Orrville, Ohio-based The J. M. Smucker Company (SJM) manufactures and markets branded food and beverage products. Valued at $10.8 billion by market cap, the company's principal products include peanut butter, shortening and oils, fruit spreads, canned milk, baking mixes and ready-to-spread frostings, flour and baking ingredients, juices and beverages, and more.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and SJM perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the packaged foods industry. SJM has a strong portfolio of iconic brands such as Folgers, Dunkin', Milk-Bone, and Meow Mix, which drive market leadership in coffee and pet foods. The Hostess Brands acquisition enhances its presence in sweet baked snacks, supporting future growth.

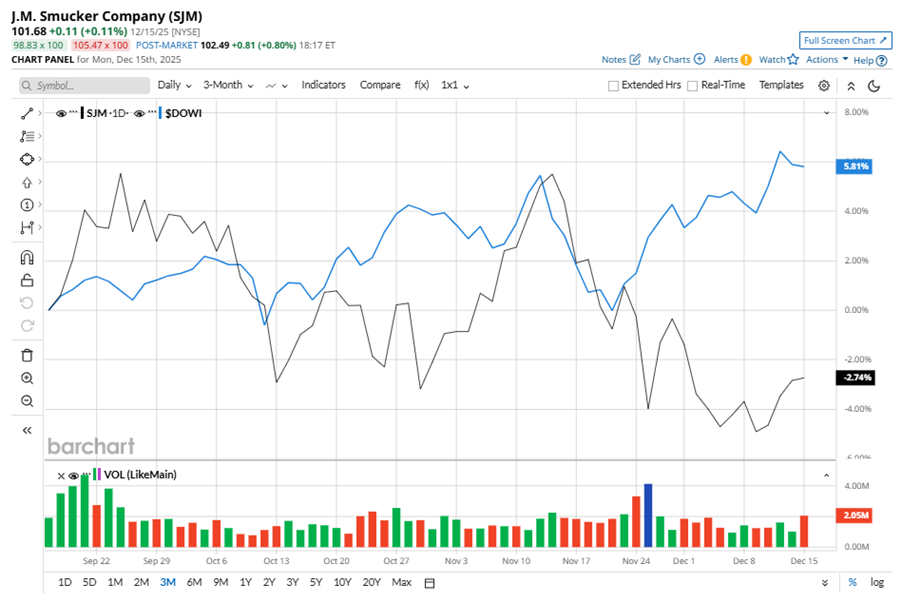

Despite its notable strength, SJM slipped 16.3% from its 52-week high of $121.48, achieved on Mar. 10. Over the past three months, SJM stock declined marginally, underperforming the Dow Jones Industrials Average’s ($DOWI) 5.5% gains during the same time frame.

In the longer term, shares of SJM rose 6.2% on a six-month basis but fell 10.4% over the past 52 weeks, underperforming DOWI’s six-month gains of 14.7% and 10.5% returns over the last year.

To confirm the bearish trend, SJM has been trading below its 200-day moving average over the past year, experiencing some fluctuations. The stock has been trading below its 50-day moving average since mid-September, with slight fluctuations.

On Nov. 25, SJM shares closed down by 3.7% after reporting its Q2 results. Its adjusted EPS of $2.10 did not meet Wall Street expectations of $2.12. The company’s revenue was $2.33 billion, beating Wall Street forecasts of $2.32 billion. SJM expects full-year adjusted EPS in the range of $8.75 to $9.25.

SJM’s rival, The Campbell's Company (CPB) shares lagged behind the stock, declining 13.8% over the past six months and falling 34.2% over the past 52 weeks.

Wall Street analysts are reasonably bullish on SJM’s prospects. The stock has a consensus “Moderate Buy” rating from the 18 analysts covering it, and the mean price target of $118.19 suggests a potential upside of 16.2% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)