/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

Gear up for Jan. 5 because today’s the day Wall Street and AI enthusiasts alike are eyeing as a potential catalyst event for Nvidia’s (NVDA) next chapter. After an explosive run that briefly made Nvidia the first company in the world to surpass a $5 trillion market cap, driven by surging demand for artificial intelligence (AI) chips and datacenter hardware, the tech giant kicks off 2026 with a high-profile platform to shape the coming year’s narrative.

That’s when CEO Jensen Huang is expected to deliver an address at CES 2026, a stage where Nvidia has historically outlined strategic technology roadmaps and unveiled innovations that influence investor sentiment and industry direction. With demand for its advanced AI accelerators, geopolitical trade dynamics, and potentially lifting chip stocks, Jan. 5 could set the tone for Nvidia’s performance and investor expectations for the year ahead.

Wedbush analysts expect Jensen Huang to use his speech to lay out the company’s next-phase AI strategy, highlighting surging enterprise adoption as the AI revolution enters a new growth stage. The focus is likely to center on data centers, physical AI, robotics, and autonomous technologies, with updates on Nvidia’s Cosmos foundation model platform. Beyond AI infrastructure, Nvidia is also expected to unveil new developments across gaming, content creation and simulation.

About Nvidia Stock

Nvidia Corporation is a global leader in accelerated computing and AI, renowned for pioneering the graphics processing unit (GPU) that revolutionized gaming, data centers, and AI-driven computing. Headquartered in Santa Clara, California, Nvidia’s technology now powers everything from high-performance gaming and cloud computing to autonomous vehicles and generative AI applications. With a market cap of roughly $4.6 trillion, Nvidia stands among the world’s most valuable companies, driven by its dominance in AI infrastructure and continued innovation in next-generation chip design.

In 2025, Nvidia’s share price experienced a noteworthy but volatile year. After opening the year significantly lower, the stock rallied on sustained demand for its AI hardware and datacenter solutions, driven by its leadership in the generative AI boom.

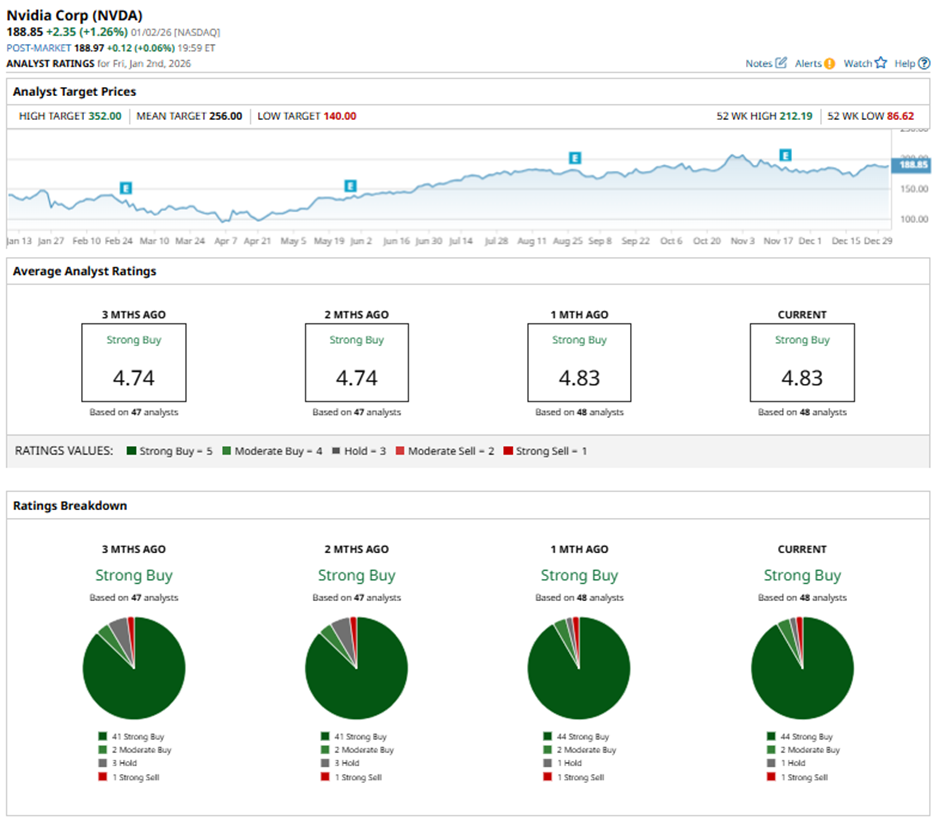

The 52-week low was around $86.62, reached in April 2025, while the 52-week high reached around $212.19, achieved in late October as the company hit record valuation milestones and investor optimism peaked.

That wide gulf between the high and low underscores how sentiment shifted throughout the year as Nvidia navigated geopolitical concerns, macroeconomic headwinds, and equally powerful AI demand tailwinds. The stock has overall delivered 31.6% returns over the past year.

Nvidia’s dominant position has led it to trade at a pronounced premium valuation compared to its industry peers, at 42.35 times forward earnings.

Strong Q3 Performance

Nvidia delivered a particularly strong showing in its third quarter of fiscal 2026 results that underscore just how deep the demand for AI infrastructure has become. On Nov. 19, the company reported revenue of a record $57 billion for the quarter ended Oct. 26, representing a 62% year-over-year (YOY) jump and a 22% increase from the prior quarter.

The company’s datacenter business was the main engine, with datacenter revenue hitting $51.2 billion, up 66% from a year ago, reflecting surging demand for AI-ready GPUs and cloud computing infrastructure. The firm’s profitability remained strong, with non-GAAP gross margins holding around 73.6% and the non-GAAP EPS at $1.30, a 60% YOY rise and comfortably ahead of Wall Street estimates.

Management also offered bullish forward guidance, expecting around $65 billion, plus or minus 2% in revenue in the fourth quarter of fiscal 2026. That projection suggests confidence in continued strong demand for its AI chips and datacenter gear despite macroeconomic headwinds or geopolitical uncertainty.

Analysts tracking Nvidia project the company’s EPS to climb 51.2% YoY to $4.43 in fiscal 2026 and grow another 56.7% to $6.94 in fiscal 2027.

What Do Analysts Expect for Nvidia Stock?

Several Wall Street analysts have recently reaffirmed positive ratings on Nvidia stock in the wake of its strategic deal with AI chipmaker Groq, signaling continued confidence in the company’s growth prospects. Following the announcement of the approximately $20 billion non-exclusive licensing agreement and talent acquisition from Groq, analysts are showing renewed optimism.

Among others, Mizuho reiterated its “Outperform” rating and $245 price target on Nvidia following its deal with Groq, reinforcing bullish analyst sentiment. Mizuho views the transaction as a long-term positive that enhances Nvidia’s inferencing capabilities and supports its strong growth trajectory.

Also, Bernstein SocGen reiterated an “Outperform” rating and a $275 price target on Nvidia after its Groq technology deal.

Wall Street’s bullishness is evident in Nvidia having a consensus “Strong Buy” rating. Of the 48 analysts covering the stock, 44 advise a “Strong Buy,” two suggest a “Moderate Buy,” one analyst is on the sidelines, giving it a “Hold” rating, and one offers a “Strong Sell” rating.

The average analyst price target for NVDA is $256, indicating a potential upside of 35.6%. Also, the Street-high target price of $352 suggests that the stock could rally as much as 86.4%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Blackrock%20Inc_%20logo%20on%20building-%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Amazon_com%20Inc_%20storefront%20by-%20%20Markus%20Mainka%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)