(NGZ25) (NGF26) (NFF26) (TGF26) (BOIL) (UNG) (KOLD)

“The Volatile Factors Affecting Natural Gas Trading ”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Edited by Scott Mathews

- “Thanksgiving Eve” Report - November 26-27, 2025

The surge in natural gas prices has been attributed to:

A) Pre-winter buying on long-range cold forecasts;

B) The advent of AI technology and greater demand;

C) Strong LNG exports to Europe at a near record pace.

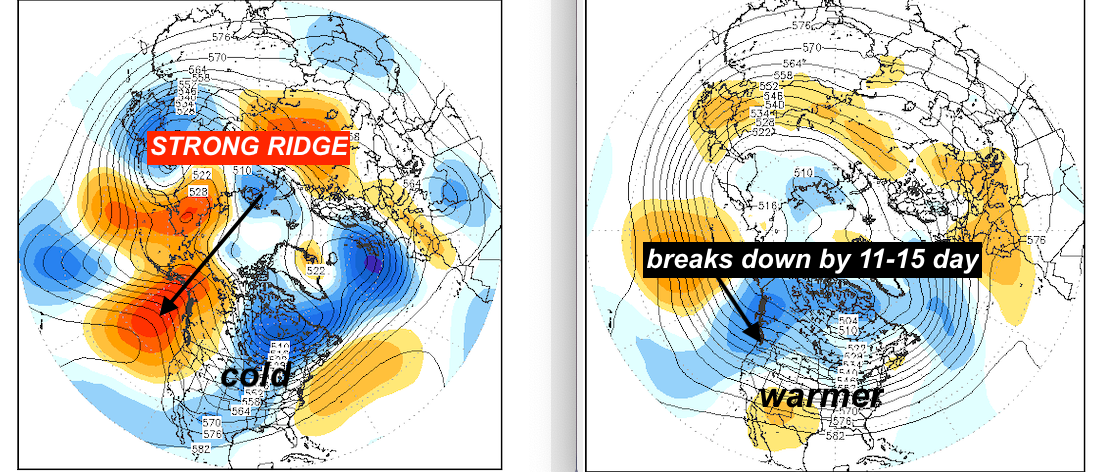

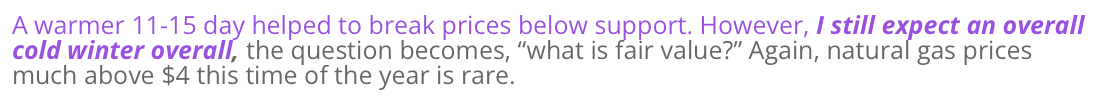

While the market could be over-bought and we explain some of the reasons why natural gas prices may have a hard time making new highs for the moment, weather models may not be cold enough for most of December. Some models are breaking down the upcoming cold US outlook by mid-December, but that may only be temporary. Below we discuss the conflicting signals in the market.

Please Click Here to Request This Recent Example of Our Newsletter

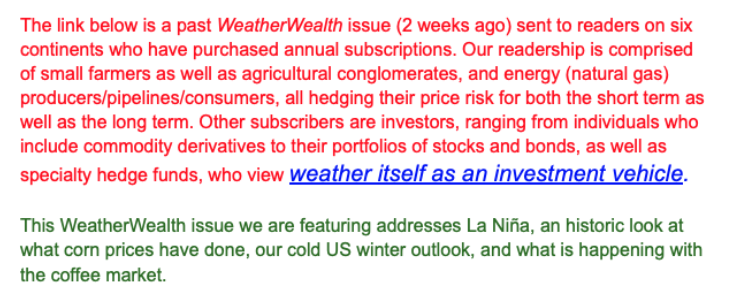

US production is still above the 5 year average:

November 2025 saw daily US production hit a new record at 109.7 billion cubic feet per day, with a fresh single-day high just shy of 111.2 bcfd. Storage levels are also overflowing, sitting 4.6% above the five-year average at nearly 3,950 billion cubic feet.

While weather forecasts could still turn bullish this winter, what are some of the more bearish factors that could prevent prices from making new highs in the short-term?

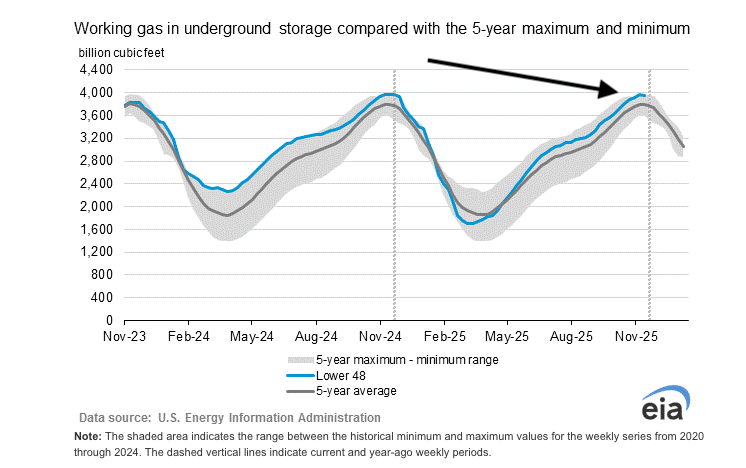

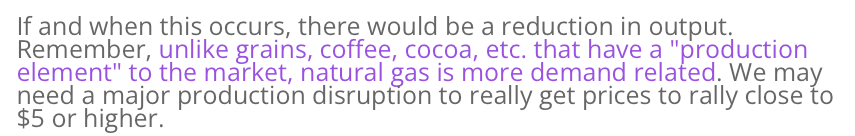

Record LNG exports may slacken off: While the country’s LNG exports are steaming ahead too, averaging 18.0 bcfd and aiming for new highs as plants like Golden Pass come online. LNG exports going forward may be much less the next couple months. This is due to warm weather in Europe and the fact that many European end users and utility companies may have already bought most of their winter needs

Large European gas stocks & downward spiral in UK and Dutch natural gas prices:

- Sources: Weatherbell.com & Barchart.com

I sent this out early on Monday morning.

Heavy spec long position: On my recent natural gas Weather Spider, I really should have had the anti-herd mentality at a (-2) somewhat bearish as everyone and their dog was long the market now.

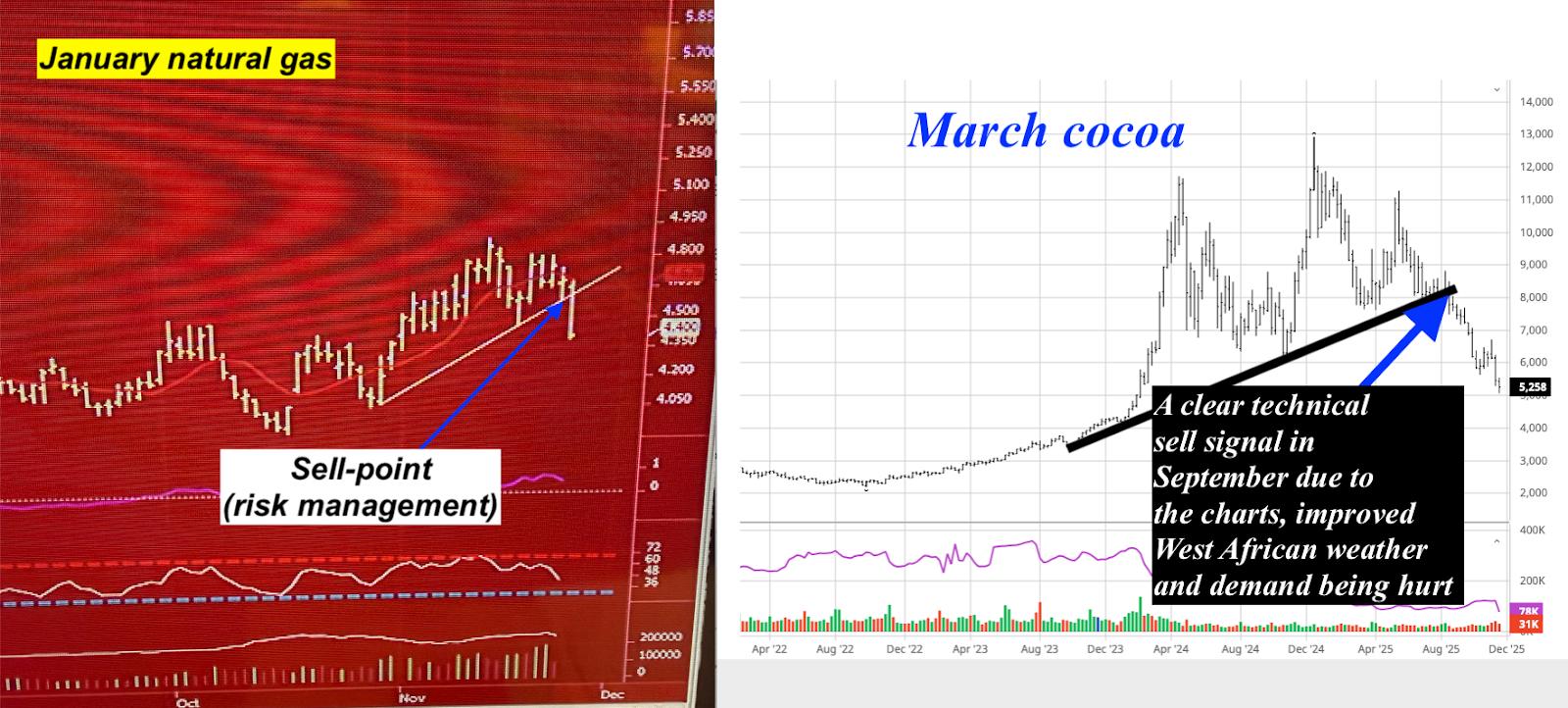

Technical selling: When trading natural gas or any other markets, don’t let hope or your emotions get the best of you. Use technical analysis, just like I said a couple of months ago with respect to a longer-term bearish attitude in the cocoa market.

Sources: QST and Barchart.com

Some models break down the extreme cold by mid-December

Source: StormVistaWxModels.com

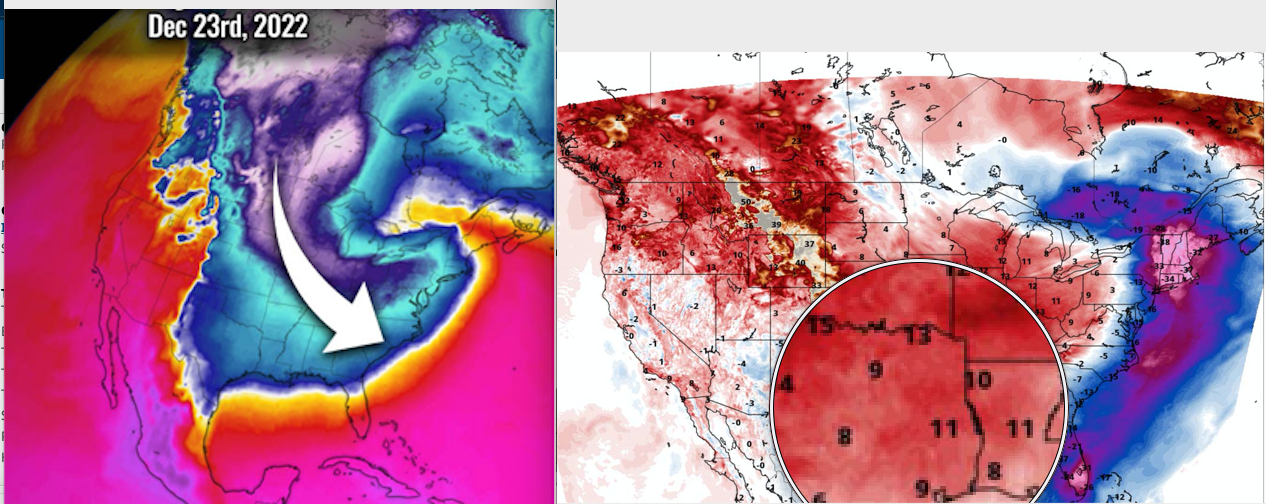

Extreme cold will not hit Gulf coast production:

When temperatures in the teens and 20s knock out Gulf Coast production, this often has a bullish reaction in natural gas. It is rare for this to happen.

Source: PivotalWeather.com

In 2022, natural gas prices soared in mid-December, as cold lowered Gulf Coast production. Prices then collapsed more than 20-30% on a warm January and February.

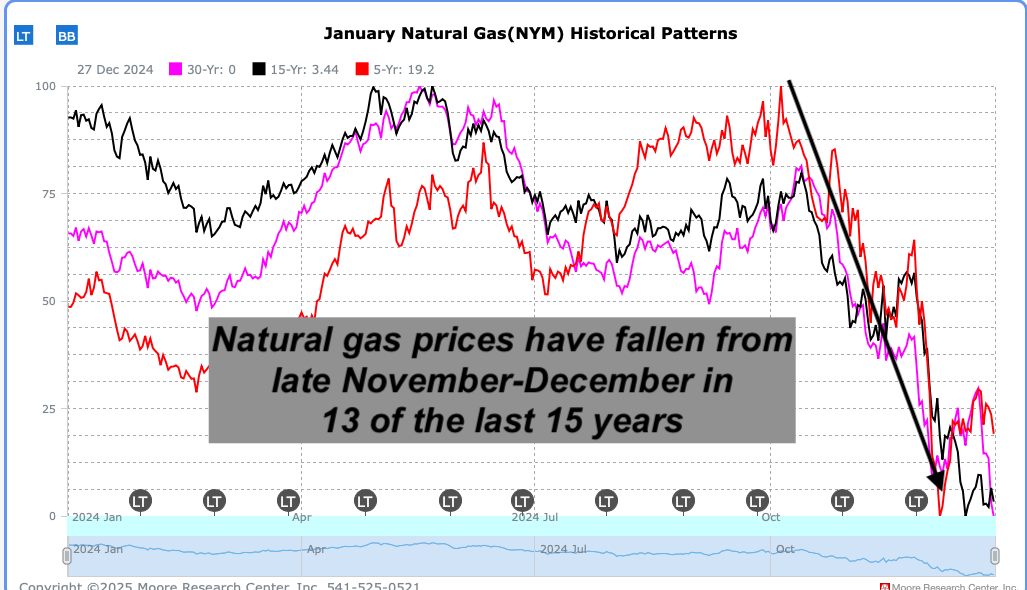

Seasonal bearish tendencies later in November:

This is especially true when there is a heavy net long spec position as there is now.

Source: MRCI.com (Moore Research Center)

“So how does one trade this market? Futures, options, or ETFs? That is where our WeatherWealth newsletter comes in by helping traders and producers around the world.”

– Jim Roemer

To receive frequent FREE weather and commodity updates, sign up for our reports on Substack HERE

Remember when trading commodities, always use risk management, such as stop-loss orders and position sizing, and consider using spreads to isolate the seasonal component of a particular market move.

Thanks for your interest in Commodity Weather Intelligence !!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.