/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

In a market dominated by headline-grabbing artificial intelligence (AI) giants, On Semiconductor Company (ON) is quietly inventing the power systems, materials, and technologies that makes the entire AI revolution possible. Yet, ON stock may still be flying under the radar. With accelerating AI revenue, breakthrough innovations in power efficiency, and momentum across automotive, industrial, and data-center markets, this overlooked player could deliver the kind of upside investors aren’t expecting yet.

A Silent AI Powerhouse With Room to Run

ON semiconductor develops semiconductor technologies that efficiently manage energy and power a wide range of applications, including electric vehicles, industrial equipment, AI data centers, and imaging systems. ON Semiconductor delivered a stronger-than-expected third quarter with $1.55 billion in revenue, an increase of 6% from the previous quarter. It reported a 38% adjusted gross margin. The company is already seeing stabilization in automotive and industrial markets. AI continues to grow rapidly, nearly doubling year over year and targeted to reach almost $250 million in 2025.

The company’s Treo platform is expanding into automotive, industrial, and AI infrastructure, with a design funnel that currently exceeds $1 billion. Treo combines precision analog, advanced digital, and low-voltage power technologies to provide high-performance, energy-efficient solutions.

Teledyne Technologies (TDY) chose Treo for next-generation infrared imaging systems used in aerospace, defense, and security, marking a significant win for the quarter. The company expects to double the number of Treo products sampling this year, speeding client adoption and expanding engagement in its main verticals.

ON Semiconductor’s newly announced vertical GaN (vGaN) technology, based on a patented GaN-on-GaN design, is one of its most intriguing technologies and is likely to be its most significant future growth driver. This technology provides greater operating voltages, faster switching, record power density, and up to a 50% reduction in energy loss. Management claimed that it is an excellent fit for AI data centers, EVs, renewable energy, aerospace, and defense. ON has already began sampling with key automotive and AI customers, providing the company an early mover advantage in a market that is becoming increasingly important to the AI infrastructure boom.

Management noted that its business model is proving resilient, restructuring efforts are underway, and the balance sheet is strong, with $4 billion in liquidity. The company’s financial health and shareholder returns support the bull case. ON returned more than 100% of free cash flow to shareholders and has repurchased $925 million worth of shares YTD. The company didn’t provide full-year guidance. However, analysts project earnings to dip for the full year to $2.33 per share, before increasing by 25% in 2026 to $2.92 per share.

Management anticipates that the market for AI energy will grow exponentially. According to the International Energy Agency, AI-optimized data center power consumption is expected to quadruple by 2030 , and On Semiconductor is well positioned to capitalize on this demand.

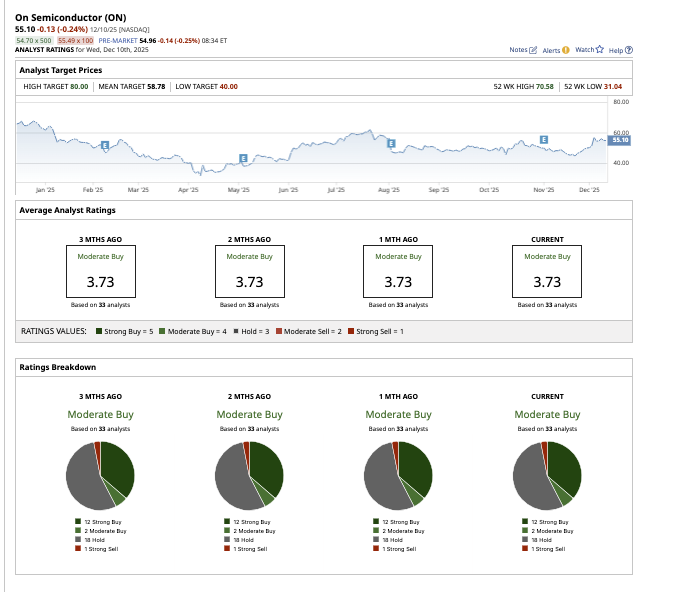

What Does Wall Street Say About ON stock?

Overall, Wall Street remains moderately bullish about ON stock. Out of the 33 analysts that cover the stock, 12 rate it a “Strong Buy,” two say it is a “Moderate Buy,” 18 rate it a “Hold,” and one recommends a “Strong Sell.” The stock is trading close to its average price target of $58.78. However, its high target price of $80 implies potential upside of 45.1% in the next 12 months.

While the market focuses on GPU makers, ON Semiconductor is becoming a critical enabler of the AI ecosystem. Nonetheless, it remains overlooked. The company’s acceleration in AI revenue, breakthrough technology launches, high-value design wins, and shareholder-friendly capital strategy, all paint the picture of a company with meaningful upside ahead. ON stock could be a great option for investors with a high risk appetite seeking an under-the-radar AI name with room to run.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)