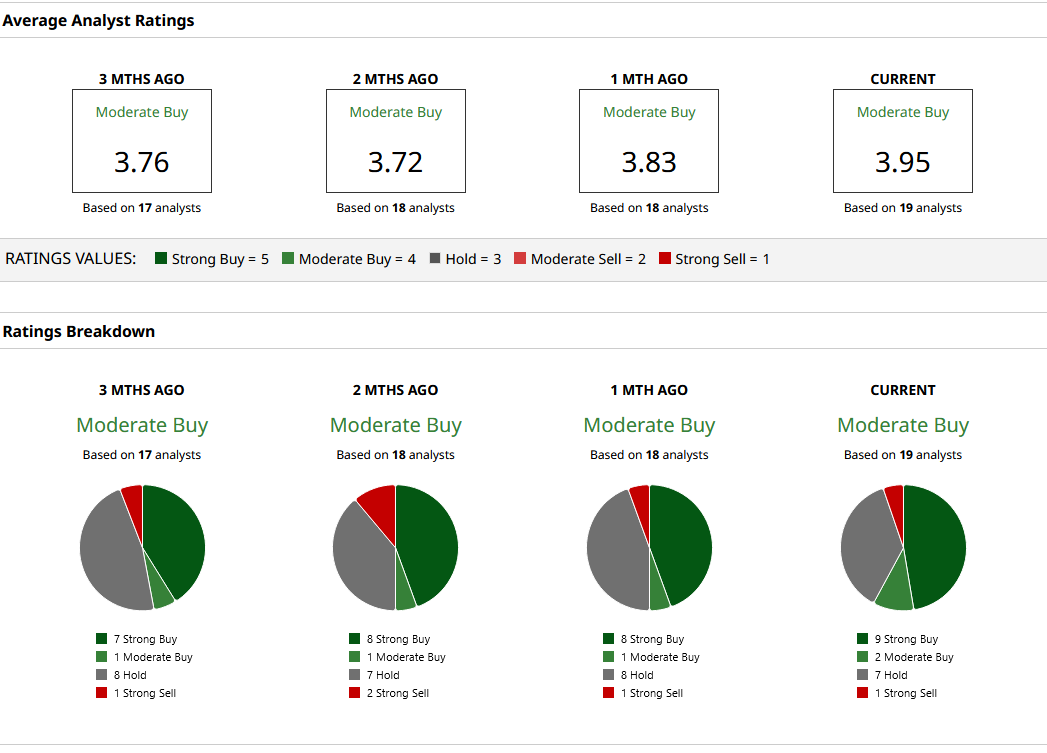

OKLO stock is covered by 19 Wall Street analysts, with half of them giving it a “Strong Buy” rating. However, the presence of seven “Hold” ratings suggests the Street is divided when it comes to OKLO’s prospects.

At present, the mean target price of $108.56 offers 13.6% upside, while the highest target price of $175 could see the stock gain 84% in value from here. At the beginning of December, OKLO received a number of positive analyst upgrades on Wall Street, so the short-term momentum is certainly in the investors’ favor.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)