/Seagate%20Technology%20Holdings%20Plc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Singapore-based Seagate Technology Holdings plc (STX) engages in the provisioning of data storage technology and infrastructure solutions in Singapore, the U.S., and internationally. With a market cap of approximately $60.4 billion, Seagate operates as one of the largest manufacturers of hard disk drives (HDDs) in the world.

Companies with a market cap of $10 billion or more are categorized as "large-cap stocks." Seagate fits this description perfectly, with its market cap exceeding this threshold, reflecting its substantial size and influence in the SSD and HDD storage market.

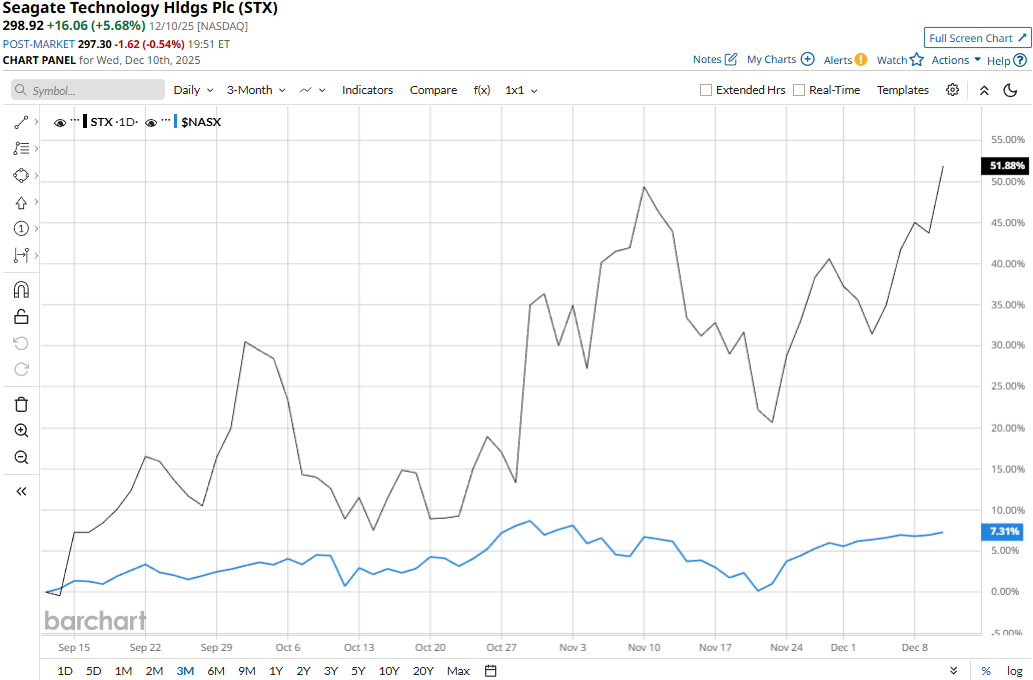

STX touched its all-time high of $301.47 in yesterday’s trading session before slightly pulling back. Meanwhile, the stock has soared 54.9% over the past three months, notably outperforming the Nasdaq Composite’s ($NASX) 8.1% gains during the same time frame.

Seagate’s performance has remained impressive over the longer term as well. The stock has surged 246.3% on a YTD basis and 206.3% over the past 52 weeks, notably outpacing Nasdaq’s 22.5% gains in 2025 and 20.2% returns over the past year.

STX stock has traded consistently above its 50-day moving average since late April and above its 200-day moving average since early May, underscoring its bullish trend.

Seagate Technology’s stock prices soared 19.1% in a single trading session following the release of its impressive Q1 results on Oct. 28. The surge in new data centers and the demand for storage solutions has significantly boosted Seagate’s sales in recent quarters. Benefitting from this trend, the company has continued to report solid growth in revenues. It delivered a 21.3% year-over-year surge in topline to $2.6 billion.

Further, the company delivered massive improvement in gross and operating margins, leading to a 72.3% growth in EPS to $2.43, beating the consensus estimates by a notable margin.

When compared to its peer, STX has lagged behind Western Digital Corporation’s (WDC) 306.8% surge in 2025 and 252.5% returns over the past year.

Among the 24 analysts covering the STX stock, the consensus rating is a “Strong Buy.” As of writing, the stock is trading slightly above its mean price target of $293.86.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Cloud%20Computing%20diagram%20Network%20Data%20Storage%20Technology%20Service%20by%20onephoto%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)